- 60% of municipalities consider their investments in climate mitigation and adaptation infrastructure in the last three years to be insufficient.

- 69% of municipalities lack experts with environmental and climate assessment skills, posing a serious problem for the implementation of local investment programmes.

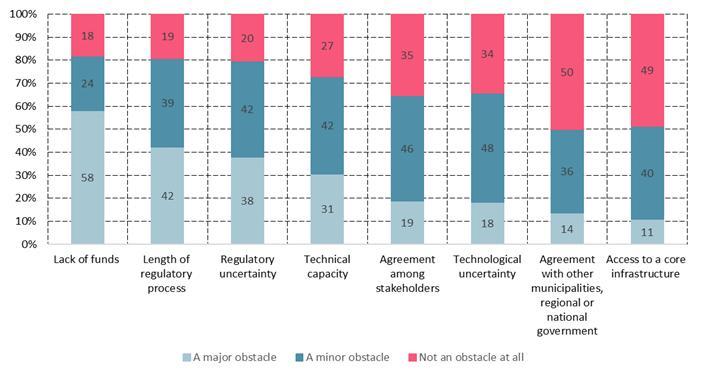

- Around 80% of municipalities say a lack of funding, the length of regulatory processes and uncertainty about regulations are obstacles to investment.

The European Investment Bank (EIB) has released the findings of the 2022 Municipality Survey. Covering 744 municipalities across the European Union, this comprehensive survey provides unique insights into past and planned investments, as well as the challenges municipalities face in their digital and green transitions, and the progress they have made in these domains. Since municipalities account for almost half of public investment in the European Union, these findings are of the utmost importance.

Key findings from the 2022 Municipality Survey:

1. Investment gaps and challenges: A lack of funding, and uncertain and lengthy regulatory processes, continue to deter municipalities from planning crucial investments. Moreover, when it comes to implementation, a shortage of skilled labour and supply chain bottlenecks are significant constraints.

2. Skills shortage: The survey highlights the critical importance of providing necessary training to the current and future labour force. Municipalities report difficulties in securing experts with environmental and climate skills, as well as technical and engineering expertise. Addressing these challenges is essential for the successful execution of investment plans.

3. Focus on green and digital transitions: Climate change mitigation, adaptation, and digital infrastructure play a central role in municipalities' investment plans for the next three years. However, more than 60% of municipalities express dissatisfaction with their past investments in climate mitigation and adaptation, while 40% report dissatisfaction with their investments in digital infrastructure.

4. Regional disparity: European municipalities have come further with the digital transformation than they have with the green transition. While higher-income regions show a higher proportion of municipalities actively investing in both transitions, less developed regions face challenges in making similar progress.

Obstacles to municipal investment

To what extent is each of the following an obstacle to the implementation of your infrastructure investment activities? Is it a major obstacle, a minor obstacle or not an obstacle at all?, in percent

*Base: All municipalities (excluding don't know/refused responses)

“As the EIB Municipality Survey reveals, municipalities across Europe face significant investment gaps, particularly in climate change mitigation and adaptation infrastructure. It is crucial for policymakers and stakeholders to address these gaps and prioritise sustainable and resilient investments for a greener and more digital future. The persistent lack of skills, including at the municipality level, must be addressed across Europe to enable the adequate implementation of regional and pan-European investment programmes,” said EIB Chief Economist Debora Revoltella.

EIB Vice-President Ricardo Mourinho Felix added: “Municipal investments are key to providing consistent support for people and businesses. Given the significant proportion of public investments made by municipalities, it's imperative that they are equipped with the necessary resources, expert knowledge, and strong cooperative networks for effective implementation. As the world evolves swiftly, municipalities' roles in the green and digital transitions become ever more critical. To nurture sustainable practices across areas like urban planning, energy efficiency, waste management and transport, an enhancement of expertise throughout Europe is a necessity. Our EIB Municipality Survey provides insights into the adaptation strategies of municipalities and underlines the significant needs that must be addressed moving forward.”

The EIB in cohesion regions

Today the EIB also released a new report analysing the EIB Group’s operations in Europe’s cohesion regions in 2022. The report focuses on the EIB Group’s contribution to innovation to promote an inclusive green and digital transition, together with its macroeconomic impact. In 2022, the EIB Group provided €28.4 billion to projects in cohesion regions. Support for innovation represented 25% of total EIB lending in 2022, €4.6 billion (34%) of which was in cohesion regions. Green investments are on the rise: like in 2021, the share of EIB-financed green investments was higher in cohesion lending than in total EU lending. This is in line with the EIB’s cohesion orientation, which committed to a significant increase in the share of climate action and environmental lending across transition and less developed regions.

EIB Vice-President Lilyana Pavlova commented: “As regional cohesion suffers from geopolitical uncertainty, the arrival of refugees and energy shock, cities and regions still need to transform to meet the European Union’s climate goals and bridge the digital divide. Innovation is vital to addressing these challenges. The EIB Group provides a wide range of financial and advisory tools in support of these policy objectives which have shown tangible impact.”

For more information and to access the full survey report, click here.

About the Economics Department of the EIB

The EIB Economics Department provides economic research and studies, as well as unique analysis of investment activities in the European Union and beyond and supports the Bank in its operations and in the definition of its positioning, strategy and policy. Chief Economist Debora Revoltella heads the department, which has a team of 40 economists.

About the EIB Group’s support for cohesion

The European Investment Bank (EIB) is the long-term lending institution of the European Union owned by its Member States. It makes long-term finance available for sound investment in order to contribute towards EU policy goals. Financing projects that help strengthen the economic, social and territorial cohesion of the European Union has been at the heart of EIB operations since its foundation in 1958.

Its lending in cohesion areas covers the full spectrum of economic activity and must fall under at least one of the EIB’s four priorities: innovation (digital and human capital); sustainable cities and regions; sustainable energy and natural resources; and small and medium-sized enterprise (SME) and mid-cap finance. EIB cohesion regions encompass less developed regions (GDP per capita of less than 75% of the EU average) and transition regions (GDP per capita of between 75% and 100% of the EU average), as defined by the EU cohesion policy map.