Repeated crises are exacerbating companies' financial worries. €350 million in guarantees could be mobilised under a new cooperation agreement between the EIB and Gigarant, providing companies with easier access to total financing of at least €875 million.

- The European Guarantee Fund (EGF) will enable the EIB to provide €350 million in support for the guarantee capacity of Gigarant, a special support facility set up by the Flemish authorities and managed by Flemish investment company PMV.

- Gigarant will support Flemish businesses by granting guarantees starting at €1.5 million for loan operations.

- In total, at least €875 million in new financing could be provided to Flemish companies.

The European Investment Bank (EIB) and Gigarant N.V., a specialised support facility managed by Participatiemaatschappij Vlaanderen (PMV), have signed a new cooperation agreement covering a €350 million counter-guarantee granted by the EIB to Gigarant. This will make it possible to provide at least €875 million in new financing to Flemish large and mid-cap[i] companies.

The EIB counter-guarantee was made possible by the support of the European Guarantee Fund (EGF), which was set up in summer 2020 to help European businesses cope with the coronavirus pandemic. The health crisis has triggered a series of further crises that still weigh heavily on the economy and businesses. The war in Ukraine has also led to major energy price increases, while Belgium is seeing a sharp surge in inflation. This cooperation agreement is therefore an important step to prepare companies for the future.

Gigarant's support facility enables commercial banks to obtain guarantees from Gigarant (from €1.5 million) for loans granted to Flemish companies experiencing difficulties in accessing appropriate financing due to the economic consequences of the health crisis or other reasons and crises.

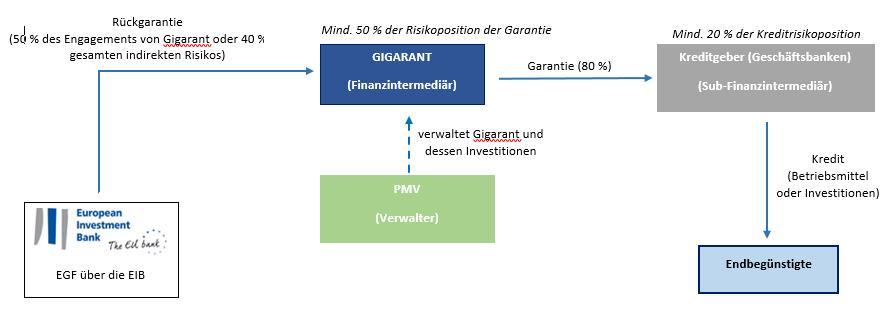

The added value of the support facility lies in the risk sharing between commercial banks, Gigarant and the EIB. Sharing the risks associated with loans means than a larger volume of loans can be made available, thereby helping more Flemish companies.

In practice, at least 20% of the risk remains with the commercial banks while Gigarant guarantees a maximum of 80% of the risk borne. Half of the risk on this amount will be taken on by the EIB under the €350 million counter-guarantee. The risk will therefore be shared and better distributed between the various parties, making it possible to support at least €875 million of loans to Flemish companies.

Gigarant has the last word on granting the guarantees. The support facility can be applied retroactively to the guarantees granted by Gigarant since 1 January 2021.

Flemish Minister of Economy Hilde Crevits said: “Flemish companies have had to face crisis after crisis in the last two years. After COVID-19 and Brexit, they are now facing the consequences of the war in Ukraine. Companies and the self-employed must have easy access to financing to weather such circumstances. In addition to the direct liquidity support currently being provided by the Flemish authorities in the form of bridge lending, a solid guarantee system is needed to ensure access to loans. The counter-guarantees we are signing today with the EIB and the EIF will enable businesses to benefit from more advantageous guarantee premiums and Gigarant to support more Flemish companies. This is a brilliant example of European cooperation that delivers concrete results for Flemish companies.”

Gigarant Business Manager Frédéric Meire added: “We are delighted to partner with the EIB to continue helping Flemish companies to deal with financing problems linked to the current difficult conditions. This common approach can address companies’ ongoing challenges.”

EIB Vice-President Kris Peeters said: “The consequences of the pandemic are still being felt in Flemish businesses, and some companies are still facing unmet financing needs. The European Guarantee Fund (EGF) and Gigarant’s support will enable the EIB to take on part of the risk of loans to Flemish companies. Sharing risk with our partners in this way means that we will be able to provide more loans and reach more Flemish companies. This is how we will make a difference.”

Support facility diagram

The European Guarantee Fund (EGF) was set up by the EIB Group with contributions from EU Member States to protect companies suffering from the economic consequences of the COVID-19 crisis. With almost €25 billion in guarantees, the EGF enables the EIB and its subsidiary the European Investment Fund (EIF) to quickly provide guarantees, asset-backed securities, equity and other financial instruments to European companies, particularly small and medium-sized enterprises (SMEs). At the end of March 2022, the total amount of projects approved was €23.1 billion. This financing is in turn expected to mobilise around €174.5 billion in new investment. To date, €583 million in financing has been approved in Belgium, which is expected to mobilise up to €2.8 billion in investment.

Background information

In 2021, the EIB provided €3.42 billion in loans for Belgian projects in various sectors, including healthcare, water management, education and SMEs.

Participatiemaatschappij Vlaanderen (PMV) is a do and dare company that is shaping the future of the Flemish economy. It provides funding for promising companies, from the day they first open their doors, through their various growth stages and even on to operating internationally. PMV offers tailor-made financial solutions for entrepreneurs with a solid business plan and a strong management team, including equity, loans and guarantees. It also implements projects that are key to the prosperity and well-being of Flanders, with and on behalf of public authorities as well as with other partners. PMV manages a portfolio of €1.35 billion.

Via Gigarant NV, a special purpose vehicle of the Flemish authorities, Flanders provides market-based guarantees from €1.5 million to support of loans to companies. A €3 billion guarantee budget has been set aside by the Flemish government for this purpose. In certain circumstances, investments may also be made in underlying companies in addition to guarantees.

[i]a) A mid-cap company has between 250 and 3 000 full-time equivalent employees.

b) A mid-cap can also be a company with fewer than 250 employees, but with annual turnover of over €50 million and an annual balance sheet total of over €43 million, as established under European Commission recommendation 2003/361/EC concerning the definition of micro, small and medium-sized enterprises, which came into force on 1 January 2005.

c) A large company has at least 3 000 full-time equivalent employees.

d) A company is any entity engaged in an economic activity, regardless of its legal form.