- Substantial policy support during the pandemic helped to prevent large-scale bankruptcies in the Western Balkans, with only 3% of firms filing for insolvency or closing permanently.

- Trade with developed economies, information and know-how increased through global value chains, and access to foreign technology helped boost innovation and competitiveness in the region.

- The transition to a net-zero carbon economy presents significant risks for the Western Balkans, while firms lack the incentives for greening their business models.

- Lack of access to finance continues to constrain SMEs’ growth in the region. In particular, the financing of young innovative firms and start-ups is hindered by the lack of credit history and a reliance on intangible assets that are hard to collateralise.

Russia’s invasion of Ukraine and its economic fallout come just as firms in the Western Balkans are recovering from the COVID-19 shock. Today’s presentation “Business resilience in the Western Balkans at times of repeated shocks”, presented by the EIB’s Chief Economist Debora Revoltella at the Western Balkans Investment Framework Strategic Board in Rome, examines how firms in the region weathered the sharp downturn caused by the pandemic and how prepared they are to face future challenges. The results are derived from the report entitled Business Resilience in the Pandemic and Beyond, recently launched and jointly published by the EIB, the EBRD and the IMF, which covers a broader region of Eastern Europe and Central Asia.

You can read the full report here.

You can read an online summary here.

“The war in Ukraine is testing again the resilience of the Western Balkan economies as they recover from the pandemic,” said Debora Revoltella. “New risks and heightened uncertainty are putting cross-border flows and trade under pressure. This matters as our analysis shows that firms’ resilience and innovation capacity are linked to their participation in global value chains and trade. In this phase of potential deglobalisation trends, the Western Balkans should build on its competitive advantage of strong ties with the European Union and reinforce it further, as a springboard for faster development.”

Western Balkans — the impact of COVID-19

To date, firms have come through the pandemic better than initially feared. They lost 29% of turnover and shed 9% of their labour force, with the pandemic hitting contact-intensive services and smaller and medium-sized businesses especially hard. Nevertheless, massive policy support helped to prevent large-scale bankruptcies, with only 3% of firms in the region filing for insolvency or closing permanently.

The report shows that firms that were integrated into global value chains, those that had been more innovative in the past, those that were more digitalised and those with better quality management adapted better during the pandemic. They expanded their online presence, switched to remote work, adjusted production or took advantage of the available policy support more effectively.

Government programmes played a stabilising role by mitigating the stress of vulnerable firms, such as smaller businesses, standalone firms and those lacking overdraft facilities.

Openness to trade in the Western Balkans drives resilience, innovation and competitiveness

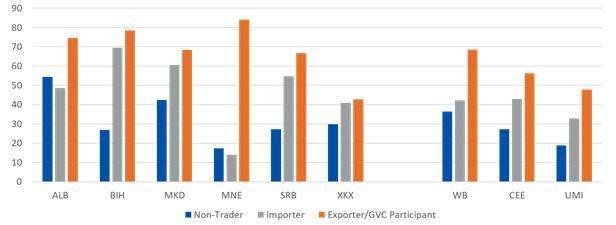

Share of innovators, % of firms within trading profile

Source: EIB calculation based on the 2019 EIB-EBRD-WB Enterprise Survey.

The report finds that the economies of the Western Balkans generally invest more in innovation than benchmark economies, although the process is led by adapting new technologies developed elsewhere. Opening up the global economy has been key to enable these countries to improve their comparative advantages and increase their competitiveness. The industrial composition of regions more integrated in global value chains is clearly focused on higher value-added products, while those that are less integrated are trading mainly manufacturing products with lower value added or raw materials.

The evidence in the report indicates that trade integration with developed economies, in particular the European Union, access to information and know-how through participation in global value chains, foreign licensed technology and modern management practices are among the most important ingredients for boosting innovation in the Western Balkans.

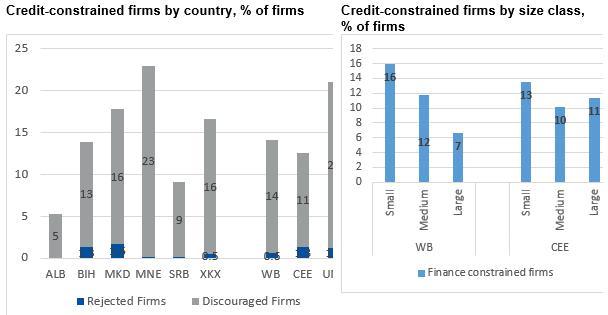

Financial gaps

The financial systems in the Western Balkans have held up well so far. Firms continue to rely largely on bank credit for external finance. Capital markets are underdeveloped, and the availability of venture capital, private equity and leasing is very limited. The share of credit-constrained firms in the Western Balkans is significantly higher among small firms compared to large ones (16% versus 7%). These credit constraints result from insufficient transparency of SMEs, as well as limitations in the risk assessment capacity of intermediaries. Going forward, the legacy of the COVID-19 pandemic and the impact of the Russian invasion of Ukraine are likely to further impede firm financial access. Over time, higher policy rates will translate into tighter financing conditions, with the credit demand-credit supply gap even greater for SMEs. This is a concern, as having access to finance, including overdrafts, was a source of resilience for firms during the pandemic.

Source: EIB calculation based on the 2019 EIB-EBRD-WB Enterprise Survey. Small refers to firms with fewer than 20 employees, Medium are firms with 20-99 employees and Large are firms with 100 or more employees.

Green economy

The region is slowly shifting from a dependence on coal and oil to nuclear power and renewable energy, strengthening its energy security. However, until 2018, the region relied heavily on fossil fuels to generate three-quarters of its electricity. Several countries continue to provide generous subsidies that lower the price of gas and other fossil fuels for consumers, slowing down the motivation to cut emissions.

SMEs in the Western Balkans typically lack the incentives for greening their business models. Physical climate risk is already affecting SMEs in the Western Balkans, with 10% of Enterprise Survey respondents reporting losses from extreme weather events in the three years preceding the interview. Nevertheless, the study documents a limited awareness among SMEs of environmental issues since only 21% of SMEs are investing in energy efficiency, and among those not adopting any climate measures 59% of firms consider that such investment is not a priority. More specifically, the report shows that climate investments depend on both managerial capacity and access to finance. Effective intervention will address both financing constraints and bottlenecks in managerial awareness and capacity.

Background information

About the report

Business resilience in the pandemic and beyond — Adaptation, innovation, financing and climate action from Eastern Europe to Central Asia is a joint publication of the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD), with contributions from the International Monetary Fund (IMF). The data in this report were gathered and analysed before Russia’s armed invasion of Ukraine.

The report uses a unique firm-level dataset, the latest wave of the EBRD-EIB-World Bank Group Enterprise Survey (Enterprise Survey 2019), which collected data on more than 28 000 registered firms from 2018 to 2020. The survey was conducted just before the onset of the pandemic, providing a structural snapshot of firms in the region. The report also uses the first round of the COVID-19 Follow-up Enterprise Surveys, which queried more than 16 000 firms. The World Bank used the follow-up survey to examine how firms adapted to the crisis.

EIB Global is the EIB Group’s new specialised arm dedicated to increasing the impact of international partnerships and development finance. EIB Global is designed to foster strong, focused partnership within Team Europe, alongside fellow development finance institutions, and civil society. EIB Global brings the Group closer to local people, companies and institutions through our offices across the world.