Our COVID-19 economy roundup shows Europe headed for deep recession, banks set to ease credit for businesses, and emerging markets vulnerable

By Simon Savsek, Joana Conde, Andrea Brasili, Matteo Ferrazzi, Aron Gereben, Laurent Maurin, Ricardo Santos and Patricia Wruuck

The EIB Economics Department is producing a fortnightly update on the economic impact of the COVID-19 pandemic in Europe and across the world. It also covers impacts on the financial system and the evolving economic policy response. Here we summarise the main messages.

The European economy is on its way towards a deep recession

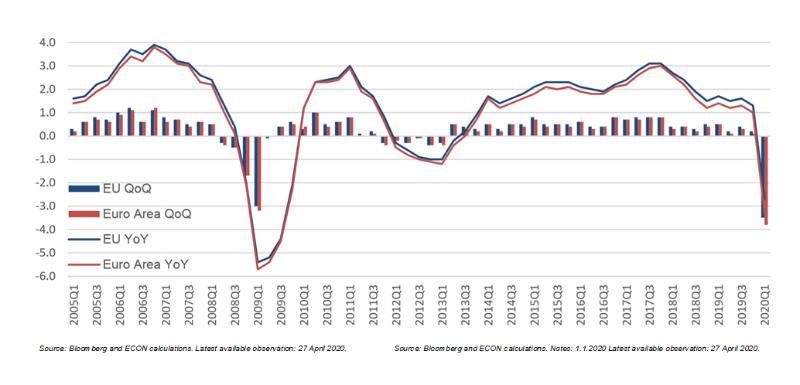

GDP decreased by 3.5% in the EU (3.8% in the euro area) in 2020Q1 compared to the previous quarter (q-o-q). At the country level, France’s GDP dropped by 5.8% q-o-q, Spain by 5.2% and Italy by 4.7%, the largest quarterly falls since the series began.

Expectations for Q2 remain gloomy. This is confirmed by the EIB’s coincident indicator, the flash Purchasing Managers Index indicators and the European Commission’s Business and Consumer sentiment indicators in Europe, which all deteriorated in April, with a significant worsening of the expectation component for the next three months. More than 20 million European workers from Germany, France, Italy, Spain and the UK, about a fifth of all workers, are currently on temporary work-schemes. All in all, a U-shape recovery seems a rather likely outcome.

Figure 1: GDP dynamics, the EU and the euro area

As the crisis persists and the impact on public finances and economic performance continues to grow, more downgrades, including for the EU, can be expected during the coming weeks.

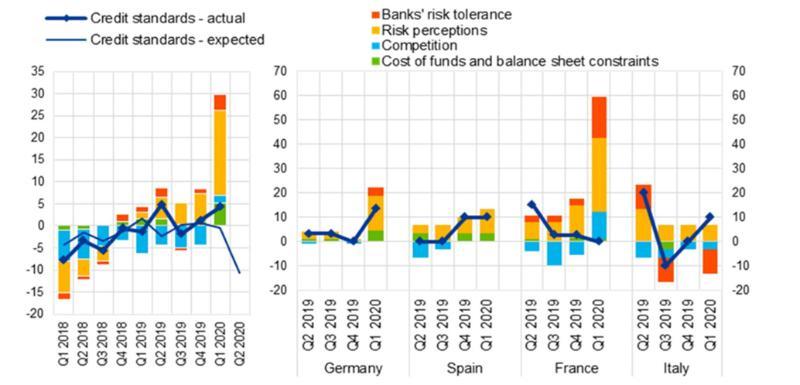

Banks expect an easing of credit standards for businesses

Euro area banks report higher demand for credit from enterprises and future easing of credit standards. This reflects higher liquidity appetite from corporates as well as the numerous policy measures introduced by governments and regulators to help alleviate credit standards. This situation is likely to persist also in the second quarter according to the ECB Bank Landing Survey for April. That said, country heterogeneity is quite evident. A dichotomy can be also observed in funding conditions for corporates. While some early signs of gradually improving of funding conditions can be observed for larger corporates, which can also benefit from the ECB bond purchase programme, smaller enterprises that do not access market finance still encounter major difficulties driven also by sectoral characteristics.

Figure 2: Changes in credit standards for loans or credit lines to enterprises and contributing factors

Emerging Markets remain vulnerable

Turning to emerging markets, market sentiment remains weak, albeit with slight improvements compared to the past couple of weeks. Some early signs of stabilisation were mainly driven by the generally positive news about the evolution of the COVID-19 pandemic in major advanced economies along with announcements of gradual unwinding of containment measures and additional policy interventions. That said, emerging markets’ vulnerability to the economic fallout of the pandemic and their capacity to respond remain a cause for concern, in particular with regard to debt sustainability.

Policymakers across the EU have taken swift action to mitigate the impact of the pandemic

The focus has been on the short-term, including measures to contain the spread of the virus, support medical care and maintain economic structures. On top of national measures, EU leaders agreed on a common response package amounting to a total of €540 billion to fight the consequences of the pandemic, including a) a pandemic crisis support instrument at the European Stability Mechanism, b) support via SURE, helping to boost member states’ efforts to protect employment and c) a €25 billion guarantee fund at the European Investment Bank to support European companies, and particularly SMEs, with up to €200 billion.

Moreover, the Commission was tasked with preparing plans for a recovery fund. The discussion is still very open in terms of recovery strategies and policy priorities looking ahead. In line with this, we elaborate further on areas of medium- to long-term warranted policy attention including public investment focusing on ‘smart’ and ‘green’, fixing the labour market, or proper strategies to address, post crisis, repairing balance sheets, scaling back the emergency support measures and reacting to shifts in preferences.