- Demand for loans by small and medium-sized companies (SMEs) and corporates might face sharply tightening credit standards.

- Non-performing loans could increase for the first time since 2015 in the region.

A new EIB report published today, the CESEE Bank Lending Survey, provides insights into banking group activities and business expectations in Central, Eastern and Southeastern Europe (CESEE). The report analyses portfolios, demand and supply for financing and the development of non-performing loans. The new edition includes a special analysis on banking group expectations before and after the impact of the coronavirus pandemic.

According to the new survey, the banking sector in Central, Eastern and Southeastern Europe is likely to face one of its worst years since the global financial crisis in 2007-2008 due to the coronavirus pandemic. From a banking sector perspective, the region entered the crisis on a strong footing, with easing credit standards and robust demand for loans in the past six months. According to the new EIB survey, however, banking groups in the region are expecting the overall demand for financing to contract sharply, credit standards to tighten significantly and loan approval rates to decline. With decreasing loan application quality, non-performing loans are expected to increase for the first time since 2015.

“The coronavirus pandemic is an unprecedented crisis. But coordinated action and support at a European level has and will be unprecedented as well,” said EIB Vice-President Lilyana Pavlova. “In light of the grim expectations by the banking sector in the region and an increased likelihood of declining financing opportunities, we are particularly glad to have approved the pan-European Guarantee Fund. It is a timely and targeted response to alleviate the hardship endured, especially by entrepreneurs and smaller companies. We will work closely with national institutions to make sure that businesses in need can quickly access the support provided by the EIB.”

“The COVID-19 shock has changed the expectations of banking groups in the CESEE region significantly. Higher uncertainty will persist over the coming months. For the banking sector to return to pre-crisis activity levels and to ensure financing for smaller companies and corporates, providing support through instruments like the European Guarantee Fund and others will be essential. They can support a faster and forceful rebound,” said EIB Chief Economist Debora Revoltella.

The CESEE Bank Lending Survey is part of regular reporting from the EIB, IMF, EBRD and World Bank for the European bank coordination “Vienna Initiative”, a framework for safeguarding the financial stability of emerging Europe. The survey for the new edition of the report was conducted as the COVID-19 pandemic unfolded. Previous editions are accessible here.

Demand for loans

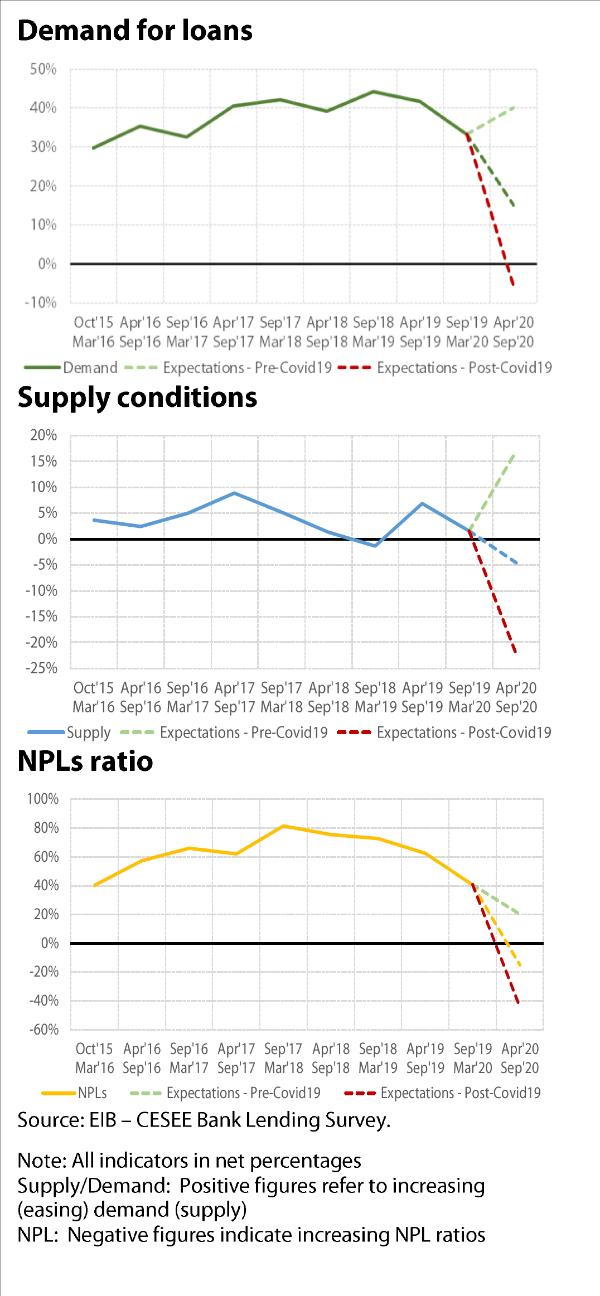

Banking groups operating in the CESEE region reported a continued increase in demand for loans in the last six months. However, demand in the coming months is expected to drop sharply. Before the pandemic, banking groups were expecting a further increase. The contraction in demand is expected to come from households rather than from corporates or SMEs. This suggests a sustained need for finance from the latter two, to meet liquidity and short-term needs.

Supply conditions for financing

In the months before the pandemic, banks in the CESEE region were mildly easing credit standards. Expectations are now that standards will sharply tighten across the client spectrum. Many factors that positively supported an easing of standards are expected to turn negative. In addition to the local and international economic environment, non-performing loans, the quality of loan applications and local capital conditions are expected to exert significant negative pressure.

Non-performing loans

Credit quality has continued to improve over the last six months. The positive trend is expected to invert dramatically. The vast majority of banks (64%) in the region anticipate that the number of non-performing loans will increase.

Background information

About the Economics Department of the EIB

The EIB Economics Department provides economic research and studies, as well as unique analysis of investment activities in the EU and beyond, and supports the Bank in its operations and in the definition of its positioning, strategy and policy. Chief Economist Debora Revoltella heads the Department, a team of 40 economists.

About the EIB CESEE Bank Lending Survey

The EIB CESEE Bank Lending Survey is a unique, bi-annual survey of some 90 local banks, banking groups and financial institutions in Central, Eastern and Southeastern Europe. It collects information on credit standards, credit terms and conditions, approval rates as well as on the various factors that may be responsible for their changes, including domestic and international elements. Demand for loans is also investigated in terms of loan applications as well as their quality. The survey also includes specific questions on credit quality and the funding conditions for banks. It is designed to build a panel of observations to support time series analysis, observations that can provide an almost real time assessment of the health of the banking sector in the CESEE region. The CESEE Bank Lending Survey was developed and is managed by the Economics Department of the EIB, and is part of a series of reports by the EBRD, IMF and World Bank for the Vienna Initiative.