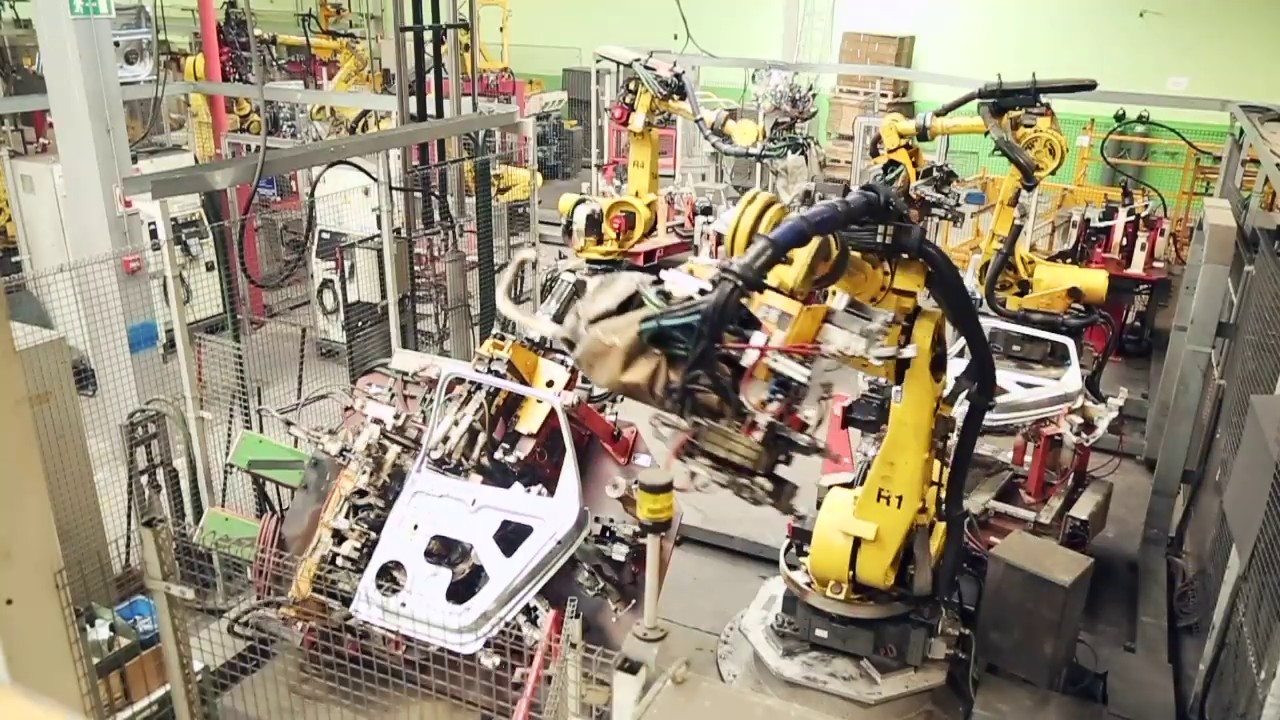

When IPM Rubi needed to upgrade its metal-stamping production lines, the Vitoria-Gasteiz mid-cap turned to Banco Santander for financing. A €4 million loan from the Spanish bank helped IPM Rubi retrofit its factories in Galicia and the Álava region, which gave the company a sustainability award in October 2024 for cutting energy consumption and, therefore, emissions by half. The retrofit also ensured that IPM Rubi, which employs 400 people, can keep up with developments in the automotive industry and maintain its two biggest clients, Mercedes Benz and Stellantis, which owns a stable of carmakers including Fiat, Opel and Peugeot.

“For us, this is dramatic, it's essential. Without this project, we couldn't survive,” says Chief Executive Ricardo Romo. “And we couldn't do it without the financing.”

The upgraded production lines are for passenger vehicles. But Romo expects he'll soon need to carry out similar improvements on his lines for goods vehicles. “We hope to come back to the banks for more financing,” he says, “so that we keep up with the electrification of the automotive industry.”

That's where the nuts and bolts of IPM Rubi's metal-stamping business, which had turnover of €128 million in 2023, meets the arcane and intangible world of financial securitisation. Banco Santander packages loans like the one it made to IPM Rubi into securities, sells them to investors, and in turn uses the proceeds to make new loans, like the one IPM Rubi expects to take for its goods vehicle line. Securitisation is a huge, liquid market in the United States and Asia. And Europe is trying to catch up, so that there's more financing for businesses like IPM Rubi that are vital to the real economy. The European Investment Bank is investing in securitisations by European banks and developing innovative securitisation structures that it hopes will lead to a bigger market, as part of its backing for the single market for capital across the continent known as Capital Markets Union.

Efficient funding for SMEs

Compared to the US and Asia, tight regulation has somewhat slowed securitisation's growth in Europe – particularly in the part of the market for securitisations with a higher rating and lower yield. To counter this, the EIB Group (the European Investment Bank and the European Investment Fund) is backing innovative banks with big investments in securitisations that create a more liquid market.

It’s part of a plan by the European Union’s financing arm to promote Capital Markets Union (which is, in recent proposals, sometimes referred to as Savings and Investments Union). At the same time, it also unlocks financing for small and medium-sized companies (SMEs) across various sectors, including key areas such as climate and innovation.

“We are increasing our participation in the securitisation market,” says Manuel Conthe, a loan officer at the European Investment Bank. “It’s an efficient way of funding loans to SMEs.”

That’s why the EIB Group worked on a €530 million investment in a securitisation with Banco Santander signed in May 2024. The European Investment Bank invested €440 million in highly rated tranches of securities that were based on a pool of Santander’s loans to its clients, while €60 million was allocated to non-investment grade tranches. In return, Santander agreed to originate double that amount in new loans to Spanish SMEs and Mid-Caps, which are vital to the country’s economy and play a crucial role in driving employment and growth.

“By selling these bonds, we release capacity for additional loans to customers,” says Koldo Oleaga Gascue, head of asset mobilisation at Santander in Madrid. “We recycle capital, and we increase the support we give to communities and to our customers.”

Filling a gap in the securitisation market

The European securitisation market has been growing somewhat since the middle of the last decade. That’s mostly limited, however, to the tranches of any deal that carry a lower risk. “Senior” tranches, where the risk and, consequently, the payoff is lower, represent the largest portion of most securitised structures—often close to 80%, as in the Santander securitization. That means banks like Santander need to place a significant amount of this kind of tranche in the market.

That’s where the investment by the EIB Group plays a major role. “By purchasing an important part of the senior tranche, the EIB Group facilitates the placement in the market of the full structure of very big transactions,” says Balint Konya, structured finance analyst at the European Investment Fund.

The European Investment Fund is the subsidiary of the European Investment Bank that focuses on SMEs. Though its investment in the Santander securitisation was much smaller – at €30 million – its expertise in synthetic securities plays a key role in structuring, negotiating and executing securitisations for both the European Investment Fund and the Bank. The European Investment Fund’s contribution, which resulted in Santander agreeing to originate a €60 million portfolio of new loans granted to SMEs and small mid-caps, also included a commitment that 30% of the new loans should target sustainable investments and 20% should be for “gender-balance financing,” such as companies run by women entrepreneurs.

Karen Huertas, senior investment manager at the European Investment Fund, believes that these deals prove the value of the EIB Group in the Capital Markets Union. “EIB Group participation in these deals shows that securitisation transactions are economically efficient and effectively placed in the market, while we still contribute to the growth of the European economy,” Huertas says. “We need to strategically put the EIB Group investments and efforts in places where the market and the originators need us most.”

Born and raised in the EU

European companies tend to depend more on bank financing than their counterparts in the US and Asia, where there is a bigger venture capital market. Consequently, European start-ups are often bought by US investors. European capital markets also lack the depth of US markets, because they are national and, therefore, relatively limited in scale.

The latest push for Capital Markets Union started with an initiative from the European Commission in 2020. At a Euro Summit in Brussels in March 2023, EU government leaders called “for stepping up collective efforts, involving policymakers and market participants across the Union, to take forward the Capital Markets Union.” In October 2024, EU finance ministers welcomed proposals from the European Investment Bank to deepen Capital Markets Union.

President Nadia Calviño has spoken of several ways in which the European Investment Bank might provide some of the building blocks to a Capital Markets Union, so that “ideas, businesses and technologies born in the European Union can grow, develop and thrive within our borders”. One of these ideas is a securitisation platform that would allow for more standardized deals, bringing in smaller banks and freeing their capital in turn for loans to SMEs.

Time consuming

Standardisation would be important, because bespoke securitisations are complicated and time-consuming to set up.

In July, the European Investment Bank signed a deal with BPCE, a big French banking group. The European Investment Bank and the European Investment Fund bought senior notes—the Bank made an investment of €750 million and the Fund invested €50 million. In return BPCE agreed to make twice that amount in new loans within three years. In a first for the European Investment Bank in France, the new loans will target small companies in the innovation sector, including health technologies.

“This is something we definitely want to do more of,” says Nicolas Mardam-Bey, the European Investment Bank loan officer who worked on the deal. “Capital markets union should relax regulations to allow more issuance. In the US, they need to allocate much less capital than Europeans, because they operate under less stringent capital allocation requirements. That could provide valuable insights for Europe.”

Until capital markets union progresses, the European Investment Bank’s participation itself facilitates deals that might otherwise not be done at all.

"The scale of the European Investment Bank's operations allows for economic efficiency,” says Jean-Philippe Foeillet, expert leader at BPCE’s Natixis investment banking unit. “These transactions are demanding in terms of resources, time, and information technology, so they benefit from economies of scale that make their management more viable."

At the scale of the European Investment Bank deal, Foeillet knows that he will be able to bring other investors into the same structure.

Structures that could be platforms

And the structure developed for the BPCE deal is more complex even than a typical securitisation – and more innovative.

Most securitisations represent a set pool of underlying loans made during a particular period of time. The BPCE deal allows the French bank to periodically replace the underlying loans with new loans. The bank could effectively maintain the same structure and keep it running for decades, long after the first underlying loans have been paid off. That makes it closer to the kind of securitisation platform the European Investment Bank might set up as part of its backing for capital markets union, says Jesper Skoglund, a structured finance manager at the European Investment Fund who worked on the BPCE deal.

“We want to keep on deploying these kinds of securitisation instruments to encourage new lending,” Skoglund says. “It will create a more active securitisation market in Europe and boost lending to the real economy.”

Champions of tech

The European Investment Fund is also behind another capital markets union initiative from the European Investment Bank Group that is, effectively, an investment platform in its own right.

The European Tech Champions Initiative aims to plug a hole in the venture capital market in Europe, mobilising public and private resources. That's because most European deep-tech companies are financed by foreign investors. Only a small portion are funded by European investors, and almost none of the financing comes from the capital markets.

The European Investment Fund accounts for a large portion of what venture capital there is in Europe, investing in funds which in turn invest in startups and scaleups. The second phase of the Tech Champions Initiative will do that too—but it will also target the mobilisation of large pools of resources from European pension funds and insurance companies, for example, which will come to Tech Champions through an investment instrument.

Such investors typically don't view venture capital as worth all the time and resources it takes to make relatively small venture capital investments; the Tech Champions Initiative 2.0 will give them an opportunity to make a larger investment through an instrument that gives them access to a diversified European venture capital portfolio at once.

“Once investors start to familiarise themselves with the asset class, they will be more eager to dedicate meaningful resources,” says Adrian Zambrano, a structuring expert at the European Investment Fund.

EIF

Europe's venture capital market will receive a double boost from the Tech Champions Initiative. First, investors such as pension funds will enter the market by investing in the Tech Champions platform. Second, the consequent increase in investment in venture capital funds will allow more of those funds to reach their fund-raising goals and, thus, increase the financing available for startups and scaleups.

“We're trying to open access for European investors to this asset class,” says Zambrano. “Even though it's very challenging, we expect it to be a ground-breaking solution.”

To get the fund started, six EU member states and the European Investment Bank have invested €3.7 billion. The fund is expected to open for private investors in 2025.

- Read how the Tech Champions Initiative fits into a wider effort to boost financing for innovative European companies

SANTANDER ABS FOR SME SUPPORT II

Purchase of several tranches of a true-sale securitization in order to stimulate lending to SMEs and Mid-Caps.

BPCE ABS INNOVATION

EIB dedicated financing to support SMEs and Midcaps. This operation will also contribute 35% to innovation to foster sustainable economic growth.