The EIB Investment Survey reveals that the impact of the coronavirus pandemic is being felt by firms across the European Union and is impacting their investment outlooks. In particular, the survey finds that:

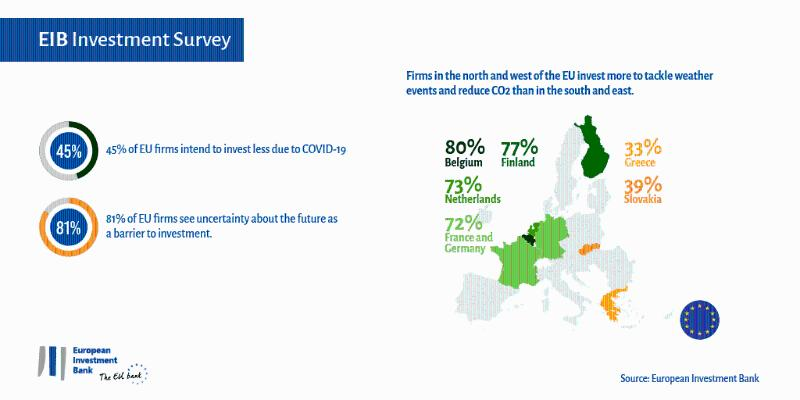

- 45% of firms intend to invest less than initially planned in the current financial year due to the coronavirus.

- The main long-term impact of COVID-19 on EU firms is the expected increase in the use of digital technologies (50%). Large firms (58%) cite this more than small firms (43%).

The European Investment Bank (EIB) has launched the fifth edition of its EIB Investment Survey.

The first findings of the survey show a widening investment gap throughout Europe, which can be linked to the stretch in government budgets due to the pandemic and the economic crisis. These investment gaps threaten to undermine the European Union’s ambitious plans for a green and digital transformation.

Read the full report here.

The survey assessed the following action categories:

Investment plans reduced by almost half of EU firms

For the first time since the survey has been conducted, investment expectations turned overly negative, with more firms holding a negative rather than a positive investment outlook. In addition, almost half of EU firms (45%) say that the coronavirus has had a negative impact on their investment plans.

Furthermore, among a majority of firms, the overall short-term outlook over the next year is negative. On balance, firms are pessimistic about the political and regulatory climate, and expectations for the overall economic climate have also become more negative, continuing the increasingly pessimistic trend seen since 2018. Turning to the reported long-term barriers to investment, the average EU firm considers uncertainty about the future as the main obstacle. This barrier has gained significance and is cited by a larger share of firms than in the previous wave of the survey (81% in the current wave, up from 69%).

Investment in innovation increased in 2019 and is a priority, mostly for firms impacted by COVID-19

Around four in ten firms (42%) developed or introduced new products, processes or services as part of their investment activities, higher than in the previous wave of the survey (33%).

European firms that have been impacted by the coronavirus have slightly different investment priorities for the next three years compared with firms that have not felt the effects of the pandemic. Specifically, firms impacted by COVID-19 are more likely to say they are prioritising new products or services (30% compared with 24%), while they are also more likely to say that they have no investments planned (13% compared with 10%).

The implementation of digital technologies remains a high priority among European firms

The survey’s results show that around two-thirds of EU firms have already implemented at least one digital technology, either fully or partially. Interestingly, 51% of firms across the European Union have partially implemented at least one digital technology, while a further 12% have organised their entire business around at least one such technology.

The survey results also show that while 37% of EU firms had not adopted any digital technology, this figure is only 27% in the United States. The areas where the US has a particularly notable edge are the use of IOT applications and drones. In addition, large firms are significantly more likely to have implemented digital technology compared to small and medium-sized enterprises (75% vs. 52%).

The impact of climate change

Almost 58% of EU firms report that physical risk related to climate change is having an impact on their business, with 23% stating that it is having a major impact.

EU firms are more likely to think that the transition to a low-carbon future will have a positive rather than negative impact in relation to market demand and their firm’s reputation. However, they are more likely to expect a negative rather than a positive impact on the supply chain in their market. EU firms are more positive than US firms on these issues.

When asked about investments to tackle the impacts of weather events and the reduction in carbon emissions, many EU firms have already made investments or plan to do so. Nevertheless, there is wide variation in investments to tackle the impacts of weather events among the EU 27. For instance, investments are higher in northern European countries such as Belgium (80%), Finland (77%), the Netherlands (73%), France and Germany (both 72%) than in southern countries like Greece (33%), or Slovakia (39%).

The survey also notes that the uncertain regulatory environment and taxation (72%) as well as the cost of investment (69%) are the most widely cited barriers among EU firms to investing in activities to tackle weather events and emissions reduction.

EIB Vice-President Ricardo Mourinho Félix, said: “The pandemic is weighing on investment and potentially hampering Europe’s ability to meet the challenges of the 21st century. We need coordinated European action to overcome uncertainty, both now and looking beyond the recovery, not least on the climate and digital transition. As the EU climate bank and one of Europe’s largest investors in innovation, the EIB Group can play an important role in tackling these challenges and getting investment off the ground.”

Debora Revoltella, Chief Economist of the EIB, said: “The EIB Investment Survey provides a clear picture of the mounting challenges for EU firms. At the same time, COVID-19 is also changing the market, requiring firms to invest and further adapt: more digitalisation, more innovation, more climate and rethinking their global value chains. The investment needs and strained internal finance of European firms call for patient long-term investors – combining equity, debt and technical assistance as well as advisory services.”

About the EIB Investment Survey

The European Investment Bank conducted a thorough assessment of the investment activities of small and medium-sized businesses and larger corporates, their financing requirements and the difficulties they face. The 5th edition of the EIB Investment Survey (EIBIS) aims to gather unique insights on the corporate investment environment across the European Union, the United Kingdom and the United States. The EIBIS is a significant tool for identifying needs and understanding constraints holding investment back. It is even more relevant this year, as it will help assess the consequences of the COVID-19 crisis on companies’ investment plans and will allow the EU bank to address the challenges arising from this crisis.

About the European Investment Bank

The European Investment Bank (EIB) is the long-term lending institution of the European Union and is owned by the EU Member States. It makes long-term finance available for sound investment in order to contribute towards EU policy goals both in Europe and beyond. The EIB is active in around 160 countries. It is one of the largest multilateral providers of climate finance worldwide and recently announced that it will unlock and support €1 trillion of investment in climate action and environmental sustainability in the decade to 2030. At least 50% of EIB finance will go towards climate action and environmental sustainability by 2025. By the end of 2020, all EIB Group financing activities will be aligned with the goals of the Paris Agreement.