Digital technologies promise big productivity boosts and disproportionate competitiveness dividends for early adopters. In Europe digitalisation needs decisive policy action if EU firms are to catch up with US and China. Find out what that should be.

By Andrew McDowell, Philipp-Bastian Brutscher and Désirée Rückert

On 28 and 29 November, the European Investment Bank and the European Central Bank, in cooperation with the Massachusetts Institute of Technology, Columbia University and SUERF (the European Monetary and Finance Forum) will co-organise a high-level conference on ‘Investment, Technological Transformation and Skills’.

EU firms represent 20% of global spending in R&D, but they feature less often among the top tech-firms in areas such as microelectronics, consumer electronics, digital infrastructure and services, and cybersecurity. In this post, we use a novel survey-based dataset to analyse the process of digitalisation for EU and US firms. We show that European firms lag in adopting digital technologies, particularly in the services sector and for the most advanced technologies. We highlight the fact that the adoption of digital technologies promises large boosts to productivity and disproportionate dividends in terms of competitiveness for early adopters, creating strong path dependencies, as first-mover advantages mean that the “winner takes it all”. The barriers to reverse the EU delay are deep-rooted and, thus, require decisive policy action.

Europe digitalisation lags the US

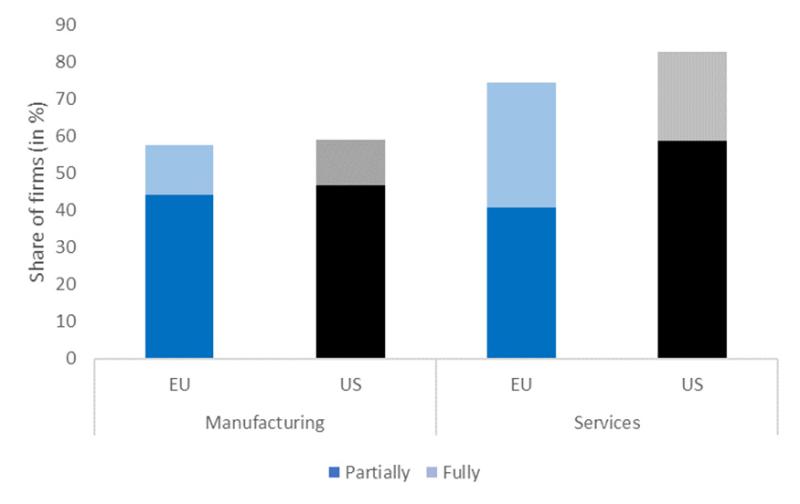

In our survey, we asked firms whether they have adopted one of four digital technologies 1 to date. Digital adoption rates in the EU service sector are below those in the US and European firms tend to lag particularly in adoption of the most sophisticated technologies, like big data, as well as the depth of integration. A much higher share of firms in the US have organised their entire business around digital technologies, which we label as “fully digital” (Figure 1). Given the markedly larger service sector in the US, this translates into lower adoption rates in Europe overall.

Figure 1: Share of firms that adopted digital technologies

Base: All firms. Question: Can you tell me for each of the following digital technologies if you have heard about them, not heard about them, implemented them in parts of your business, or whether your entire business is organised around them? Note: “Partially” are firms that have implemented at least one of four technologies in parts in recent years. “Fully” are firms that have organised their business around one of the four technologies.

Source: EIBIS Digital and Skill Survey 2018.

Europe digitalisation promises to be a game changer for competiveness

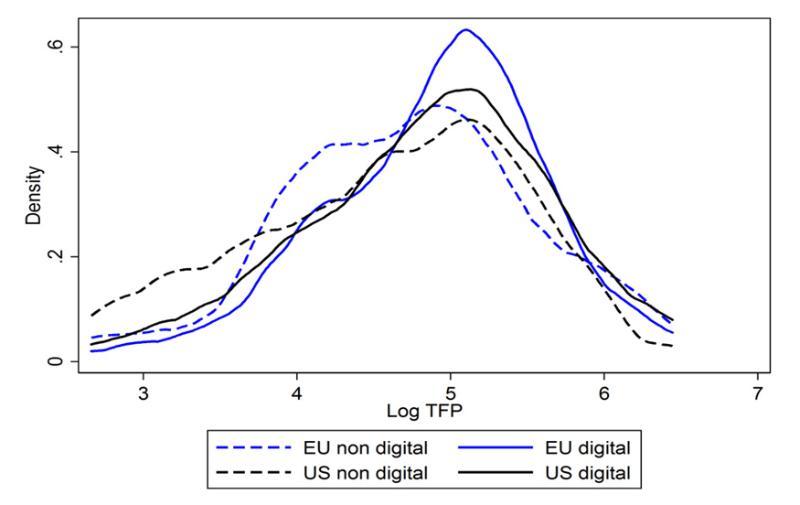

Our results show that, both in the EU and the US, firms that have adopted at least one digital technology (we label these “digital” firms), tend to have a higher productivity than their “non-digital” peers.

Figure 2: Total factor productivity of digital versus non-digital firms

Base: All firms. Note: Total factor productivity is based on sector by sector ordinary least squares regressions of value added on number of hours worked and firms’ total fixed assets plus country fixed effects. Distribution plots are weighted.

Source: EIBIS Digital and Skills Survey 2018.

When asked about the impact of adopting digital technologies on their sales (compared to a situation in which firms had not digitalised), firms generally report a positive effect of digitalisation. Specifically, more than 50% of EU firms and 36% of US firms say, on balance, that their sales levels would have been lower had they not adopted a digital technology. This suggests that at least part of the observed productivity difference in a firm’s performance can be causally related to the adoption of digital technologies.

Digital firms also invest more. If we compare the distribution of investment intensity (defined as investment spending per employee) for firms that have adopted digital technologies and those that have not, we consistently find a higher investment spending among digital firms than non-digital ones. This is true even if we zoom into individual sector and size classes and can largely be explained by the higher productivity of digital firms and the greater demand for their goods and services that comes on the back of this.2 What is more, digital firms are more active innovators.

Subheadline Digitalisation often means “winner takes all”

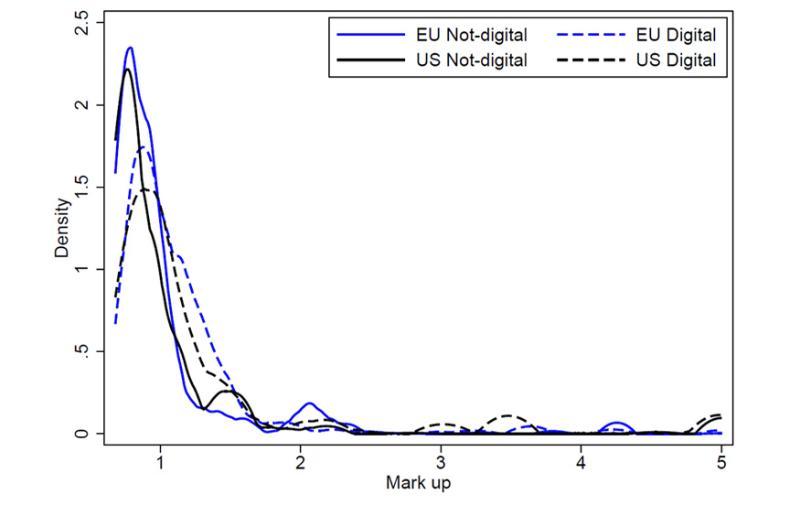

Digitalisation is associated with higher mark-ups. While most firms tend to agree that digital technologies lead to more competition, those adopting digital technologies are often in a relatively privileged market situation, with above average mark-ups (see also Calligaris et al., 2018). What is more, those that are furthest ahead in terms of their digitalisation efforts (i.e. they fall into the top productivity quintile and are fully digitalised) overwhelmingly report that further digitalisation leads to less competition in their market. This suggests strong “winner takes all” tendencies and highlights the risk to Europe in missing out on early adoption.

Figure 3: Estimated mark-ups by digitalisation status

Base: All firms. Note: Mark-up calculations are based on the approach of de Loecker and Eeckhout (2017). Distribution plot is weighted.

Source: EIBIS Digital and Skills Survey 2018.

What to do for Europe digitalisation?

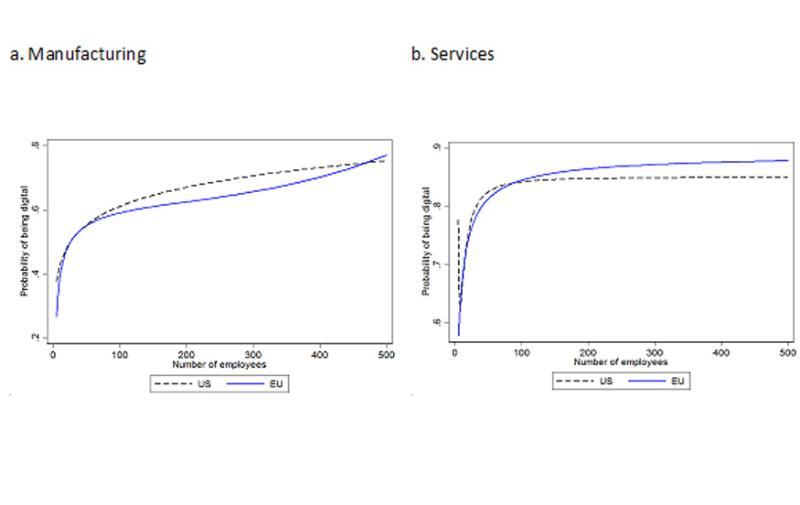

If policy-makers want to close the gap in adoption rates between the EU and the US, they have to address some profound barriers to adoption. The most important ones are those holding back European firms from growing into sufficient size. If we examine which firms do adopt digital technologies, we find that adoption rates increase in firm size both in the EU and in the US. The size effect is particularly pronounced at lower levels of firm size, and there is a marked increase in adoption rates as firms pass 50 employees, as Figure 4 highlights.

Figure 4: Firm size and probability of being digital in EU and US by sector

Base: All firms. Questions: Can you tell me for each of the following digital technologies if you have heard about them, not heard about them, implemented them in parts of your business, or whether your entire business is organised around them? How many people does your company employ full- and part-time at all its locations?

Source: EIBIS Digital and Skills Survey 2018.

The fact that more firms in the EU fall below the 50 employees threshold (40.1%) than in the US (28.6%) is, therefore, likely to be a major disadvantage for further adoption of digital technologies. Policymakers can address this barrier by reducing cross-country market fragmentation, in particular in the service sector in which we are still far from a Single Market and by removing disincentives to growth (as reported by Garicano et al, 2016, Schivardi and Rorini, 2008 and Braguinsky, Branstetter and Regateiro, 2011).

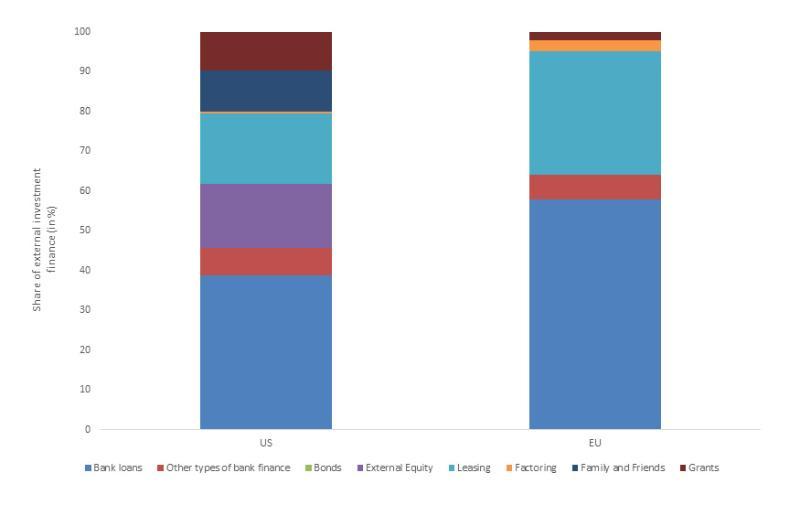

A second structural dis-advantage of European firms is the financial structure in Europe. Our survey data confirms that the financial system as it is, with its strong focus on bank finance, puts European firms at a funding disadvantage. This is true in particular for young firms, which are much more likely to report problems of access to finance (58%) than their older EU peers (47%), as well as their young US counterparts (49%). An important explanation for this is the difference in access to growth capital, which plays a much bigger role in the US (Figure 5).

Figure 5: External financing mix among young firms

Base: Firms younger than 10 years. Question: Did you use any of the following sources of finance for your investment activities? What share of your external financing does each type account for?

Source: EIBIS Digital and Skills Survey 2018.

Finally, policy makers should pay attention to factors that weaken business dynamics in Europe. We find that even though EU firms lag their US counterparts in terms of digital adoption, they are less likely to report “under-investment” in digital technologies. The difference in perceptions can be explained, at least in part, by weaker incentives to adopt. EU firms report they are less concerned about cost pressure and the entry of new competitors into the market as a result of digitalisation than their US counterparts. This suggests that the potential costs of missing digitalisation need to be raised among firms, as well as changing regulations that unduly shelter firms from competition (on the latter see Bravo-Biosca, A., 2016).

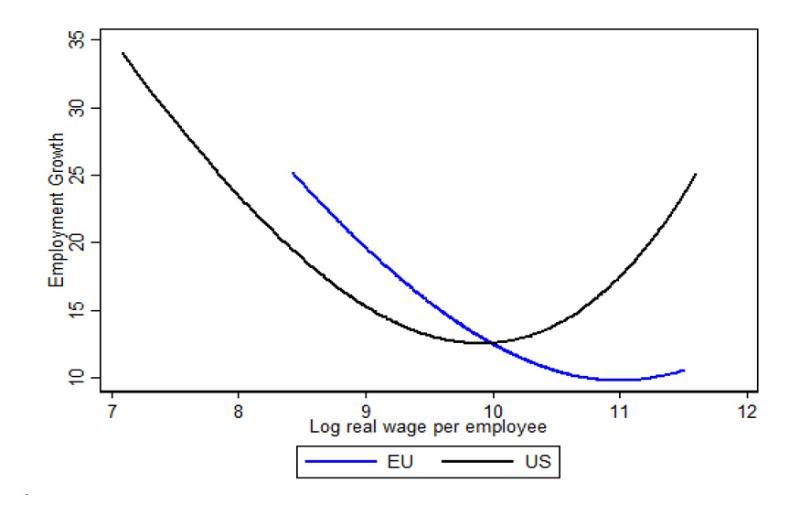

Digitalisation has downsides, but managing them shouldn’t come at the expense of adoption

Whether European firms lead in terms of digitalisation or not, new technologies will come with challenges that policy makers need to address. When plotting firm employment growth across the wage spectrum, we find positive growth among low-wage firms and, to a lesser extent, high-wage firms, but much less so among mid-level firms (which is in line with Autor and Dorn, 2013, Acemoglu and Autor, 2011, and Goos et al., 2014). Using our survey data, we can link this hollowing out of what used to be mid-level jobs (in terms of wages) to increased automation on the back of digital technologies (EIB, 2018).

Figure 6: Change in employment over wage spectrum

Base: All firms. Questions: How much did your company spend on wages? How many people does your company employ full- and part-time at all its locations? How many employees did you employ three years ago?

Source: EIBIS Digital and Skills Survey 2018

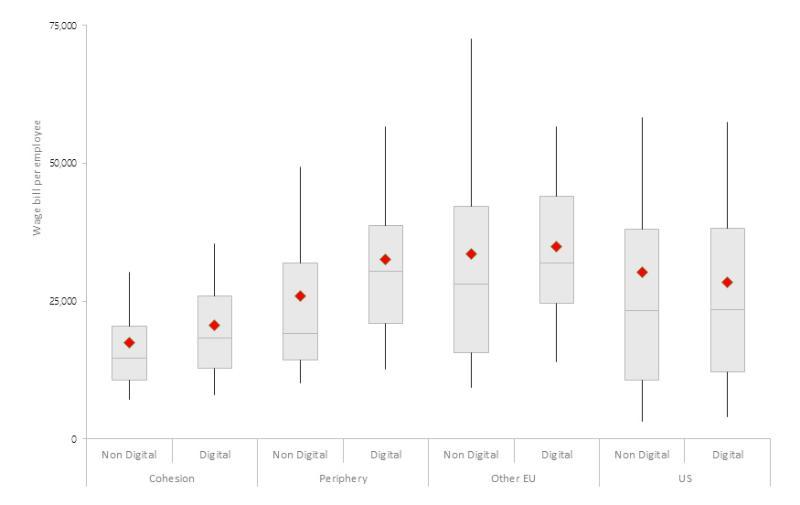

The survey results are evidence that, while digitalisation generally comes with lower demand for “low-skilled” staff, it comes with a high demand for “high-skilled” staff and that this is reflected in higher wages among digital firms. This suggests that, while digitalisation can lead to the disappearance of entire professions, the jobs created by digital firms are often relatively well-paid, “high-skilled” ones, potentially fuelling the polarisation between “low-skilled” and “high-skilled” workers even further.

Figure 7: Change in employment over wage spectrum

Base: All firms. Questions: How much did your company spend on wages? How many people does your company employ full- and part-time at all its locations? Note: Wages have been adjusted for purchasing power parity.

Source: EIBIS Digital and Skills Survey 2018

The flipside of the disproportionate competitiveness gains of digitalisation due to scale/network effects is that digitalisation can lead to strong market-concentration tendencies. To the extent that these can negatively affect consumer surplus, overall efficiency as well as undermine economic dynamism, policymakers need to stay vigilant. In addition, cyber-security threats risk having disruptive effects on trade, competitiveness, innovation, and society at large and, therefore, merit close surveillance.

Conclusions

While it is not too late, Europe needs to wake up to the potential—and the challenges—that digital technologies bring. Our survey results suggest that the adoption of digital technologies has the ability to boost firm performance (productivity, investment and innovation activities). To ensure that European firms do not lose touch with their US peers, it is important that the EU completes the Single Market, and that Member States review regulations that hamper firms from growing to the size needed for successful adoption.

This is even more true given the strong “winner takes all” tendencies of digital technologies. Whether Europe leads the digital transformation or follows it, policymakers will need to pay attention to some of the downsides of further digitalisation, which we also find in our data. These include the hollowing-out tendency for mid-level jobs, job polarisation, risks of too-high market-concentration, as well as cyber-security threats.

About the authors

Andrew McDowell is Vice President of the European Investment Bank. Philipp-Bastian Brutscher and Désirée Rückert are economists in the EU bank’s Economic Studies division.

Footnotes

- The technologies comprise, for the manufacturing sector: advanced robotics, Internet of Things, 3D printing and big data. For the service sector, the four technologies are digitalisation and automation of internal routines, web-based applications for marketing and sales, provision of digital content over the internet and big data.

- Differences in depreciation patterns add to this. Our survey evidence suggests that digital firms invest more in intangibles.

References

- Acemoglu, D. and Autor, D. (2011). “Skills, tasks and technologies: implications for employment and earnings”. In D. Card and O. Ashenfelter, eds, Handbook of Labor Economics, Volume 4, PartB. Amsterdam: Elsevier, pp. 1043–1171.

- Autor, D. and Dorn, D. (2013). “The growth of low-skilled service jobs and the polarization of the U.S. labor market”. American Economic Review, Volume 103(5), pp. 2121–68.

- Braguinsky, S., Branstetter, L., and Regateiro, A. (2011). “The incredible shrinking Portuguese firm”. NBER Working Paper No. 17265. National Bureau of Economic Research, Cambridge, MA.

- Bravo-Biosca, A. (2016). “Firm growth dynamics across countries: Evidence from a new database”. FORA-NESTA Working Paper (16:3).

- Calligaris, S., Criscuolo, C. and Marcolin, L. (2018), “Mark-ups in the digital era”. OECD Science, Technology and Industry Working Paper No. 2018/10. Organization for Economic Cooperation and Development, Paris. Available at: http://dx.doi.org/10.1787/4efe2d25-en.

- De Loecker, J. and Eeckhout, J. (2017). “The rise of market power and the macroeconomic implications”. NBER Working Paper No. 23687. National Bureau of Economic Research, Cambridge, MA.

- EIB (2018), EIB Investment Report 2018/2019: Retooling the economy of Europe, European Investment Bank, Luxembourg.

- Garicano, L., Lelarge, C., and Van Reenen, J. (2016). “Firm size distortions and the productivity distribution: evidence from France”. American Economic Review, Volume 106(11), pp. 3439–79.

- Goos, M., Manning, A., and Salomons, A. (2014). “Explaining job polarization: routine-biased technological change and offshoring”. American Economic Review, Volume 104(8), pp. 2509–26.

- Haskel, J. and Westlake, S. (2017). Capitalism without capital: the rise of the intangible economy. Princeton, NJ: Princeton University Press.

- Schivardi, F.; Torrini, R. (2003). “Identifying the effects of firing restrictions through size-contingent differences in regulation”. Labour Economics, 2008, vol. 15, issue 3, 482-511