New EIB index measures economic vulnerability to COVID-19 in countries outside the EU

- Half of low-income countries and a quarter of middle-income countries are facing the highest risk of the economic fallout of COVID-19

- Most vulnerable are oil exporting countries and those that are highly dependent on tourism

The new European Investment Bank (EIB) COVID-19 Economic Vulnerability Index examines which countries are the most vulnerable to a virus such as the COVID-19 and which countries should take the most stringent precautions to prevent the spread of such a virus. It is the only report currently available that takes a closer look at how developing countries are affected by the crisis.

The index covers countries outside the European Union and highlights the regions that need the most help. It takes into account risk factors such as the quality of healthcare, age of the population and structure of the economy – including reliance on tourism, remittances, commodity exports, global value chains, capacity of the countries to implement countercyclical financial policy, strength of the banking sector, and more.

The index draws on both publicly available and proprietary data, but does not reflect the evolving policy responses in each country or the way the epidemic will unfold. Equally vulnerable countries may be impacted differently depending on the policy responses and the development of the epidemic.

Aligned with the EU's Team Europe response to ease the negative economic impact of the COVID-19 in non-EU economies, the EIB is committed to helping those countries hardest hit by the crisis. The report therefore focusses on regions outside the EU.

“Amidst the uncertainty during this pandemic, unfortunately one thing has become clear: the virus will have a harsh and direct impact on growth and jobs globally. It is a crisis like no other,” said EIB Vice-President Andrew McDowell. “The new EIB index of countries outside the EU not only shows which countries might be impacted the most economically but also what factors help to mitigate the economic fallout of COVID-19. Guided by these insights we will continue – as the EU bank and leading development institution – to reach out to those worst hit to strengthen their resilience and to fight for a smart, green recovery.”

“This crisis is unprecedented in terms of the global and synchronised nature of the impact: nearly all countries and regions of the world are affected. For all or most of these countries, it is one of the most severe blows to growth on record,” said Debora Revoltella, EIB Chief Economist. “This index is one small step towards better understanding the crisis. It assesses the economies of countries around the world, to single out those that are more vulnerable/resilient to the specific features of this crisis.”

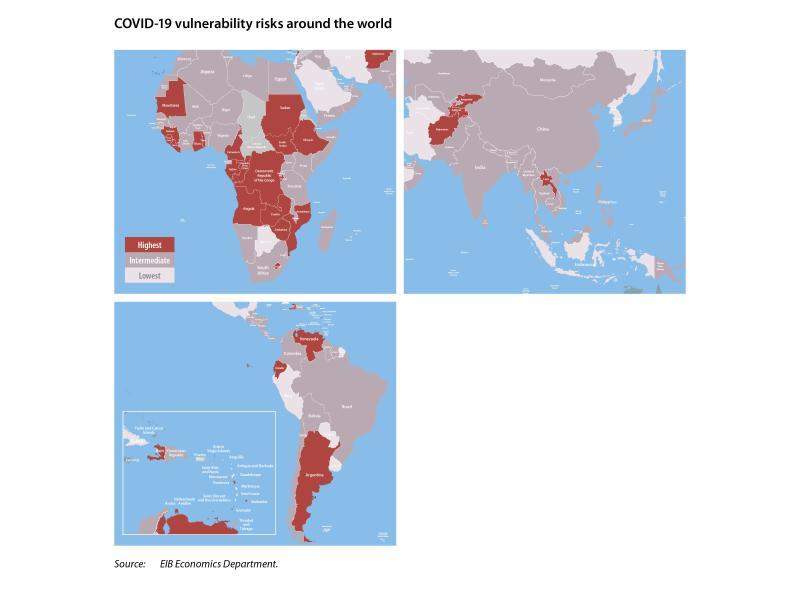

The global picture

The index shows that the economies of low-income countries are highly vulnerable to the COVID‑19 pandemic, exacerbating underlying weaknesses. Half of the low-income countries and 25% of middle-income countries are facing the highest risk of COVID-19 impacts. Unsurprisingly, higher-income states generally have better coping capacity, even when hit by an unprecedented global shock. Nonetheless, 56% of high-income countries are considered to face an intermediate level of risk, along with 63% of middle-income economies and half of the poorest countries. The index also shows less diversified economies are at a high risk when hit by a crisis such as COVID-19. The group of countries considered most vulnerable to COVID-19 impacts includes a number of oil exporters and countries that are highly dependent on tourism.

None of the countries in the Western Balkans or Turkey are among the most vulnerable, but Albania, Bosnia and Herzegovina and Serbia fall into the intermediate vulnerability category. In the Southern Neighbourhood, one country, Lebanon, is in the highest vulnerability group, but most others have intermediate vulnerability. Most of the countries in the European Union’s Eastern Neighbourhood and Central Asia (ENCA) region are in the intermediate vulnerability group, with the poorest two, Kyrgyzstan and Tajikistan, falling into the highest vulnerability category.

Outside the European Union’s immediate neighbourhood, sub-Saharan Africa, the Caribbean and the Pacific states are the most vulnerable regions. Around half of the countries in Africa, the Caribbean and the Pacific are among the most vulnerable, with almost all of the remainder falling into the intermediate vulnerability category. Latin America and Asia each have a small number of countries in the highest and lowest vulnerability groups, while most of the remaining countries face intermediate vulnerability. This reflects the diversity of both regions, which are predominantly middle-income areas, but also contain both low- and high-income countries.

The EIB Group will provide up to €6.7 billion as a comprehensive response to the coronavirus pandemic outside the EU in the coming months. This financing is part of the Team Europe response and supported by guarantees from the EU budget. It will both strengthen urgent health investment and accelerate long-standing support for private sector investment that reflects financing needs in more than 100 countries around the world.

The EIB Group will also provide €1.7 billion to support the social and economic recovery of the Western Balkans from the COVID-19 pandemic, as part of a €3.3 billion financial support package for the region announced on 29 April by the European Commission.

The immediate fast-tracked support will help to sustain jobs and livelihoods in sectors most threatened by the economic and social impacts of the coronavirus, and will be followed by additional long-term health and business financing as needed.

About the EIB Economics Department

The EIB Economics Department provides economic research and studies, as well as unique analysis of investment activities in the EU and beyond, and supports the Bank in its operations and in defining its positioning, strategy and policy. Chief Economist Debora Revoltella heads the Department and its team of 40 economists.

About the EIB Investment Survey (EIBIS)

The EIB Group Survey on Investment and Investment Finance is a unique annual survey of some 13 500 firms. It comprises firms in all EU Member States, as well as a sample of US firms that serves as a benchmark. It collects data on firm characteristics and performance, past investment activities and future plans, sources of finance, financing issues and other challenges that businesses face. Using a stratified sampling methodology, the EIBIS is representative across all EU Member States and the US, as well as across firm size classes (micro to large) and four main sectors. It is designed to build a panel of observations to support time series analysis – observations that can also be linked to firm balance sheet and profit and loss data. The EIBIS was developed and is managed by the Economics Department of the EIB, with Ipsos MORI providing development and implementation support.

For more information see: http://www.eib.org/eibis.