Wilhelm Molterer

The higher you raise the level of ambition, the more you are at risk. But, on the other hand, if you succeed, then you have really done something great. The Commission and the EIB Group can be proud that the two institutions took responsibility. We had a discussion in the Parliament where I had to answer a question about whether it was possible that we might lose some money out of a €26 billion guarantee. I said, “That’s the nature of a guarantee. If you offer a guarantee, you must be ready to lose. That’s not our intention, for sure, but the reality is that money could be lost.” The vast majority of parliamentarians and the staff at the Commission were used to the grants world, whereas the EIB had a keen interest in financial instruments. To blend the two was also a bit of a cultural shock. President Hoyer started to talk about a paradigm shift for the EU.

Another crucial element was the cooperation with national promotional banks. If you want to be successful in any market, you need their capacity and their market knowledge. Also not everybody was happy about the advisory component. The staff at the Advisory Hub were strict about the prerequisites for going to the financing stage. The learning curve was steep for everybody in this endeavour.

Where do you think the impact of EFSI has been the greatest in the economy?

I would turn it the other way around. The biggest impact has been on the institutional side. The institutions—the Commission, which is responsible for European taxpayers’ money and the EU budget, and the EIB Group—have learned that if you put the strengths of these two big institutions together you achieve a higher impact, much higher than when using just the old instruments.

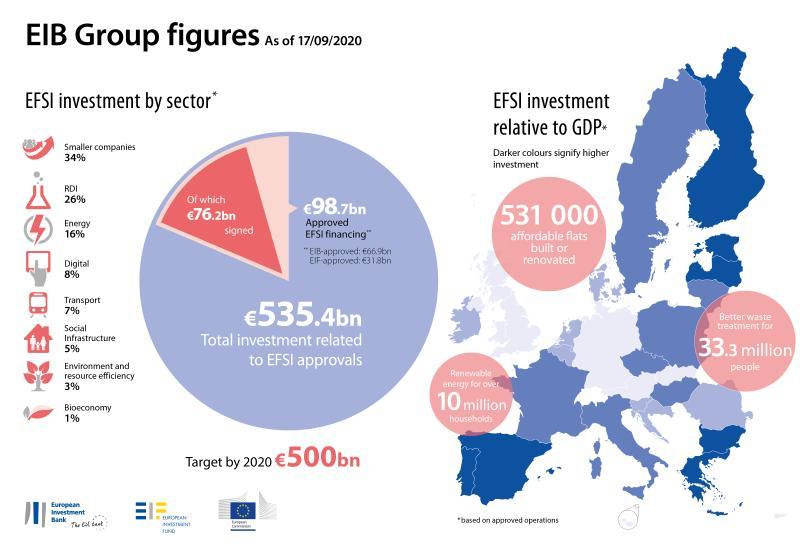

I would say you can see it most in the three Cs, Competitiveness, Cohesion and Climate. You can showcase the fact that EFSI has supported a huge number of projects in RDI (Research, Development and Innovation) to strengthen competitiveness (and the digital sector). If you look at the distribution of EFSI deals in Member States and compare these volumes to the size of the countries’ GDPs, you can see that the right ones are getting EFSI deals into their economies. As for the climate, the 40% target of the Infrastructure and Innovation Window will be achieved. These key points are also a good answer to the criticism we heard at the beginning.

There is a third component I want to highlight—flexibility. The 40% climate target was added to the regulation in 2018 when EFSI had already been in full swing for three years, and yet we managed to achieve the target.

And this year, 2020, when COVID-19 has created such turmoil for people and the markets, the EIB Group reacted immediately. The EFSI guarantee was crucial for this quick and bold move.