- In 2022, the European Investment Bank Group financed more climate-related projects than ever before, including in Belgium, where 68.5% of the almost €2.7 billion went to green projects.

- The European Investment Bank (EIB) signed loan agreements for more than €2.3 billion supporting projects in water, medical innovation, energy and mobility, the standout being a €475 million loan for Brussels public transport.

- The European Investment Fund (EIF) made €334.9 million available to small and medium-sized enterprises (SMEs) in the form of equity, guarantee facilities and inclusive financing.

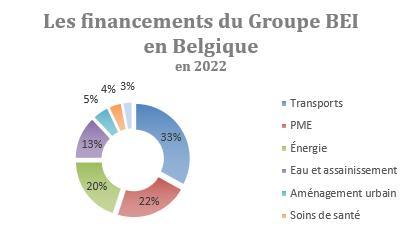

In 2022, the EIB and the EIF, which together make up the EIB Group, made almost €2.7 billion in financing available to Belgian projects. Just over €2.3 billion came from the EIB and almost €335 million from the EIF, the group subsidiary devoted exclusively to SME financing. Supporting such businesses still grappling with the consequences of the health crisis was one of the top priorities, as was backing climate action projects. For example, the EIB signed a new tranche of financing with Fluvius for infrastructure investments, which include adapting distribution networks for the electrification of public buses.

EIB Vice-President Kris Peeters said: “Belgian companies weathered the consequences of the COVID‑19 crisis better than expected, but the EIB and the EIF were still ready to help those who had struggled the most by providing them with suitable financing. We will certainly continue the upward trend in climate finance in 2023. We also want to focus on providing venture debt so that companies in strategic sectors can get the funds they need and stay in Europe.”

In addition to continued financing of this type for innovative Belgian medtech companies as in previous years, in 2022 the EIB supported a number of public sector projects. For example, the Brussels Capital Region received a €475 million loan for new metros, trams and electric buses, and Wallonia received continued support for water management, housing and energy projects following the floods in 2021. Favourable financing was also made available to small and medium businesses in the region through a €200 million partnership agreement between the EIB and the Regional Investment Company of Wallonia (SRIW).

“The European Investment Bank Group aims to operate countercyclically, meaning we only mobilise our financing solutions when and where necessary,” Peeters added. “Our financing activities also support the European Union’s strategic objectives, such as those related to climate, healthcare and innovation. We are therefore delighted to have been able to support major projects such as the upgrade and development of the Brussels public transport system and the new hospital in Antwerp. These types of projects have a direct positive impact on the day-to-day lives of people in Belgium.”

The European Investment Fund, a subsidiary of the EIB, remained an important source of financing for Belgian small businesses through equity investments and guarantee facilities, in particular those managed alongside ING Bank. The EIF also expanded its thematic funding through an investment in a renewable energy fund and support for inclusive financing with microStart.

Background information

The European Investment Bank (EIB) is the long-term financing institution of the European Union. Its shareholders are the EU Member States (Belgium contributes just over 5%), which enables the EIB to borrow money on the capital markets at very favourable rates. It makes long-term finance available for sound investment in order to contribute towards key EU policy goals related to sustainable growth, job creation and climate action.

The European Investment Fund (EIF) is part of the European Investment Bank Group. Its main goal is to help microenterprises and SMEs to access financing. The EIF designs and deploys venture capital, growth capital, guarantee and microfinance instruments specifically targeted at this market segment. Its activities foster EU objectives promoting innovation, research and development, entrepreneurship, growth and job creation.