The European Investment Bank (EIB) and BRD Groupe Societe Generale SA have signed an agreement for EUR 100 million to finance projects which will contribute to increasing employment, improving access to medium and long-term financing for Romanian companies and boosting the competitiveness of the Romanian economy. The EIB funds will be used to finance projects promoted by SMEs (with up to 250 employees), mid-cap companies (with up to 3 000 employees) and public-sector entities, as well as other types of private-sector promoters in Romania.

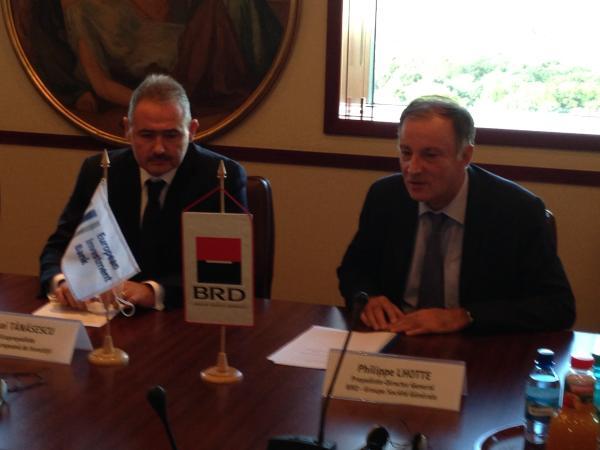

Mr Mihai Tanasescu, EIB Vice-President responsible for lending operations in Romania, stated, “Support for the financing of projects implemented in particular by SMEs and mid-cap companies is a core policy objective of the EIB in Romania, as the SME and mid-cap sector is an engine of growth and innovation. Through its cooperation with BRD, a well-established partner of the EIB in Romania, the EIB is ensuring that the benefits of providing loans on favourable terms are passed on to eligible promoters”.

This intermediated loan is being provided under the Joint IFI Action Plan for Growth in Central and South Eastern Europe, which focuses on providing better access to long-term finance for Europe's SMEs in order to help mitigate the effects of the financial crisis. These funds will support growth by fostering economic restructuring, consolidation and diversification, as well as enhancing long-term competitiveness through the increased availability of long-term credit.

“BRD believes that Romania is on the right way to economic recovery and is committed to boosting the performance of Romanian companies by capitalising on its professionalism and reach to the real economy. We are aware of the vital importance of SMEs and mid-cap companies to the economic fabric of the country and to its future growth. This is why we offer specially tailored products and our entire expertise to companies wishing to achieve a sound business performance through innovation. Lending is crucial for a country aiming at significant growth, and we are certainly able to contribute to Romania’s progress”, said Philippe Lhotte, BRD Chairman and CEO.

This loan represents a continuation of the successful cooperation between the EIB and BRD. Including the current loan, the EIB has already granted four credit lines to BRD totalling some EUR 230 million. Previous loans have been successfully disbursed and allocated to the final beneficiaries, primarily SMEs.

A significant part of EIB lending to Romania is made up of loans to financial institutions for financing Romanian companies, mainly SMEs and mid-caps. Over the last five years, the EIB has provided credit lines of over EUR 800 million to banks and leasing companies in Romania. Currently the EIB local network of intermediaries includes eleven active financial institutions that channel EIB funds to support the country’s economy.