FEMIP MEETS ITS OBJECTIVES DURING 1ST FULL YEAR OF ACTIVITY, DISCUSSES OPTIONS FOR ITS FUTURE DEVELOPPMENT AND ANNOUNCES EUR 270 MILLION OF NEW LOANS

The 3rd Ministerial Committee Meeting of EIB's Facility for Euro-Mediterranean Investment and Partnership (FEMIP) took place in Naples on 10 and 11 November 2003 to assess FEMIP's results during its first complete year of activity and discuss FEMIP's future prospects; the Committee also reviewed important policy issues confronting Mediterranean Partner Countries (MPCs) in their quest for sustained and sustainable growth and development.

The meeting at Ministerial level, was opened and held under the joint chairmanship of the Italian Minister of Economy and Finance, Mr. Giulio Tremonti and EIB President, Mr. Philippe Maystadt, in the presence of Mr. Philippe de Fontaine Vive, EIB Vice-President in charge of FEMIP. It was attended by the 15 EU Member States and the 12 MPCs, as well as by representatives of the European Commission, the International Monetary Fund (IMF), the World Bank group (WB and IFC) and the African Development Bank (AfDB). The Ministerial Committee took place after EIB President or Vice-President visits in almost every partner country in the course of the year.

FEMIP's 3rd Ministerial Committee Meeting reaffirmed the strong commitment of 27 European and Mediterranean Finance and Economy Ministers to forge a closer economic partnership and greeted with satisfaction FEMIP's results, which met fully the objectives set out by the March 2002 European Council resolution.

FEMIP is a major step forward in financial and economic cooperation between the Union and the MPCs. Its priorities are:

- extensive involvement of the MPCs in FEMIP policy with the creation of the Ministerial Committee Meetings and opening of regional offices in the Mashreq and Maghreb countries;

- focus primarily on development of the wealth- and job-creating private sector;

- develop investment in human capital;

- greater technical assistance for the design of quality projects and the process of economic reform in the MPCs;

- deployment of innovative financial products and risk capital;

- gradual increase in the annual volume of EIB activities in the MPC from EUR 1.4 to 2 billion.

By 2006, the EIB plans to invest between EUR 8 and 10 billion in the MPCs. The EIB has at its disposal funds under the existing Euro-Mediterranean mandates, risk capital resources from the EU budget as well as technical assistance and investment aid funds provided by the Union in application of the decisions of the Barcelona European Council (March 2002).

1. FEMIP - one full year of activity (October 2002- October 2003):

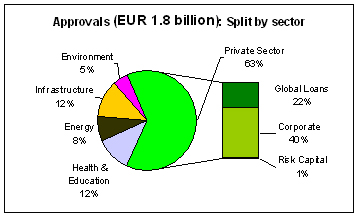

During FEMIP's first full year of activity the Bank has extended over 1.8 billion of new loans and approved a pipeline of 17 new investment operations for another total amount of EUR 1.8 billion, benefiting to almost all Mediterranean Partner Countries (MPCs).

The EIB activity clearly reflects the FEMIP's top priority, with more than one third of financing directly promoting the growth of private businesses - whether through foreign direct investment (in Turkey and Tunisia), joint ventures resulting from cooperation between MPC promoters (Algeria) or financing for SMEs (Egypt, Syria, Tunisia, creation of a regional venture capital fund). At the same time, FEMIP has placed emphasis on transport infrastructure projects underpinning private sector development in Morocco, Algeria, Egypt, Lebanon and Syria; power and water supply and distribution in Egypt, Morocco and Tunisia; improvement of health infrastructure in Syria and Tunisia; and remodelling of education systems in Jordan and Turkey. Lastly, FEMIP has endeavoured to assist populations stricken by natural disasters by making available or pledging EUR 250 million for reconstruction after the earthquake of May 2003 in Algeria.

The Ministerial Committee also greeted that all necessary organisational changes, including the creation of a new Private sector development division and the opening of the 1st Regional Office in Cairo have been fully realised within one year.

2. FEMIP's future development:

In the context of the current political tensions in the region, there is more than ever work to do for a closer Euro-Med Partnership and the further development of the economies of the region.

The Barcelona European Council Resolution (March 2002) to create the FEMIP further stipulated that, one year after the launch of the Facility, a decision will be taken on the "incorporation of an EIB majority-owned subsidiary dedicated to our Mediterranean Partner Countries". Such decision was to be taken "on the basis of an evaluation of the Facility's performance, and taking into account the outcome of consultations with our Barcelona Process Partners". Based on the Barcelona European Council Resolution, European Member States face today three options: (i) Continue with the facility in line with the FEMIP Business Plan 2003 - 2006; (ii) Take the decision to incorporate FEMIP into a dedicated EIB-subsidiary for the Mediterranean; iii) Strengthen FEMIP to increase its activities and ownership. These options are currently being considered by the Member States, together with other stakeholders in the Barcelona Process. A decision is expected to be adopted by the European Council at the beginning of December 2003, following consultation with the MPCs.

The Bank is ready to implement whatever viable option will be decided by the European Council concerning the possible evolution of FEMIP and to prepare in a timely manner for approval by its governing bodies an action plan that outlines how the new requests will be implemented.

3. Discussion on Policy issues:

The Ministerial Committee was preceded by a workshop for the discussion of important policy issues for sustained and sustainable economic growth and development, in the region namely:

- Infrastructure financing as support to private sector development: the need for reforms creating an enabling environment and exploration of new types of suitable financing vehicles, allowing greater involvement of the private sector and associated modes of operation.

- Facilitation of Foreign Direct Investments in the Mediterranean region: how to address the task of improving the institutional and regulatory frameworks, including administrative procedures, legal system, as well as fiscal incentives.

- Financial instruments for Small & Medium-sized Enterprises (SMEs) development: how to overcome the scarcity of suitable financial instruments through improvement of legal and administrative environment, development of specialised financial institutions and appropriate financial projects (equity finance, leasing instruments, guarantee funds etc).

The next meeting of the Ministerial Committee is scheduled to take place in June 2004 in Egypt and will be prepared by a prior high-level official meeting.

4. EIB announces new loans totalling EUR 270 million for a wide range of sectors:

On the occasion of the Ministerial Committee Meeting in Naples, the EIB announced new loans totalling EUR 270 million for regional transport, environment, human capital, private sector and energy in Morocco and Tunisia. Mr. Ph. de Fontaine Vive, EIB Vice-President, in charge a.o. of FEMIP announced in the presence of Mr. F. Oualalou, Moroccan Minister of Economy, Finance and Privatisation, and Mr. M. Jouini, Tunisian Minister of Development and International Cooperation. the following new loans:

In Morocco 180 million:

- EUR 10million to Moroccan micro-finance associations under a local currency, long-term loan aimed at supporting a large number of small investment projects promoted by their clients. Micro-finance has proven to be an effective tool for poverty and inequality reduction and development of basic forms of private sector enterprise. The operation will be implemented through a global loan to well established Moroccan micro credit associations: Al Amana and Zakoura.

- EUR 30 million provided to the Kingdom of Morocco, is for Professional Training (creation and the extension/modernisation of some 30 training centres in tourism, textiles and IT). This EIB's first operation in professional training outside the Union is part of the Moroccan government's Private Sector Development (PSD) strategy. Co-financed with the European Commission, the project will provide space for training to about 15,000 Moroccan workers and unemployed professionals each year, increase professional training quality by aligning the domestic workforce to a Knowledge Economy creating life-long learning possibilities and introduce new options for Moroccan enterprises to upgrade their human capital stock.

- EUR 110 million goes to the Société nationale des autoroutes du Maroc (ADM) for construction of the motorway section Settat-Marrakech, completing the motorway link from Marrakech via Casablanca and Rabat to Tangier. Co-financed with the Arab Funds, this regional transport motorway will connect key centres of economic growth within the country, and its neighbours including the European Union. It will improve flows of domestic and international passenger and freight traffic, contributing to the development of the national economy.

- EUR 30 million to the Régie Autonome de Distribution d'Eau et d'Électricité d'Oujda (R.AD.E.E.O.) is for rehabilitating and expanding the water supply, waste-water and storm-water infrastructure of the medium-sized border municipality of Oujda. It includes the construction of a wastewater treatment plant that allows to initiate the agricultural reuse of treated wastewater and to lower the pollution risk of important drinking water resources in the Moroccan province and in neighbouring Algeria. This project is an up-stream development of a project preparation study, funded by EIB's METAP grant. The project is cofinanced by EIB and three Arab funds.

In Tunisia 90 million:

- EUR 35 million to Tunisacier S.A. aims at the modernisation of a metallurgical plant in the bay of Sabra, in the free port of Bizerte, 60 km north-west of Tunis. This a Foreign Direct Investment (FDI) operation, as Tunisacier S.A is a 100% subsidiary of the Riva Group, Italy's first steel producer, ranking ninth at world level. As the project follows a privatisation process, it implies a close integration both in terms of production and technology transfers between Tunisia and Italy. Its financial structure is an example of risk sharing operation in the region, and it's financed in cooperation with Banca Unicredito, a longstanding financial partner of the EIB.

- EUR 55 million is lent to the Société Tunisienne de l'Électricité et du Gaz (STEG) for reinforcing the supply, transport and distribution of natural gas in Tunisia. This is a follow up operation with STEG, further to 4 previous loans to STEG totalling EUR 255 million, signed during the period 1995-2002. The project includes a series of capital expenditure spread across Tunisia, aiming at a) utilising a blend of imported LNG and gas from the Tunisian gas fields in the south, b) increasing the capacity, flexibility and security of the gas transportation network and c) develop public distribution channels in the areas crossed by the principal gas transport network (area of Tunis, Sahel and Cap Bon).

FEMIP was set up in response to the conclusions of the Barcelona European Council (15-16 March 2002) and Valencia Euro-Mediterranean Conference (22-23 April 2002). Its objective is to help the MPCs meet the challenges of economic and social modernisation and enhanced regional integration, with a view to the planned creation of a free-trade area between Europe and the MPCs by 2010.