- EU Bank provides EUR 600 million of venture debt financing per year for innovative European companies

- More than 25,000 high-quality jobs sustained

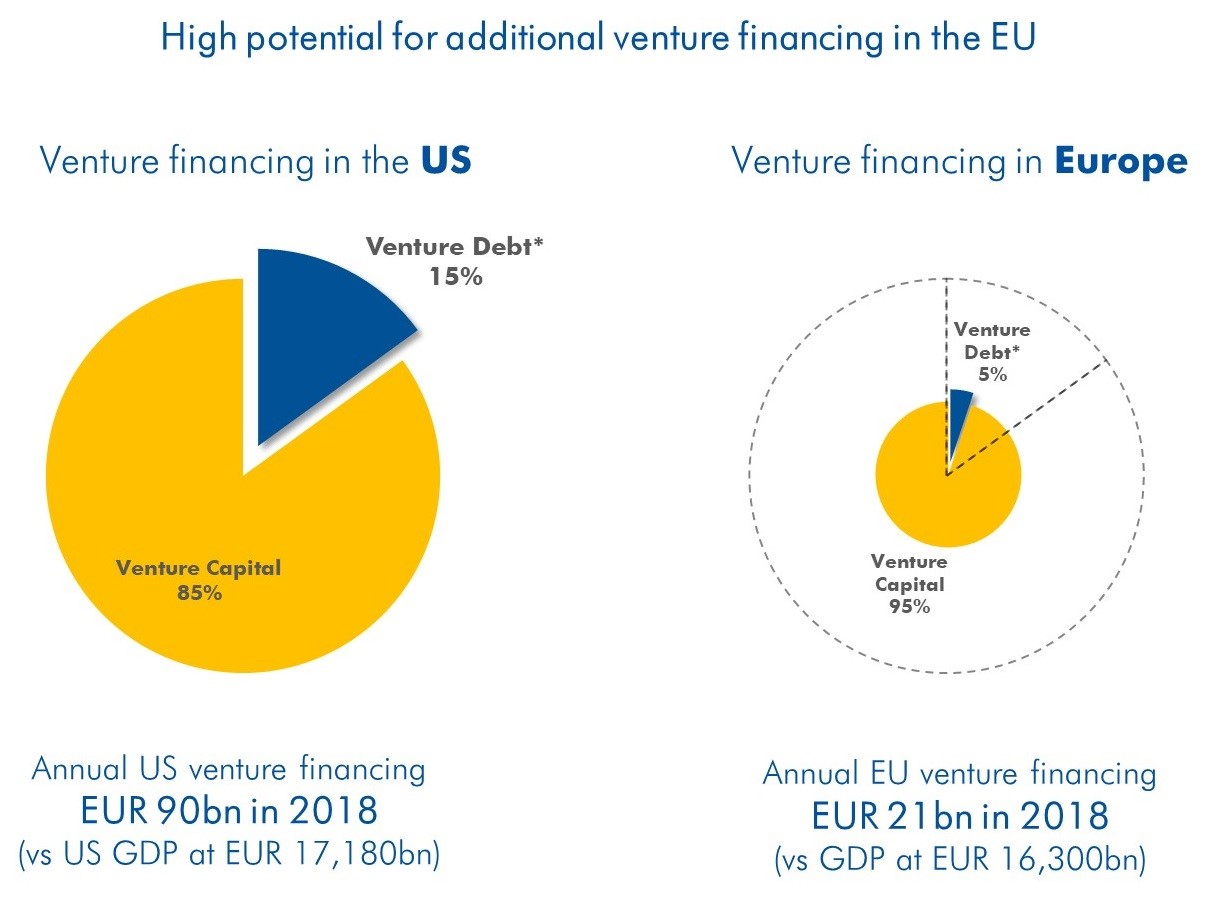

- Enormous growth potential of venture financing in Europe as it remains far behind the US

The EU Bank remains Europe’s largest provider of venture debt with EUR 600 million per year in long-term financing for highly innovative companies. Since the start of its venture debt financing operations three years ago the Bank provided more than EUR 1.8 billion to companies in sectors such as life science, robotics or artificial intelligence. The investments are expected to generate more than 25,500 high-quality jobs as well as around EUR 16 billion in additional investments in European R&D.

The venture debt product is a unique financing instrument of the EIB that supports early-stage, highly innovative companies in cutting-edge technology sectors. It combines the advantages of a long-term loan with a remuneration model based on the company’s performance. Venture debt transactions help to strengthen the borrower’s economic capital without diluting the shares of existing investors or the founders. The product, developed in response to market needs three years ago, is backed by the European Fund for Strategic Investments (EFSI), the financial guarantee from the EU budget which underpins the Investment Plan for Europe. EFSI support has helped the EIB to expand the use of venture debt considerably.

“If we want Europe to catch-up with the US in terms of innovation financing, stay competitive and develop more European champions, we need to support its most innovative companies and cutting-edge technologies. This is what we successfully have started to do with the EIB venture debt financing solution,” said EIB Vice-President Ambroise Fayolle, responsible for innovation, science and digital. “However, there is still enormous demand and potential for additional venture financing in Europe. As the EU bank, we will continue to invest in a competitive and innovative Europe.”

Source: EIB calculations

EU venture financing compared to the US

Compared to the US, Europe’s venture financing market is relatively small. While annual venture financing in the US amounts to EUR 90 billion it is only EUR 21 billion in Europe, although the US economy is not much bigger than the EU economy. Especially venture debt with a share of 15% of overall venture financing in the US plays a more prominent role than in Europe with only 5%.

To mark the success of the new product, developed in cooperation with the European Commission, the Bank has held its second annual event for businesses benefiting from venture debt financing today. The “Second EIB Venture Debt Summit” brought together representatives of companies that received venture debt financing and investors.