- Substantial policy support during the pandemic helped to prevent large-scale bankruptcies in the region, with only 4% of firms filing for insolvency or closing permanently.

- Trade with developed economies, information and know-how gained through global value chains, and access to foreign technology helped boost innovation and competitiveness in the region.

- The transition to a net-zero carbon economy presents significant risks for the regions, and firms are lagging behind developments in others parts of the world.

- A lack of access to finance continues to constrain firms’ growth in the region. The number of firms without access to credit or even a banking relationship is still relatively high.

Russia’s invasion of Ukraine and its economic fallout come just as firms in central Eastern Europe and Central Asia were recovering from the COVID-19 shock. A new report, published today by the EIB, EBRD and IMF, Business resilience in the pandemic and beyond, examines how firms in the region weathered the sharp downturn caused by the pandemic and how prepared they are to face future challenges. It also looks at whether gaps in access to finance are likely to impair their short-term resilience and long-term prospects.

You can read the full report here.

You can read an online summary here.

“The war in Ukraine marks a major change in geopolitics. New risks and heightened uncertainty are putting cross border flows and trade under pressure,” said EIB Chief Economist Debora Revoltella. “This matters as our analysis shows that firms’ resilience and innovation capacity during the pandemic were linked to their participation in global value chains and trade. It is thus important to consider carefully the consequences that a potential de-globalisation might have for the region.”

Beata Javorcik, Chief Economist at the European Bank for Reconstruction and Development said: “The full fallout from the pandemic is not known yet, as many governments introduced extraordinary measures to protect firms from creditors. As a result, in 2021 firm bankruptcies in the new EU member states were below the pre-pandemic levels. The expected withdrawal of the emergency measures, combined with the impact of the war on Ukraine, makes the topic of firm resilience especially timely.”

Alfred Kammer, Director of the IMF’s European Department, said: “The COVID-19 outbreak put businesses in Eastern Europe and Central Asia through a severe test. Their resilience and adaptation capacity are a testament to the importance of productivity, innovativeness, managerial quality, global integration and access to financial lifelines. Government support measures played a critical role by helping firms at risk. Ensuring a resilient business environment and the availability of sufficient liquidity for severely affected viable firms is crucial to enhance survival during the unfolding geopolitical crisis.”

Eastern Europa and Central Asia — the impact of COVID-19

To date, firms have come through the pandemic better than initially feared. They lost 25% of turnover and shed 11% of their labour force, with the pandemic hitting contact-intensive services and smaller and medium-sized businesses especially hard. But massive policy support helped to prevent large-scale bankruptcies, with only 4% of firms filing for insolvency or closing permanently.

The report shows that firms that were integrated into global value chains, those that had been more innovative in the past, those that were more digitalised and those with better quality management adapted better during the pandemic. They expanded their online presence, switched to remote work, adjusted production or took advantage of the available policy support more effectively.

Government programmes played a stabilising role by mitigating the stress of vulnerable firms, such as smaller businesses, stand-alone firms and those lacking overdraft facilities.

Openness to trade in Eastern Europe and Central Asia drives resilience, innovation and competitiveness

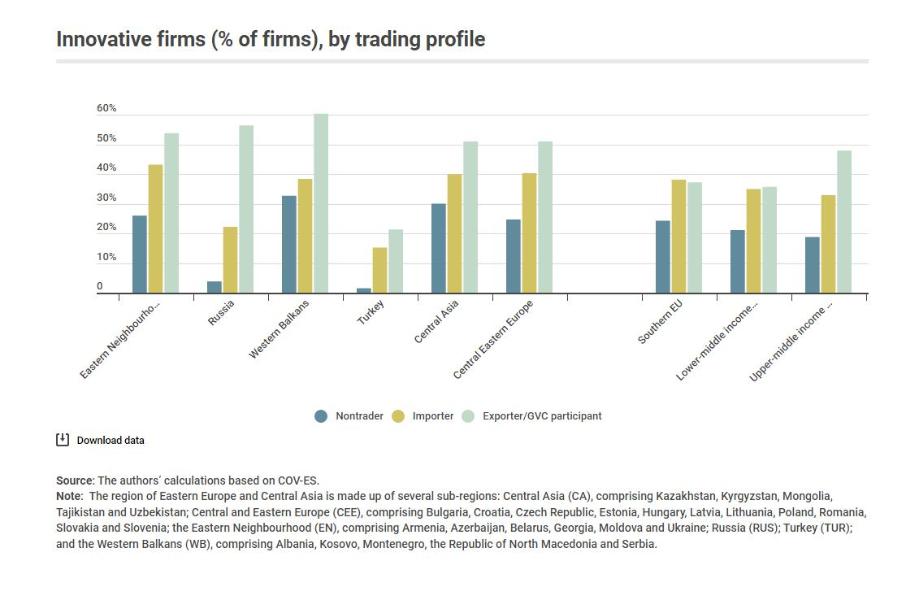

The report finds that the economies of Eastern Europe and Central Asia generally invest more in innovation than benchmark economies, although the process is led by adapting new technologies developed elsewhere. Opening up the global economy has been essential for enabling many developing countries to improve their comparative advantages and increase their competitiveness. The industrial composition of more integrated regions in global value chains is clearly focused more on higher value added products, while those that are less integrated are trading mainly manufacturing products with lower value added or raw materials.

The evidence in the report indicates that trade integration with developed economies, in particular the European Union, access to information and know-how through participation in global value chains, foreign licensed technology and modern management practices are among the most important ingredients for boosting innovation in Eastern Europe and Central Asia.

Financial gaps

The financial systems in Eastern Europe and the Western Balkans have held up well so far. Firms continue to rely largely on bank credit for external finance. Capital markets are underdeveloped, and the availability of venture capital, private equity and leasing is very limited. About 55% of firms perceive a lack of access to finance as an obstacle.

24% of small and medium-sized enterprises (SMEs) and 27% of young firms say a lack of access to loans or other finance is a problem. Innovative firms are also more likely to be credit-constrained, particularly young, innovative SMEs.

About 50% of firms rely solely on their own finances for projects, particularly small businesses and young firms. Access to credit is associated with investment and growth. Strong connections to the banking sector yield economic gains.

Green economy

The region is slowly shifting from a dependence on coal and oil to nuclear power and renewable energy, strengthening its energy security.

However, until 2018, the region relied heavily on fossil fuels to generate three-quarters of its electricity. Several countries continue to provide generous subsidies that lower the price of gas and other fossil fuels for consumers, slowing down the motivation to cut emissions.

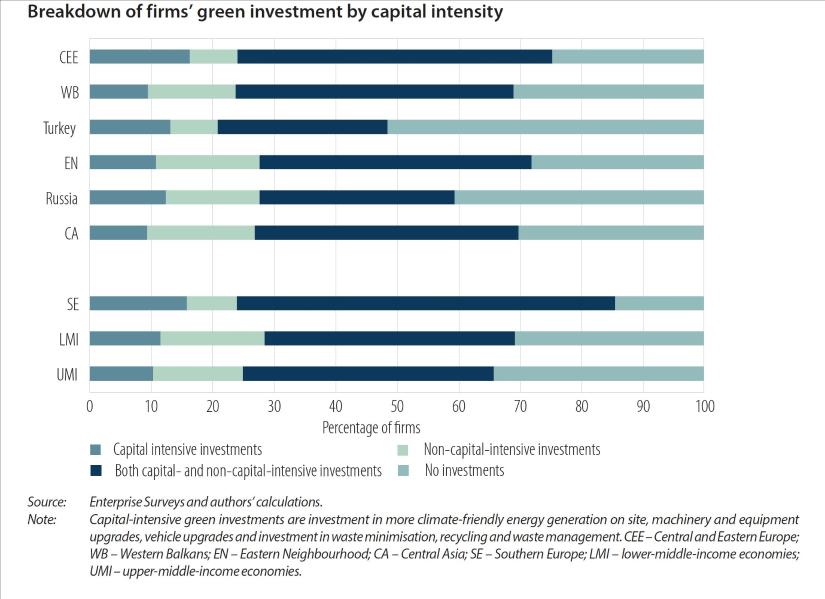

More than 70% of firms in the region have made at least one type of green investment, compared with more than 85% of firms in Southern Europe. Enterprise Survey evidence indicates that more than a quarter of respondent firms in the region have not engaged in any type of green investment, whether capital-intensive or not, over the three years prior to the survey, while 46% have engaged in both capital-intensive and non-capital-intensive green investment.

About the report

Business resilience in the pandemic and beyond adaptation, innovation, financing and climate action from Eastern Europe to Central Asia is a joint publication of the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD), with contributions from the International Monetary Fund (IMF). The data in this report were gathered and analysed before Russia’s armed invasion of Ukraine.

The report uses a unique firm-level dataset, the latest wave of the EBRD-EIB-World Bank Group Enterprise Survey (Enterprise Survey 2019), which collected data on more than 28 000 registered firms from 2018 to 2020. The survey was conducted just before the onset of the pandemic, providing a structural snapshot of firms in the region. The report also uses the first round of the COVID-19 Follow-up Enterprise surveys, which queried more than 16 000 firms. The World Bank used the follow-up survey to examine how firms adapted to the crisis.