- EU firms navigated the pandemic better than expected, but massive new shocks are testing their resilience.

- Firms have made progress in climate investment, including both mitigation and adaptation-related activities.

- The energy crisis, inflation and monetary tightening pose downside risks for corporate investment.

- Structural transformation needs remain significant, as the European Union is falling behind the United States in innovation.

In 2022, few businesses expect to be worse off than before the pandemic, thanks to extensive and swift policy support and a strong rebound in demand in the first half of 2022. In total, 84% of firms expect 2022 sales to be back to at least pre-pandemic levels. EU firms continue to lead the fight against climate change compared to the United States. Across the European Union, 88% of firms say they have taken action to address greenhouse gas emissions and more than half of EU firms have already invested in climate action. However, the war in Ukraine and subsequent shocks are testing firms’ resilience. Firms’ perceptions of investment conditions have deteriorated starkly, driven by the energy crisis, uncertainty and decelerating global growth. Economic climate expectations have turned negative once again (declining from +27% to ‑53%). The perception of business prospects in the sector also reversed its trend (declining from +34% to +3%), as did the outlook for both the political and regulatory climate (-40%) and the availability of external finance (-8%). These are some of the main findings of the new edition of the European Investment Bank (EIB) Investment Survey, which was published today.

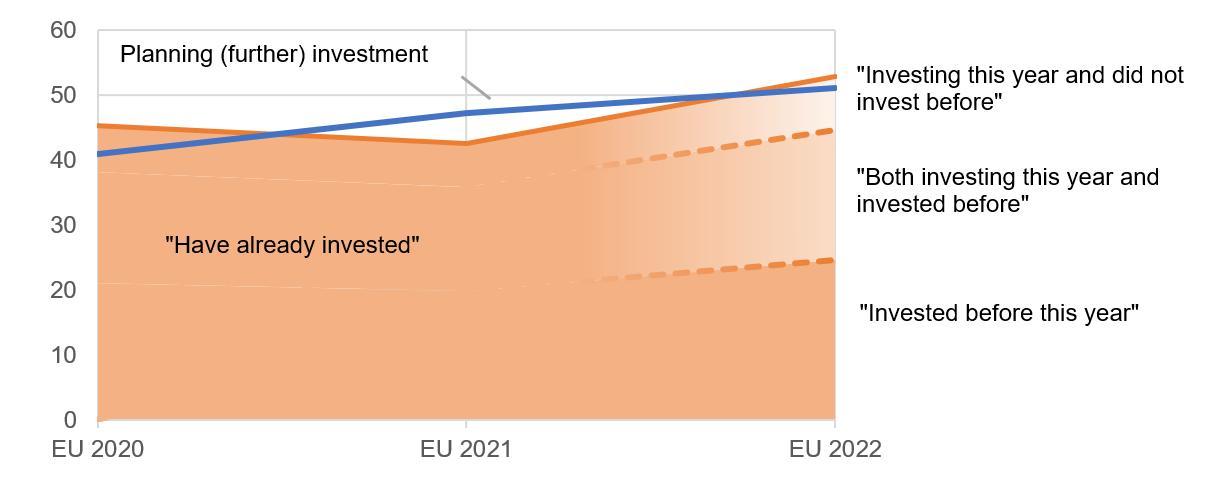

More EU firms have invested in tackling climate change, and more plan to do so

(Share of firms, %)

The seventh edition of the EIB Investment Survey provides unique firm-level information collected from April to July 2022. It looks at investment decisions and investment finance across the European Union and the United States, covering investment activities in climate action and digitalisation, and investigating the impact of the war in Ukraine and COVID-19. The EIB Group, EU institutions and EU Member States use the survey as a tool to identify needs and understand constraints holding investment back.

You can read the full report here.

A summary of the survey results can be found here.

“EU firms weathered the pandemic better than expected. A fast and ambitious COVID-19 policy response helped them during the most difficult times. Our EU-wide business survey shows that the policy support was well distributed with the most pandemic-hit firms more likely to have received it,” said EIB Vice-President Ricardo Mourinho Félix. “At the very beginning of the pandemic, the EIB Group swiftly started to channel financing to companies affected by the crisis. In the face of the new challenges emerging this year, the EIB Group is helping EU firms to weather rising energy prices, tightening financing conditions and trade disruptions. As part of our commitment, we plan to mobilise up to €115 billion of new investment by 2027 to support the REPowerEU plan to diversity sources of secure energy, speed up the energy transition and improve energy efficiency.”

“We live in a period of uncertainty and repeated shocks, testing corporate resilience,” said EIB Chief Economist Debora Revoltella. “During the pandemic, businesses in the European Union engaged in transformation and now use advanced digital technologies to the same extent as companies in the United States. EU firms have increasingly invested in climate action. The new shock should be a further stimulus. The response to the energy shock should set the basis for a more efficient and reliable EU energy market and divert finance towards green innovation.”

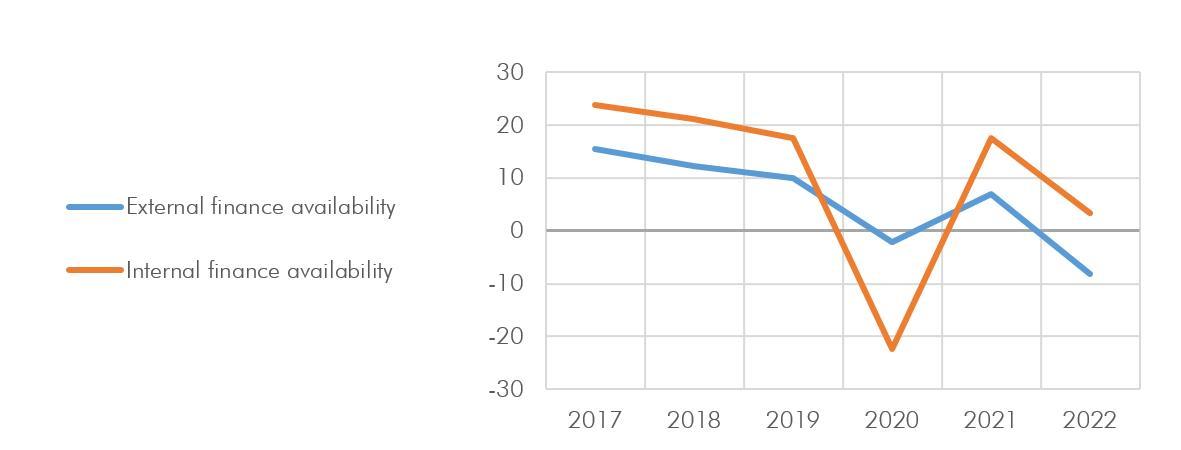

Inflation and monetary tightening pose downside risks for corporate investment

In face of the new shocks emerging in 2022, EU firms see the availability of external finance as getting worse in the short-term, even more so than at the height of the pandemic. The outlook for the availability of internal finance for investment has also strongly deteriorated (from clear improvement to stable). The share of firms that are finance-constrained has also begun to rise (6.2% in 2022 compared to 4.7% in 2021).

Note: Net balance (share of firms seeing improvement minus share of firms seeing a deterioration).

Outstanding structural transformation needs remain significant, while the persistent nature of the energy shock adds to the challenge

The period of repeated shocks is having an effect on firms’ innovation. About a third (34%) of EU firms developed or introduced new products, processes or services as part of their investment activities, similar to the share reported in EIBIS 2021 (36%). EIB Investment Survey data also shows a growing innovation gap with the United States, with 19% fewer firms in the European Union reporting investment in innovation. EU innovation levels were highest among firms in Finland (52%), followed by those in Ireland and Denmark (50% in both countries). Innovation levels were lowest in Slovakia and Spain (14% and 21%, respectively).

The European Union is falling behind in innovation, specifically in technology adoption

Share of firms investing in innovation (%)

Note: Innovation is defined as introducing products, services or processes new to the firm, country or globe.

EU firms are taking action to transform

- Climate action and energy efficiency: Firms have made progress in climate action investment, including both mitigation and adaptation-related activities. Across the European Union, 53% of firms have already invested in tackling the impact of weather events and dealing with the process of reducing carbon emissions. Furthermore, more than half of EU firms plans to invest in climate action over the next three years. About 57% of firms are making investments in energy efficiency, 64% in waste minimisation and recycling and 32% in new, less polluting business areas and technologies as a way to reduce greenhouse gas emissions.

- Digitalisation: EU firms largely closed the gap with the United States in terms of the use of advanced digital technologies, and can now reap the benefits.

- Trade disruptions: Firms are reacting to trade disruptions to increase their resilience.

Almost 90% of EU firms have faced international trade-related disruptions since 2021. Nearly as many EU firms see the Russia-Ukraine conflict and COVID-19 as creating obstacles to international trade. Overall, nearly 60% of firms facing disruptions due to international trade report having taken action to mitigate the impact of these disruptions.

About the Economics Department of the EIB

The EIB Economics Department provides economic research and studies, as well as unique analyses of investment activities in the European Union and beyond. It supports the Bank in its operations and in the definition of its positioning, strategy and policy. Chief Economist Debora Revoltella heads the Department, a team of 45 economists.