- The COVID-19 crisis highlighted pre-existing gaps and the risks of widening divergences between EU regions.

- Policy support was central to mitigating the immediate economic consequences of the COVID-19 shock and will play a crucial role in the response to the economic fallout of the war.

- The transition to a greener and more digital economy is an opportunity to increase economic resilience across the European Union and move to a more sustainable economic model.

Investment dynamics were improving across EU regions when the war in Ukraine broke out. In the past, large-scale shocks have often exacerbated gaps in regional development. A new report, Regional Cohesion in Europe 2021-2022, published today by the EIB, examines how European regions weathered the sharp downturn caused by the pandemic and how prepared they are to face future challenges.

You can read the full report here.

You can read an online summary here.

“The war in Ukraine risks upending Europe’s economic growth”, said Vice-President Lilyana Pavlova. “During the COVID-19 crisis, strong policy action has helped to contain the economic fallout. Yet, differences across EU regions remain. Through its tailor-made financing instruments and advisory services, the EIB stands ready to help European regions avoid economic shocks turning into lasting setbacks and to correct imbalances further exacerbated by the war. Following our Cohesion Orientation for the next seven years we are supporting the EU regions to face the socio-economic and environmental challenges of our time.”

The COVID-19 crisis tested the resilience of firms across Europe, but even more so in underdeveloped regions. In general firms proved more resilient than expected and adapted to the new circumstances. However, pre-existing vulnerabilities remained as a drag to resilience, and indeed firms in richer regions were more capable to adapt”, said EIB Chief Economist Debora Revoltella. “In current crisis, targeted public support across regions will be crucial to mitigate the immediate adverse impact of the war.”

COVID-19 shock

EU cohesion policy aims to correct imbalances between countries and regions, help lagging regions[1] to catch up and increase resilience across the European Union. The COVID-19 pandemic highlighted the risks of widening gaps between EU regions.

The pandemic strongly affected investment activity across all regions; while investment rates fell across the board, they were lowest in cohesion regions. In non-cohesion regions, almost eight out of ten firms (79%) invested. The share stood at some 77% in transition regions and 75% in less developed regions.

Firms have reacted to the pandemic and adapted to new circumstances, with those in richer regions moving faster. Across Europe, the pandemic has spurred digitalisation. More firms in non-cohesion regions have taken action, particularly to advance digitalisation (47% compared to 41% in transition regions and 38% in less developed regions). Similarly, firms in more prosperous regions were the quickest to develop new products.

The COVID-19 shock took a toll on climate-related investment. Compared to 2020, fewer firms across all regions invested in climate-related measures. The drop was stronger in cohesion regions, which already had lower levels. However, many firms see the need to respond to the climate challenge to protect against physical risks and reduce emissions.

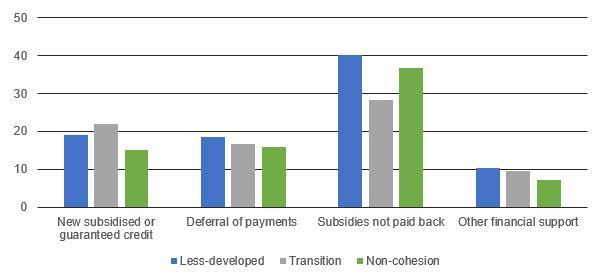

Policy support was central to mitigating the immediate economic consequences of the COVID-19 shock across EU regions, and a large share of firms benefited. However, support was not equal across the regions. Firms in transition regions were least likely to benefit from subsidies (28%) compared to those in less developed (40%) and non-cohesion regions (37%).

COVID-19 policy support, by cohesion region

Source: EIB Investment Survey 2021.

Question: Since the start of the pandemic, have you received any financial support in response to COVID-19? This can include finance from a bank or other finance provider, or government-backed finance.

Base: All firms (excluding don’t know/refused responses).

Innovation

Many firms in cohesion regions lag behind in innovation. The share of firms not undertaking innovation activity remains lowest in non-cohesion regions (48%), where many knowledge-intensive activities tend to cluster. Tackling innovation gaps looking ahead will require investment, notably in intangibles, but also stronger local innovation ecosystems.

Digital and green transition

The twin transition to a greener and more digital economy is an opportunity to increase economic resilience across the European Union and move to a more sustainable economic model. Firms are at different stages of the transition process across EU regions. More developed regions have the highest share of firms forging ahead with the twin transition and investing in green and digital technologies. 31% of firms in more developed regions can be considered green and digital, compared with 25% in transition regions and 21% in less developed regions.

Green and digital profiles (share of firms in %), by cohesion region

Source: EIB Investment Survey 2021. Base: All firms (excluding don’t know/refused responses).

Green: Firms that have already invested to tackle the impacts of weather events and reduce carbon emissions. Digital: Firms that have implemented advanced digital technologies at least in parts of their business.

Efforts to address gaps in human capital investments are key to a successful and inclusive transition across EU regions and to promoting cohesion going forward. To mitigate disparities, including in human capital, and unlock opportunities from transition on a broad basis, improvements in the business environment remain key. To tackle investment obstacles facing firms, public investment, for example in infrastructure upgrades and to address bottlenecks, will be needed and can help unlock investment synergies to foster successful regional transformation.

Background information

About the European Investment Bank

The European Investment Bank (EIB) is the long-term lending institution of the European Union and is owned by the EU Member States. It makes long-term finance available for sound investment in order to contribute towards EU policy goals both in Europe and beyond. The EIB is active in around 160 countries. It is one of the largest multilateral providers of climate finance worldwide and recently announced that it will unlock and support €1 trillion of investment in climate action and environmental sustainability in the decade to 2030. At least 50% of EIB finance will go towards climate action and environmental sustainability by 2025. Since the end of 2020, all EIB Group financing activities have been aligned with the goals of the Paris Agreement.

Find out more about EIB research: Our research (eib.org)

[1] EU cohesion policy 2021-2027 distinguishes three categories of regions at NUTS 2 level: (1) more developed regions, with gross domestic product (GDP) per capita greater than 100% of the EU-27 average; (2) transition regions, with GDP per capita from 75% to 100% of the EU average; (3) less developed regions, with GDP per capita less than 75% of the EU-27 average. In the context of this report, we refer to less developed and transition regions together as “cohesion regions” and to more developed regions as “non-cohesion regions.”