- Despite deteriorating investment conditions, firms in the CESEE region are planning to increase investment overall.

- The share of firms considering energy costs as a constraint has surged to 87% (39% invested in energy efficiency in 2021).

- Just over a third of CESEE firms developed or introduced new products, processes or services, with the region’s highest corporate innovation levels in Slovenia (48%) and Poland (44%).

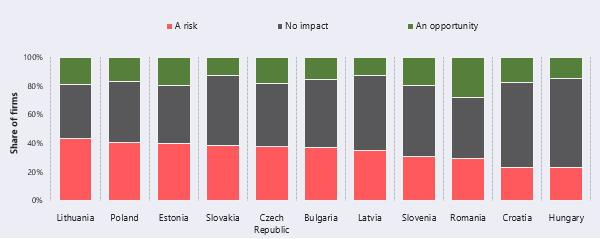

- Half of firms in CESEE report that climate change is impacting their business, but only one-third are protecting themselves (with insurance or by reducing exposure, for example).

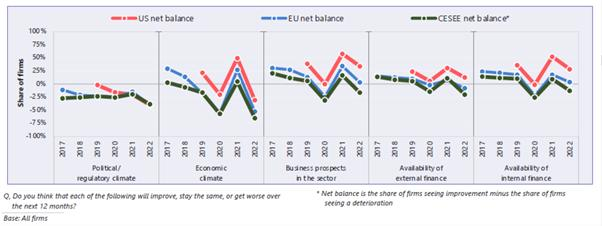

In Q2 2022, firms in Central, Eastern and South-Eastern Europe (CESEE) reported that their investment conditions had deteriorated drastically, and more than the EU average. They expected that business conditions in their sectors would continue to worsen, along with the general economic and political climate. And yet, on balance, firms in CESEE have planned to invest more in 2022 than they did in 2021. One source of impetus for this has been the pandemic, which prompted firms to become more digital, develop new products and shorten their supply chains. The use of advanced digital technologies has spread (internet of things, big data, artificial intelligence, 3-D printing, etc.): 67% of CESEE companies reporting using at least one advanced digital technology, narrowing the gap with the United States (71%) in line with the overall EU trend (69%). In response to pressure to adapt and innovate, a greater share of firms in CESEE intend to prioritise innovation over the next three years than in the European Union as a whole (27% versus 24%) or in the United States (21%).

These are some of the results from the EIB Investment Survey 2022 focused on Central, Eastern and South-Eastern Europe presented today at the Euromoney conference in Vienna. The survey presents unique, firm-level information collected from April to July 2022 from 5 000 firms in the CESEE region. It covers financing issues and other challenges that firms face such as investment needs, climate change and digital transformation, and investigates the impact of the war in Ukraine and COVID-19.

Read the full report here.

EIB Vice-President Lilyana Pavlova said, “Our economic survey highlights that the impact of the current energy crisis is even more pronounced in CESEE than in other parts of the European Union. A renewable and sustainable response is the best way to support Europe’s energy security. To speed up the green transition and reduce the region’s dependency on fossil fuels, the EIB plans to boost clean energy financing and mobilise up to €115 billion in investment for energy efficiency, renewables, grids, charging infrastructure and storage.”

Debora Revoltella, EIB Chief Economist, added, “The repeated shocks of the last three years have brought multiple challenges for companies across CESEE and the rest of Europe. Firms in CESEE are taking action: They are prioritising innovation (more than the EU average), remaining export-oriented and embracing advanced digital technologies (in line with the European Union and the United States). However, fewer firms in CESEE invest in intangible assets (research and development, software and training) than in the European Union as a whole. Uncertainty and skills, together with energy costs, are the most relevant long-term barriers to investment.”

More investment in innovation and tackling climate change

Around half of businesses reported that climate change impacts their activities, with one in ten reporting a “major impact”. However, only one-third of them had improved their resilience to physical risks related to climate change during the previous financial year. Firms in Romania (49%) and Estonia (40%) were most likely to have improved their resilience, while those in Hungary were least likely (21%). Most firms are taking action to reduce their greenhouse gas emissions, particularly in Romania (93%) and Poland (90%), but less so in Bulgaria (70%).

In contrast to the European Union overall, firms in CESEE are more inclined to perceive the transition to stricter climate standards as a risk rather than an opportunity. The infrastructure sector in particular sees the transition to a net-zero emissions economy over the next five years as a risk (41%). At company level the same is true of Lithuaniam firms (43%); companies in Romania, by contrast, are most likely to see the green economy as an opportunity. At the same time, Lithuania has the highest share of firms that have already invested and plan to invest in tackling climate change over the next three years, followed by Romania and Slovenia.

International trade

CESEE firms remained extremely export-oriented and open to international trade, but faced various trade disruptions. The majority of firms in manufacturing (94%) and of large firms (79%) reported being engaged in international trade, notably Slovenia and Slovakia. Four out of five firms in CESEE had seen their international trade disrupted since 2021, and almost half stated that both the Russia-Ukraine war and COVID-19 hampered their business. These firms’ intervention to mitigate disruptions was higher than the EU average (45% versus 37% for the whole the EU). In particular, to diversify risks, 63% of CESEE companies reported having increased the number of trade partners, and especially those in Romania (86%).