- Demand for loans increased and access to credit eased in Central, Eastern and South-Eastern Europe — but improvements are primarily for households, rather than businesses

- Non-performing loan ratios improved over the past six months but the improvement is not expected to continue over the next six months, signalling some uncertainty ahead

Today, the European Investment Bank (EIB) published the autumn 2021 edition of its CESEE bank lending survey. The report investigates the strategies of international banks active in Central, Eastern and South-Eastern Europe (CESEE) and the market conditions as assessed by the banks operating there. The report provides a regional and country-by-country analysis and comparison.

The autumn 2021 release of the survey shows a positive outlook for the banking systems in the CESEE region, albeit with lingering pockets of uncertainty and some downside risks. Despite the potent effects of the pandemic, demand for credit has rebounded and supply conditions for financing have started to ease slowly. Demand for loans is robust among households and is also reviving in the firms’ fixed investment segment. Supply conditions for credit are easing, but mostly for households rather than businesses, with conditions still tight for smaller companies in particular.

You can read the full report here.

“The survey shows that international and national support was key in sustaining banking groups’ activities in the CESEE region following the initial sharp and abrupt halt generated by the COVID-19 shock in 2020,” said EIB chief economist Debora Revoltella. “Maintaining this strong public commitment is now crucial for easing access to finance for companies and facilitating investment in the green and digital transition. Banks in the region have a strong partner with the EIB Group that they can rely on to support financing for local economies.”

“40% of banking groups operating in the CESEE region intend to expand their operations. This is good news after the turmoil COVID-19 caused in 2020,” added Luca Gattini, Head of the Macroeconomic Scenario Unit. “But some uncertainty and downside risks remain. Access to bank financing is not easing for firms yet. Also, banking groups are expecting the positive developments in non-performing loans to stall. Regulatory and policy measures will need to continue proving support, in particular to accelerate much needed investment in climate action and digitalisation.”

The CESEE bank lending survey is part of the reporting and monitoring regularly conducted by the EIB, IMF, EBRD and World Bank for the “Vienna Initiative”, a framework for safeguarding the financial stability of emerging Europe.

Banking groups’ commitment and outlook for the region

Banking groups’ exposure to the region increased over the past six months as part of a strategic commitment to maintain or even increase operations. Moreover, they reported that their CESEE operations were profitable again after a temporary drop in 2020.

Cross-border banking groups signal positive strategic intentions for their regional operations, indicating full support for their subsidiaries and exposure there in 2021. Around 60% of the banking groups surveyed intend to maintain their CESEE operations, while 40% intend to expand them.

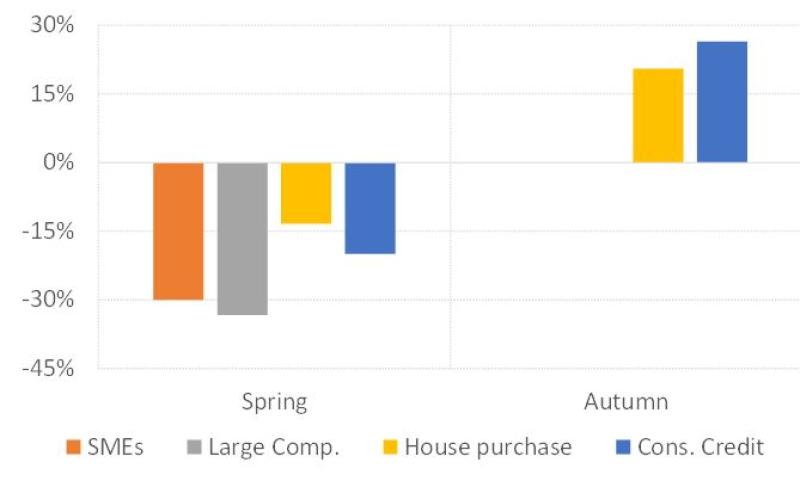

Supply and demand for credit in Central, Eastern and South-Eastern EuropeSupply conditions for credit by market segment in 2021

Source: EIB – CESEE bank lending survey, autumn 2021

CESEE subsidiaries and local banks report a robust increase in demand for credit. After contracting sharply in the second and third quarters of 2020, demand has risen, primarily supported by working capital requirements, together with a positive outlook for the housing market, consumer confidence and consumer spending. In particular, the support for demand provided by investment loans turned positive again after sharp contractions in 2020 and early 2021. This turnaround signals an improvement in real economic conditions for companies.

Lending conditions eased over the past six months after tightening in 2020 and early 2021. However, while credit conditions eased for households, they did not do so for companies, particularly small and medium enterprises.

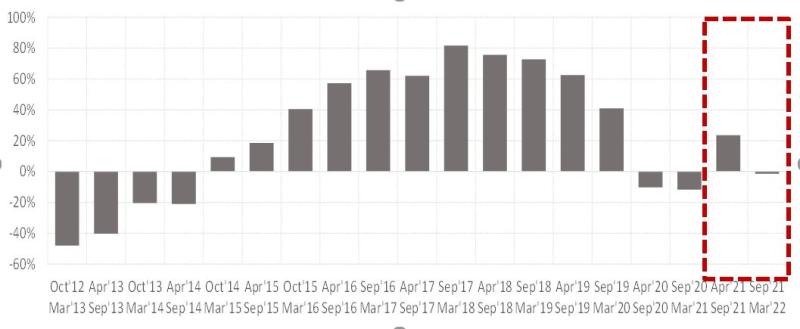

Health of bank’s credit portfolios

Credit quality started to improve again after a mild deterioration in 2020. Nonetheless, the rebound is not expected to continue over the next six months, with banking groups signalling elevated uncertainty.

Non-performing loan ratios in Central, Eastern and South-Eastern Europe Negative figures indicate an increasing ratio of non-performing loans

Source: EIB – CESEE bank lending survey, autumn 2021

COVID-19 policy support was crucial in maintaining banks’ operations in the region

Banks operating in the region reported that regulatory and policy measures to support lending have played a significant positive role. In particular, banks that took advantage of public guarantee schemes indicate that these programmes have been very effective in supporting loan extensions — a recurring finding over the last three survey waves. Banks taking advantage of central bank refinancing operations consider that these facilities have supported credit conditions.

Background information

About the Economics Department of the EIB

The EIB Economics Department provides economic research and studies, as well as unique analyses of investment activities in the European Union and beyond. It supports the Bank in its operations and in the definition of its positioning, strategy and policy. Chief economist Debora Revoltella heads the Department, a team of 40 economists.

About the EIB CESEE bank lending survey

The EIB CESEE bank lending survey is a unique survey carried out every six months, polling around 80 local banks, banking groups and financial institutions in Central, Eastern and South-Eastern Europe. It collects information on credit standards, credit terms and conditions, and approval rates, as well as various domestic and international factors that may be responsible for changes in lending. Demand for loans is also investigated, with an analysis of loan applications and their quality. The survey includes specific questions on credit quality and funding conditions for banks. It is designed to build a panel of observations that can provide an almost real-time assessment of the health of the banking sector in the CESEE region. The survey is developed and managed by the Economics Department of the EIB, and is part of a series of reports produced alongside the EBRD, IMF and World Bank for the Vienna Initiative (http://vienna-initiative.com)

For more information see: https://www.eib.org/en/about/economic-research/surveys.htm