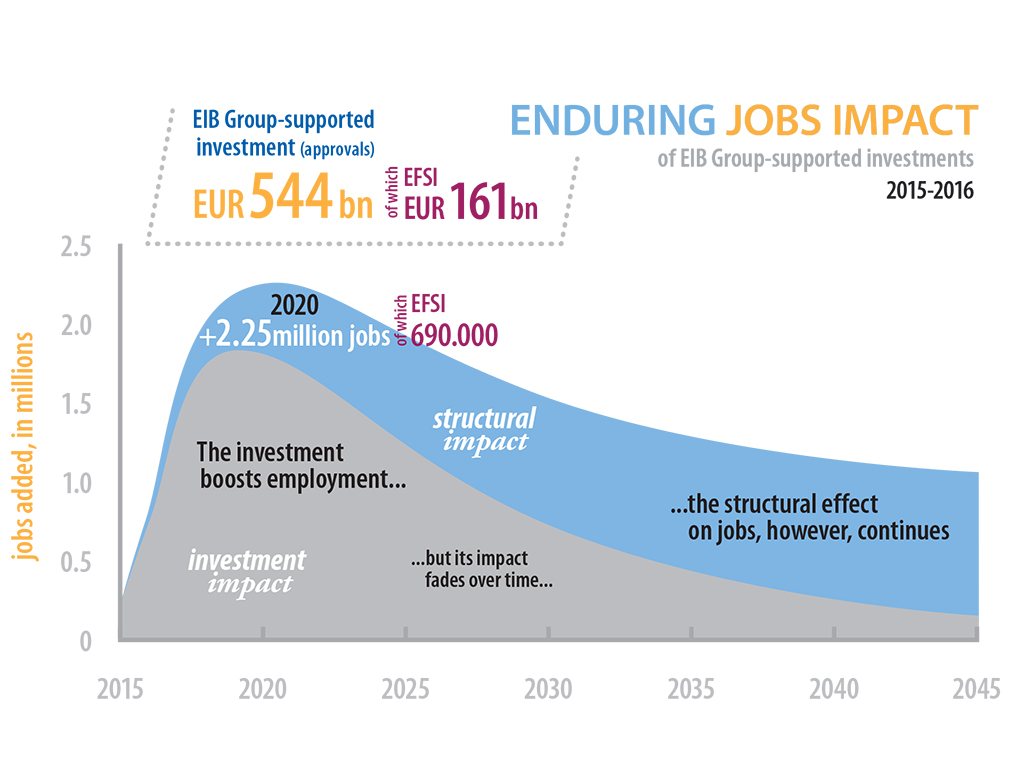

New findings show the Bank’s financial pillar of the Investment Plan for Europe will add 690,000 jobs by 2020.

Europe’s economy needed a jolt to recover some of its spark after the financial crisis. The Investment Plan for Europe aimed to provide that boost. New research by the European Investment Bank shows it’s working.

The pillar of the Plan that’s aimed at investment in innovative and small companies, the sectors where financing was most adversely affected by the crisis a decade ago, shows a strong impact, boosting jobs and gross domestic product.

“The Plan has set the economy in motion, and it’s a motion that’s self-sustaining,” says Debora Revoltella, the EIB’s director of economics. “That’s a success for the European economy and for the EIB, because we are all about jobs and growth.”

Modelling the economy

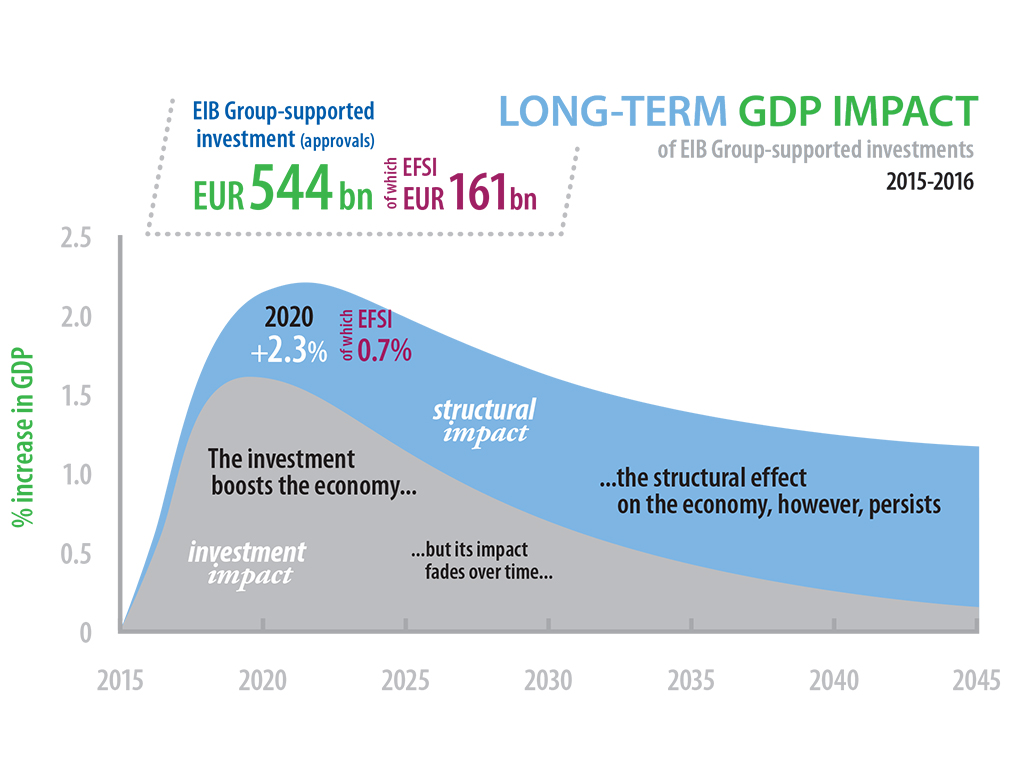

EIB economists used a well-established economic model to assess the future impact of the investments supported by all its operations during 2015-16, as well as for the loans it made specifically under the Investment Plan’s European Fund for Strategic Investments. They found that the EIB Group’s lending is likely to have a major impact on Europe’s economy.

By 2020, the EIB Group’s loans approved under the Investment Plan by the end of 2016 will:

- support EUR 161 billion of investment

- add 0.7 percent to EU GDP

- add 690,000 jobs

By 2020, overall investment approved by the EIB Group within the EU in 2015-2016:

- support EUR 544 billion of investment

- add 2.3 percent to GDP

- add 2.25 million jobs

The EIB findings demonstrate that the EIB Group’s loans—whether made in good economic times or bad—lay the foundation for long-term growth, beyond providing an immediate boost to the economy. “Our main purpose is improving EU competitiveness and long-term growth,” says Revoltella. “These findings show that in the long-term we will have a much bigger European economy, regardless of the economic cycle.”

Success against the market failure

It’s important for the EIB Group to assess the impact of its work, so it can ensure its financing is effective on behalf of EU citizens. The EU bank’s lending under the Investment Plan has already been welcomed in Brussels, where negotiations are close to conclusion for an extension to the programme, as well as an increase in its size.

The European Fund for Strategic Investments, which is operated by the EIB, started in mid-2015. It’s backed by a guarantee from the EU budget and was originally intended to trigger EUR 315 billion of investment in three years. European Commission President Jean-Claude Juncker has said he wants to boost that to EUR 500 billion by 2020.

The aim is to support companies that might otherwise have had a tough time finding bank financing, targeting key areas of innovation and small businesses.

“We built this programme to answer a crisis when there were specific market failures,” says Natacha Valla, head of the EIB’s economic policy and strategy division. “This study shows that we are making a difference.”

Conservative assumptions

To measure its impact, EIB economists had to account for the complex interaction between the Bank’s operations and other activities in the economy. The economists teamed up with the European Commission’s Joint Research Centre in Seville and worked with an economic model called RHOMOLO that was used to calculate whether increasingly scarce public financing was being used effectively.

One of RHOMOLO’s main strengths is that it captures:

- the short-term impact on economic activity

- change in productivity and, ultimately, growth in the longer-term.

For example, if the EIB finances a road, there is increased economic activity as the road is built. Once the road is complete, the EIB financing keeps on working, because the road reduces travel times and transport costs, thus increasing productivity, growth and job creation. To truly assess the impact of the EIB loan, both these factors have to be measured.

“We were conservative in the assumptions we made in the model,” says Georg Weiers, an EIB economist who worked on the study, “and yet the impact results are still very sizeable.”

Long-term impact

Once the initial boost to the economy dissipates, the study shows that the Investment Plan will continue to have a strong structural effect on the economy in the long-term, just as other loans by the EIB Group do.

By 2036, the investments supported the EIB Group’s approved loans under the Investment Plan between by the end of 2016:

- will add 0.4 percent to GDP

- will add 344,000 jobs

Overall investment supported through approved loans in the same 2015-16 period by the EIB Group provides an even larger impact after 20 years. It will:

- add 1.5 percent to GDP

- add 1.3 million jobs.

“The impact is big and it persists over time,” says Valla. “In 20 years, there will still be jobs around that are the result of these investments. That’s a key positive outcome from the Investment Plan and all the Bank’s operations.”