- New financing operations in Denmark by the EIB Group last year totalled €1.44 billion, up from €992 million in 2022.

- Danish industry and energy remained priorities with extensive support for wind power

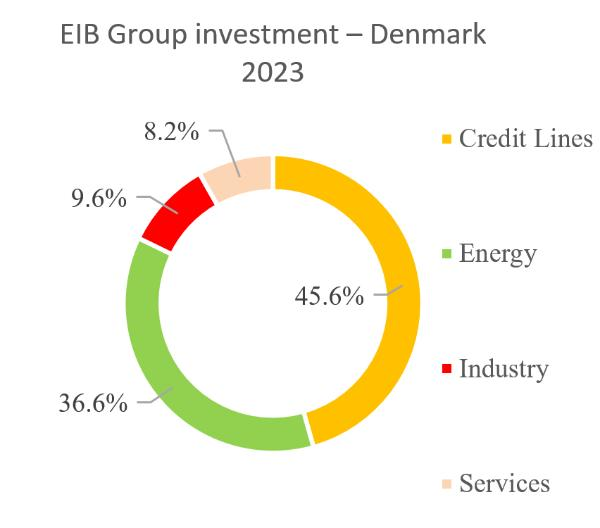

- Targeted financing for small and medium-sized companies made up nearly half the investment volume, alleviating some barriers to investment that Danish SMEs perceive.

In 2023, the European Investment Bank Group (EIB Group) signed €1.44 billion in new financing contracts for projects in Denmark – equal to 0.38% of Danish gross domestic product. The EIB Group funded 20 projects in the country, ranging from investments for energy company Ørsted by the European Investment Bank, to SME financing via the European Investment Fund.

Climate action and environmental sustainability projects made up 56% of the total – in line with the EIB Group’s ambition to ensure that at least half its investments are green. All projects financed by the EIB anywhere in the world must be compatible with the Paris Agreement.

In light of its mission to improve people’s lives, the EIB supported biotechnology research at Novozymes and Zealand Pharma while partnering with Jyske Bank and Ringkjoebing to channel financing to small businesses. Renewable power stayed high on the agenda through financing for wind and other energy projects with Ørsted and Nord/LB. A full list of European Investment Bank operations in 2023, totalling just over €1 billion and including support for data centres of IT infrastructure company Atea, can be found on our website.

“Europe is more relevant than ever for Denmark,” said EIB Director General Kim Jørgensen. “The EIB made sure that Danish projects could get the financing they needed. We are committed to financing a just transition to a carbon-neutral economy and, although the transition won’t be easy, we are taking the risk on projects that will have a long-term impact. We’re looking forward to engaging with local businesses this year to see where our financing can be relevant.”

With backing from the European Commission’s InvestEU initiative, the European Investment Fund committed €364.8 million in equity investments, guarantees and inclusive finance transactions that are expected to leverage nearly €2 billion in investments for the Danish economy. Apart from investments in angel investor funds, the EIF put up guarantees to back portfolios of SME lending by Danske Bank, Flex Funding, Sydbank, and Denmark’s Export and Investment Fund, formerly known as Vaekstfonden. Under its inclusive finance activities, the EIF partnered with Merkur Andelskasse to make available funding for SMEs in regions and rural areas where finance is not always easily accessible.

Regarding small businesses, the 2023 EIB Investment Survey published earlier this month shows that firms in Denmark were positive about their investment intentions even as barriers remain. Among the long-term impediments to Danish companies’ investments, the most frequently mentioned are energy costs (79%), the availability of skilled staff (72%) and uncertainty about the future (71%). Still, Danish businesses remain at the forefront in terms of investment in climate change and energy efficiency.

Almost half of Danish firms have taken steps to build resilience against such risks – higher than the share in the European Union overall – and 88% are taking action to reduce their CO2 emissions.

Background information

The European Investment Bank (ElB) is the long-term lending institution of the European Union owned by its Member States. It finances sound investments that contribute to EU policy objectives. EIB projects bolster competitiveness, drive innovation, promote sustainable development, enhance social and territorial cohesion, and support a just and swift transition to climate neutrality.

The EIB Group, which also includes the European Investment Fund (EIF), signed a total of €88 billion in new financing for over 900 projects within and outside the European Union in 2023. These commitments are expected to mobilise around €320 billion in investment, supporting 400 000 companies and 5.4 million jobs.

All projects financed by the EIB Group are in line with the Paris Agreement. The EIB Group does not fund investments in fossil fuels. It is on track to deliver on its commitment to support €1 trillion in climate and environmental sustainability investment in the decade to 2030 as pledged in its Climate Bank Roadmap. Over half of the EIB Group’s annual financing supports projects that directly contribute to climate change mitigation and adaptation, and to a healthier environment.

Around half of EIB financing within the European Union goes to cohesion regions, where per capita income is lower. This underscores the Bank’s commitment to fostering inclusive growth and the convergence of living standards.