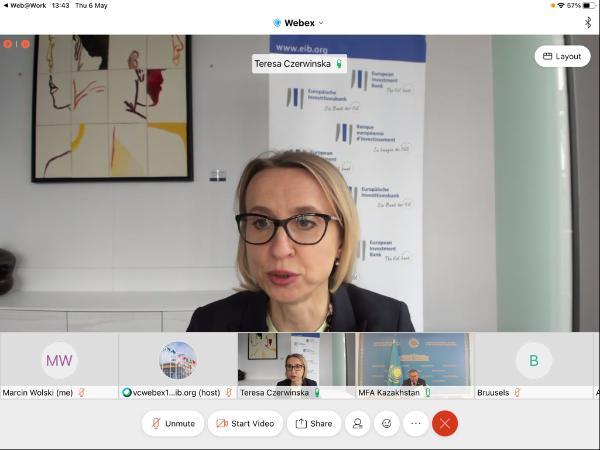

Vice President of the EIB Teresa Czerwinska and Mukhtar Tleuberdi, Deputy Prime Minister and Minister of Foreign Affairs of the Republic of Kazakhstan met ahead of the 18th EU-Kazakhstan Cooperation Council to review the EIB – Kazakhstan cooperation and investment.

The EIB investments in Kazakhstan currently amount to EUR 170 million invested in credit lines for local micro, small and medium enterprises (SME) operating in some of the most important sectors of the local economy. The EIB began operations in Kazakhstan in 2013.

The two sides expressed interest to expand the cooperation and create conditions for EIB new investments especially in the context of COVID-19 recovery, connectivity, climate action and support for energy efficiency projects in the country.

The EIB has been supporting the EU priorities in the country and the Enhanced Partnership and Cooperation Agreement a strategic framework for EU-Kazakh relationship, which touches on energy transport, environment, industry, and SMEs.

Following the meeting VP Teresa Czerwinska said: “I would like to thank the DPM Tleuberdi and his team for the good cooperation between Kazakhstan and the EIB which allowed the Bank to support local SMEs with EUR 389 million. Our cooperation also reinforced the ability of the Kazakh financial system to fuel the economic and social development of the country. We are ready to work with the Government of Kazakhstan on expanding this cooperation especially on COVID-19 recovery, climate action and energy efficiency projects.”

COVID-19 recovery a priority for the EIB in Kazakhstan

Support for the recovery from COVID-19 will be one of the priorities of the EIB and Team Europe in Central Asia. To this end, the EIB already repurposed and signed a EUR 42mn loan increasing access to liquidity to Kazakh SME. The loan will also strengthen the local financial sector by channelling finance to local financial intermediaries via the ‘Kazakh state-operated DAMU Fund. The operation is structured in synthetic local currency (Kazakh Tenge), accommodating the local financial institutions` orientation to borrow in local currency only.

Support for the sustainable development of micro, small and medium companies in Kazakhstan

Since signing the Framework Agreement with Kazakhstan in 2010, which allowed the EIB to start operations in the country, the activities of the EIB in the country focused on supporting the development of the local private sector by enabling access to finance to local SMEs across different sectors while incentivising them to adopt more sustainable and environmental-friendly practices.

The EU Bank support to Kazakhstan created new credit lines for Kazakh companies unlocking access to micro-loans as well as finance for the agricultural sector. The bank also extended support for business in the aftermath of the Covid-19 crisis.

The EIB will continue to support the EU-Central Asian cooperation priorities, working in close collaboration with EU Delegation in Kazakhstan as well as other European partners on the ground and support the development of a competitive local private sector, facilitation of an enhanced environmental, climate and water resilience in the region as well as potentially in the future promotion of a sustainable, comprehensive and rule-based connectivity.

Reinforcing the Climate Action in Central Asia

As the EU`s Climate Bank and EIB’s new commitment that climate action and environmental sustainability to exceed 50% of overall lending by 2025, the priority of the Bank will be focused on supporting efficient management of national resources and adoption of modern and climate neutral technologies, and stand ready to support climate action projects in Kazakhstan.