- International banking groups remain confident in the region’s potential, in particular for the Czech Republic, Hungary, Poland and Romania, amid higher profitability

- Credit supply is likely to tighten in the next six months, and credit quality to worsen

- Small firms to be hit the hardest

Countries in the Central, Eastern and South-Eastern Europe (CESEE) region are particularly exposed to fallout from the war. Tighter financial links with Russia, the flow of refugees, reliance on foreign direct investment and energy dependence are worsening expectations. Banks are signalling a potential tightening of credit supply, and credit quality is expected to deteriorate. Despite uncertainty and the increasing risks, international banking groups remain confident in the region’s potential. They signal positive strategic intentions towards their regional operations, amid higher profitability: two-thirds of banking groups intend to maintain operations in the region, while one-third expect to selectively expand operations in certain countries. This is despite some top banking groups in the region also having a direct presence in Russia, Belarus or Ukraine.

These are some of the main findings of the Central, Eastern and South-Eastern Europe Bank Lending Survey. The survey took place in March 2022 and provides early insights into the effect the war is having on bank credit in the region.

“The new edition of the EIB Bank Lending Survey uncovers the first signs of financial tightening in the region. Small and medium-sized firms and young corporates will be the first to feel the tightening in the coming months,” said EIB Chief Economist Debora Revoltella. “Deepening the financial sector and making it more prone to innovation financing remains a priority.”

“Elevated geopolitical tensions are inducing a deteriorating economic outlook which will negatively impact funding conditions in most of Central, Eastern and South-Eastern Europe,” said EIB Vice-President Ricardo Mourinho Félix. Small and medium-sized businesses will be the most affected. Almost half of our financing last year, about €45 billion, was extended to small and medium-sized companies. As credit supply is expected to tighten, the EIB Group remains committed to providing continued access to funding either directly or via financial intermediaries in the region.

The war in Ukraine: a new turning point

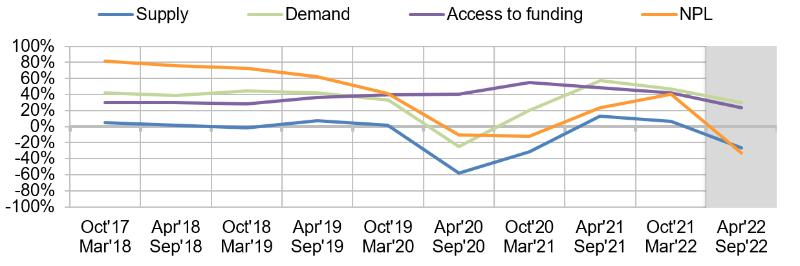

After a significant improvement in credit supply and demand, funding and credit quality, Central, Eastern and South-Eastern European banks are now signalling a turning point, with geopolitical uncertainty negatively affecting their expectations. The impact of the COVID-19 crisis was strong but credit demand rebounded in 2021, and supply conditions started to ease slowly towards the end of 2021 and early 2022. The ample policy responses of national governments and EU institutions to the crisis prevented harsh deleveraging. However, the war in Ukraine is negatively influencing banks’ expectations. Demand from bank clients is expected to remain strong, despite being tilted more towards working capital and less towards investment finance. Credit, however, appears to be tightening, and bank expectations are souring amid uncertainty over the markets’ reaction to the crisis, questions about policy intervention and inflationary pressures.

Banking outlook in CESEE

Source: EIB CESEE Bank Lending Survey. Note: All indicators are in net percentages. Supply/demand: Positive figures refer to increasing (easing) demand (supply). Access to funding: Positive values indicate increased access to funding. Non-performing loans (NPL): Negative figures indicate increasing NPL ratios

Deteriorating credit conditions and quality

Funding conditions will be less favourable than before and credit quality is expected to deteriorate. Non-performing loans are expected to rise substantially. An increase in non-performing loans at the beginning of the pandemic immediately dissipated as the economic recovery began in the second half of 2021. The latest survey shows that expectations have turned negative again since the start of the war, and more substantially so than during the COVID-19 crisis. Both corporate and household exposures are expected to be affected.

Background information

About the Economics Department of the EIB

The EIB Economics Department provides economic research and studies, as well as unique analyses of investment activities in the European Union and beyond. It supports the Bank in its operations and in the definition of its positioning, strategy and policy. Chief economist Debora Revoltella heads the Department, a team of 40 economists.

About the EIB CESEE Bank Lending Survey

The EIB CESEE Bank Lending Survey is a unique survey carried out every six months, polling around 15 international banking groups and 85 local subsidiaries or independent local banks in Central, Eastern and South-Eastern Europe. It collects information on credit standards, credit terms and conditions, and various domestic and international factors that may be responsible for changes in lending. Demand for loans is also investigated. The survey includes specific questions on credit quality and funding conditions for banks. It is designed to build a panel of observations that can provide an almost real-time assessment of the health of the banking sector in the CESEE region. The survey is developed and managed by the Economics Department of the EIB, and is part of a series of reports produced alongside the EBRD, IMF and World Bank for the Vienna Initiative

For more information see: https://www.eib.org/about/economic-research/surveys.htm