- EU and national policy response to COVID-19 supported business continuity and helped to shield investment.

- EU leadership on climate shows signs of paying off, with 43% of EU companies having already made climate-related investment compared to 28% in the United States.

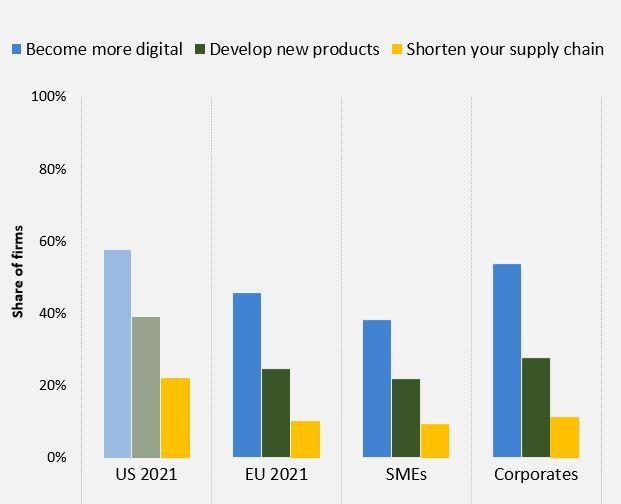

- 46% of EU firms say they used the crisis as an opportunity to become more digital.

- Access to skilled labour remains major investment barrier.

EU and US businesses’ expectations of the long-term impact of COVID-19

Source: EIB Investment Survey 2021 – Question: Do you expect the COVID-19 outbreak to have a long-term impact on any of the following?

With the recovery beating expectations and market conditions easing, European firms expect to increase investment again. Financial support for firms during the lockdowns was crucial in keeping the economy afloat: more than half (56%) of EU firms have received some form of financial support in response to COVID-19. Moreover, despite difficult circumstances, four out of five firms across the European Union (82%) believe that their investment activities over the last three years have been in line with their needs, similar to the share reported by US firms. These are some of the main findings of the new edition of the European Investment Bank’s Investment Survey that was published today.

The sixth edition of the EIB Investment Survey provides unique firm-level information about investment decisions and investment finance across the European Union and the United States. It covers investment activities in climate action and digitalisation and investigates the impact of the COVID-19 pandemic and the related policy response. The EIB Group, EU institutions and Member States use the survey as a tool to identify needs and understand constraints holding investment back.

You can read the full report here.

A summary of the survey results can be found here.

“The pandemic called for a quick and bold response. And governments and the European Union gave it,” said EIB Vice-President Ricardo Mourinho Félix. “In the outbreak itself, the EIB Group was among the first EU institutions to respond. We quickly started to channel emergency financing to companies all over Europe that needed it. Our latest EU-wide business survey confirms that this support was crucial in helping companies make it through the lockdowns. It helped to safeguard the investment capacity we urgently need to accelerate the green and digital transformation.”

“The European and national policy support targeted the resilience of firms, ensuring they had access to credit and allowing employees to retain their jobs. Targeted financial incentives remain very relevant as a way to promote and accelerate transformative investment with regard to climate and digitalisation,” said EIB Chief Economist Debora Revoltella. “The pandemic-induced push for digitalisation, for example, is less about adopting advanced digital technologies, and more about firms starting their ‘digitalisation journey’ — implementing remote working or online sales. That is why policy support is needed, in particular for digital skills and training, to further drive this digital momentum and ensure Europe’s competitiveness in the long term.”

Public support was critical in maintaining firms’ investment capacities

The COVID-19 pandemic has severely affected businesses. When asked about the impact of COVID-19 on sales or turnover, around half of all EU firms (49%) reported that their sales have declined compared to the beginning of 2020, before COVID-19 hit the economy.

The survey data shows that 56% of EU firms received some kind of financial support in the form of guaranteed credit, support for social security contributions or delayed payments. 35% of European smaller companies in manufacturing and services say that they would have faced an existential threat without the support they received.

The data also shows that public support was successfully directed towards firms that were more in need, being skewed towards firms facing a greater loss of revenue. Where firms received some kind of policy support, the link between lost revenue and downgraded investment plans was significantly weaker — firms that received support were more likely to preserve their investment programmes.

Fewer EU firms (57%) report having taken at least one short-term action, such as developing new products, digitalising or shortening their supply chain as a result of COVID-19 compared to the United States, where the share is 74%.

EU leadership on climate shows signs of paying off

43% of EU businesses have already made climate-related investment, while the share of firms planning climate-related investment has now risen from 41% to 47%. In the United States, only 28% of firms have already invested and only 40% are planning climate-related investment.

The survey data also shows that climate change is being progressively perceived as a reality, as around three-fifths (58%) of firms in the European Union report that weather events are currently having an impact on their business.

Climate change is affecting EU and US firms

Source: EIB Investment Survey 2021 – Question: Thinking about your company, what impact do you expect this transition to stricter climate standards and regulations to have on your company over the next five years?

In regard to the quickly evolving climate policy environment, 41% of EU firms do not expect the transition to stricter climate standards and regulations to affect them. In the United States, more firms see the transition as a risk rather than an opportunity (44% vs. 20%).

The pandemic pushed many firms to become more digital but some continue to lag

46% of the EU firms surveyed say they have become more digital in the last year. This is, however, less than in the United States, where 58% of firms state the same. Among firms that had not yet implemented advanced digital technologies, 34% took the crisis as an opportunity to start their digitalisation journey. Firms that had already invested in digitalisation prior to the pandemic proved to be more resilient.

While many firms indicate an increased use of digital technologies as a result of the pandemic, a substantial share (26%) of EU firms did not invest in digitalisation at all. They account for one-third of jobs in the European Union. This share of non-digital firms could have serious repercussions for employment and Europe’s future competitiveness. Stronger policy support could help to prevent them from falling further behind.

Barriers to investment

While access to finance as an obstacle to firms’ investment activities seems to be less problematic due to strong policy support, the firms surveyed highlight structural barriers limiting their upside potential. The scarce availability of workers with the right skills therefore remains a top barrier to long-term investment, a factor cited by 79% of European firms. Infrastructure matters as well, with access to digital and transport infrastructure as well as energy costs all being increasingly perceived by firms as constraints on investment in Europe.

Policy support has shown to be crucial in maintaining investment activities, particularly for the green and digital transition. Looking forward, more targeted interventions and clear policy direction can help to keep and accelerate momentum for a sustainable transformation of the economy.

Read the full report here.

Background information

About the EIB Investment Survey

The annual EIB Group Survey on Investment and Investment Finance (EIBIS) is an EU-wide survey that gathers qualitative and quantitative information on investment activities by both small businesses (with between five and 250 employees) and larger corporates (with more than 250 employees), their financing requirements and the difficulties they face.

The survey collects data from approximately 13 300 businesses in total, across the EU27, the United Kingdom and, since 2019, the United States. Using a stratified sampling methodology, it is designed to be representative at:

- EU level

- country level

- sector group level (manufacturing, services, construction and infrastructure) and firm size class level (micro, small, medium and large) for most countries.

All survey respondents are sampled from the Bureau van Dijk ORBIS database. Survey answers can be matched to reported firm balance sheets and profit and loss data.

The EIBIS is carried out annually, with the first wave of interviews having taken place in 2016. It is designed to build a panel of enterprise data. To this end, all firms that participated in the first wave of the survey are reinterviewed in the following survey waves. To compensate for panel attrition and to ensure cross-sectional representativeness, panel firms are complemented in each wave with a top-up sample of new survey firms.

Find out more: EIB Investment Survey (EIBIS) - Details

About the European Investment Bank

The EIB is one of the largest multilateral providers of climate finance worldwide and recently announced that it will unlock and support €1 trillion of investment in climate action and environmental sustainability in the decade to 2030. At least 50% of EIB finance will go towards climate action and environmental sustainability by 2025. By the end of 2020, all EIB Group financing activities will be aligned with the goals of the Paris Agreement.

Find out more about EIB research: Our research (eib.org)

About the Economics Department of the EIB

The EIB Economics Department provides economic research and studies, as well as unique analysis of investment activities in the European Union and beyond. It supports the Bank in its operations and in the definition of its positioning, strategy and policy. Chief Economist Debora Revoltella heads the Department, a team of 40 economists.

©EIB

Download original