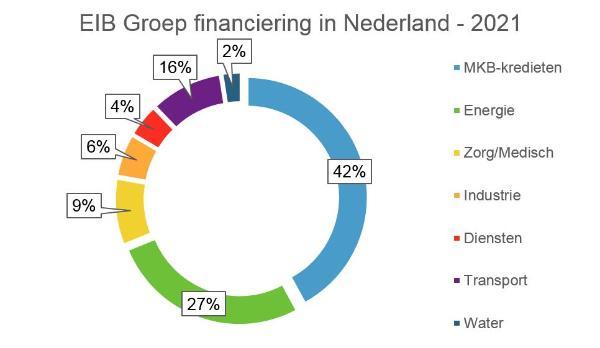

- In 2021, the EIB Group made available almost €95 billion worldwide, a record amount, of which €2.8 billion was for projects in the Netherlands.

- For the purposes of the green transition, 64% of financing in the Netherlands went to climate-related projects, a figure significantly higher than the percentage of “green” loans granted overall by the EIB Group (43%).

- Significant support was provided to new sectors, such as specialised long-term care, as well as to innovative companies through venture capital provided under the Pan-European Guarantee Fund.

In 2021, the European Investment Bank (EIB) and the European Investment Fund (EIF), which together form the EIB Group, made available a record amount of almost €95 billion in financing, a large part of which (around €45 billion) helped European SMEs to cope with the crisis. Just over €2.8 billion of this funding was used to support projects in the Netherlands, mainly in the field of climate (64%).

Last year, as in 2020, a substantial share of EIB financing went to the healthcare sector. In particular, loans were granted to specialised long-term care providers, such as Ipse de Bruggen, and to regional hospitals such as Zuyderland and Alrijne Zorggroep.

In the field of innovation, EU guarantee programmes were useful in supporting Dutch projects with EIB venture capital. For example, cybersecurity specialist EclecticIQ and medical technology pioneer Xeltis received financial backing to continue their growth despite the difficult economic environment.

The EIB subsidiary, the European Investment Fund (EIF), continued its cooperation with Invest-NL in 2021 through the Dutch Future Fund and the Dutch Alternative Credit Instrument, in particular by investing in Rubio Impact Fund, Thuja Capital Healthcare, Shift Invest and henQ Fund. The EIF also provided guarantees, to Triodos for example, to accelerate lending in the arts and cultural sectors, via a European Commission guarantee under the Cultural and Creative Sectors Guarantee Facility.

“The EIB Group remains an important financial partner for Dutch entrepreneurs and public bodies”, said EIB Vice-President Kris Peeters. “The tailored backing we have provided in recent years to projects in the healthcare sector has helped to raise our profile, so that we are now able to also support specialised long-term care facilities, for example. In the coming years, SMEs and climate will certainly remain priorities for us. The EIB Group wishes to send a clear signal that it will support entrepreneurship and the green transition through its financing. The door to our office in Amsterdam therefore remains wide open. ”