The pandemic is weighing on European businesses. Our latest EIB Investment Survey reveals that the impact of the coronavirus pandemic is being felt by firms across the European Union (EU) and has impact on their future investment plans. With investment collapsing, many firms – particularly the smaller – may fail to adapt to a new normal after COVID-19, becoming ever less competitive (“zombification”). Failing to invest, they will also be left exposed to the risks posed by the climate transition.

The EIB Group Survey on Investment and Investment Finance, conducted for the first time in 2016, is a unique, annual survey of approximately 13 500 firms. It covers 12 000 firms in all EU Member States as well as a sample of firms in the United Kingdom and the United States. The survey collects data on firm characteristics and performance, past investment activities and future plans, sources of finance, financing issues and other challenges that businesses face.

EU overview

Investment and COVID-19

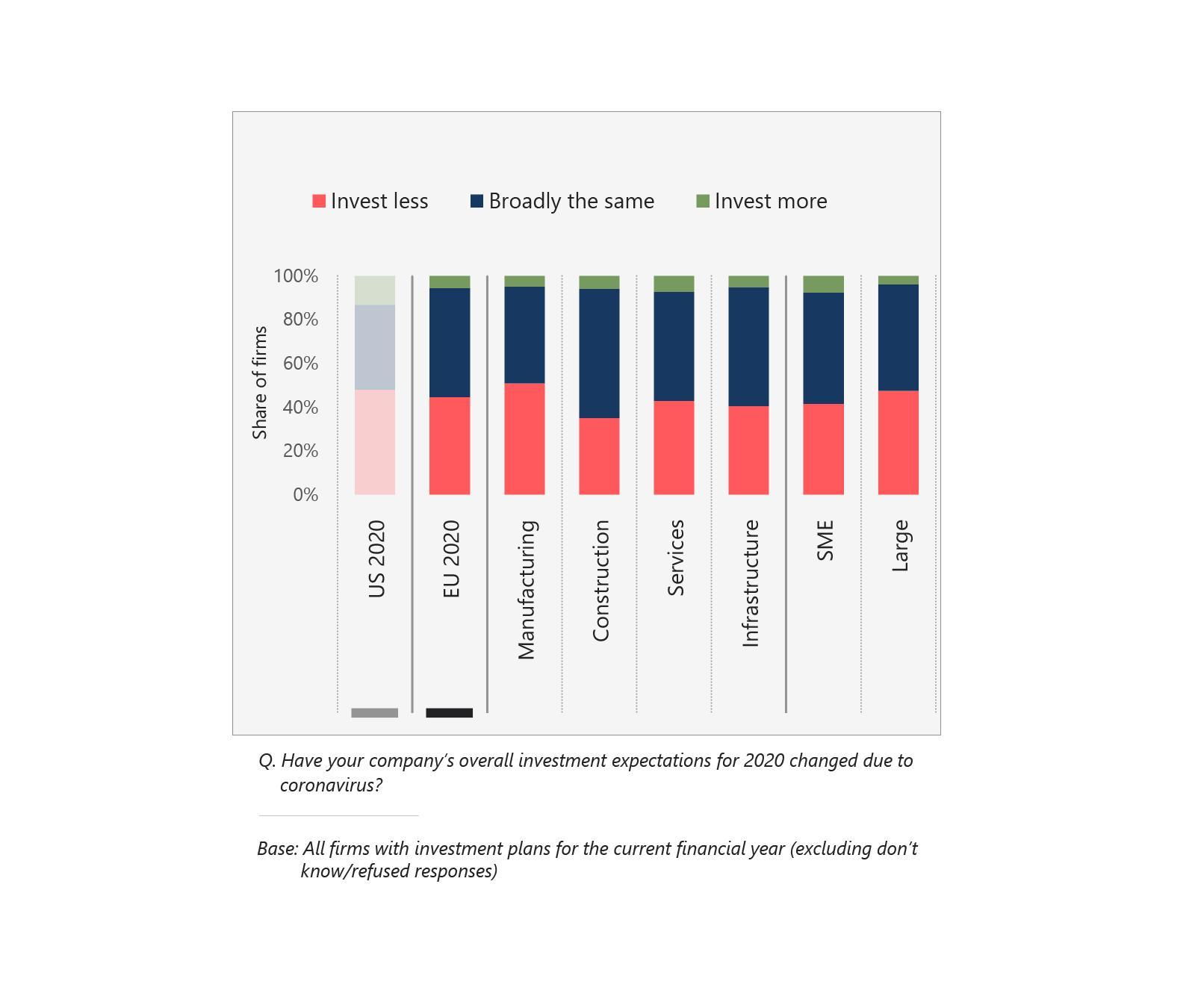

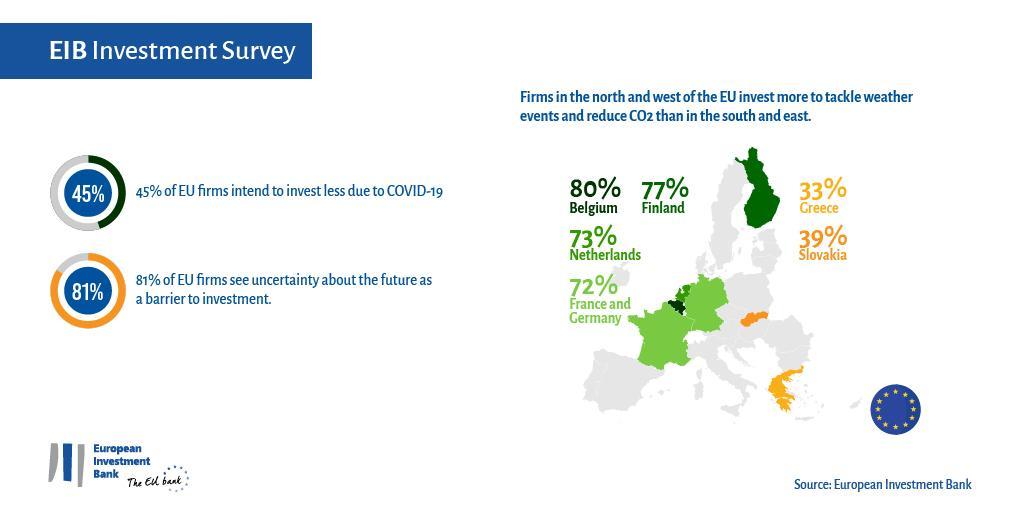

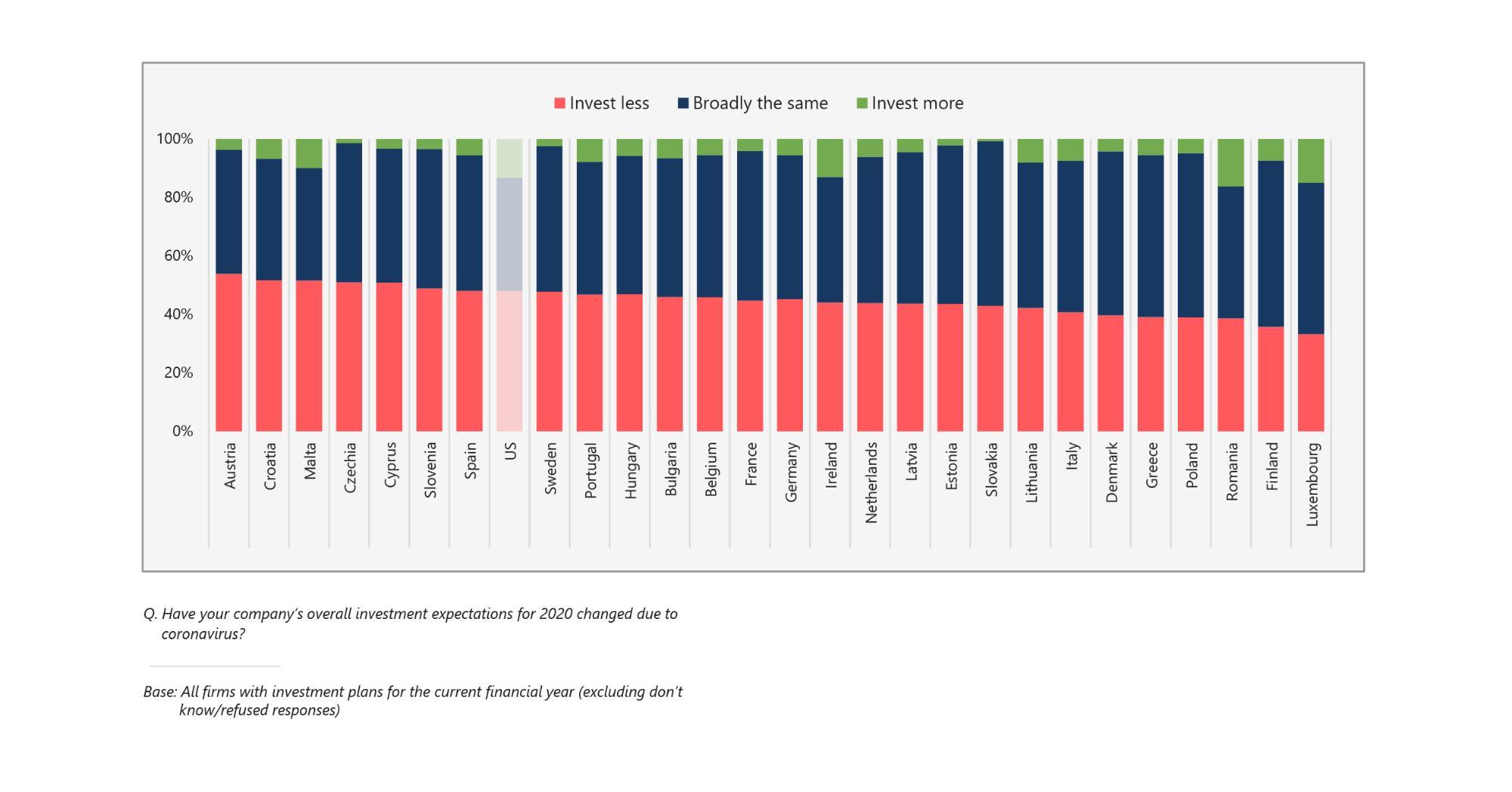

With COVID-19 abruptly hitting the economy, investment dynamics in the EU are dramatically slowing down. The new survey shows that EU firms expect to reduce investment in the coming year. Almost half of EU firms (45%) say that coronavirus has negatively affected their investment plans, leading them to delay or abandon future plans, at a time when they need to adapt to the green and digital transition.

Firms in the manufacturing sector are the most likely to expect to invest less (51%), while firms in the construction sector are most likely to say their plans are unchanged (59%). Large firms are more likely than SMEs to say that COVID-19 has had a negative impact on their investment outlook (47% and 41% respectively).

At the same time, 50% of EU firms say that more investment in digitalisation will be needed because of the pandemic.

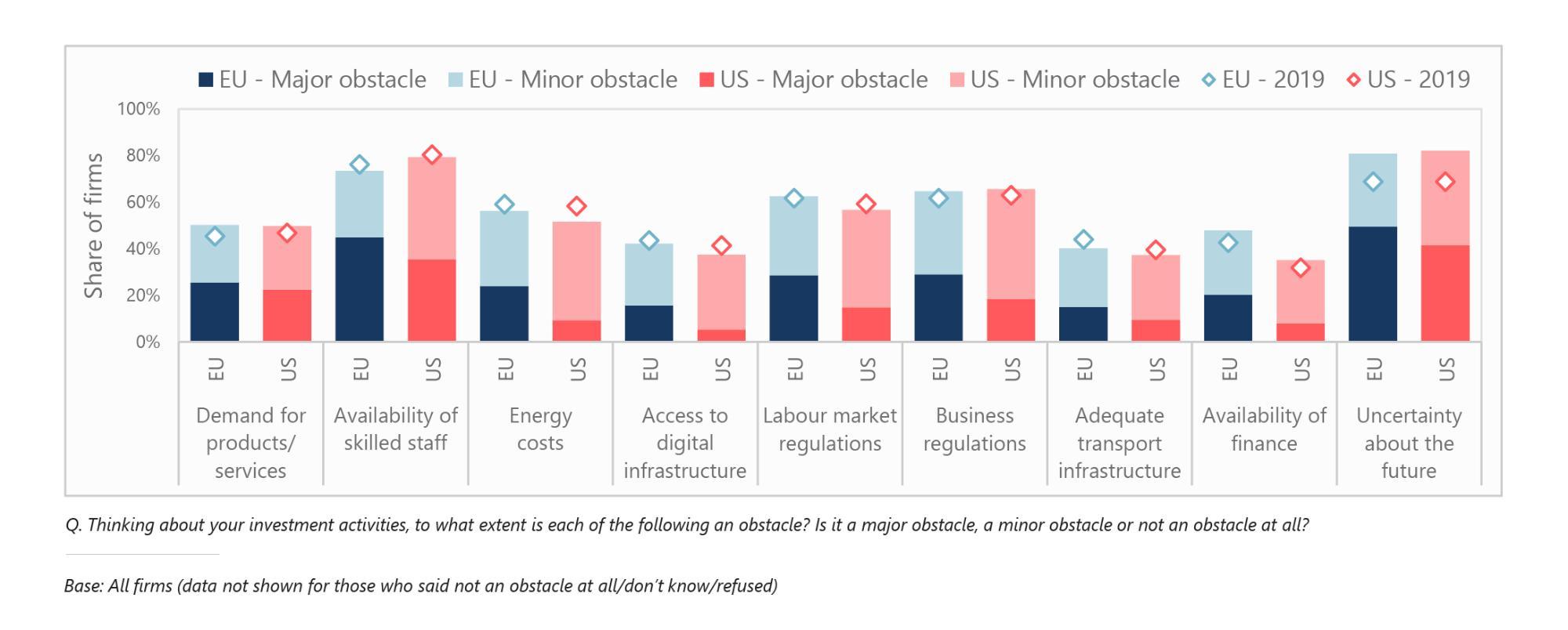

Uncertainty as an obstacle to investment

Uncertainty about the future is cited as the main long-term barrier to investment (81%), followed by the availability of skilled staff (73%). Firms are, on balance, pessimistic about the political and regulatory climate, and expectations for the overall economic climate have also become more negative, continuing the increasingly pessimistic trend seen since 2018.

Climate change

Almost a quarter of EU firms (23%) say that climate change is having a major impact on their business, with a further 35% saying it is having a minor impact. They are more likely to think that the transition to a low-carbon future will have a positive rather than negative impact in relation to market demand and their firm’s reputation. However, they expect a negative rather than a positive impact on the supply chain in their respective markets.

When compared to US firms, EU firms are more positive on these issues. Two out of three EU firms (67%) have either made investments, or plan to do so, to tackle the impacts of severe weather events and reductions in carbon emissions. This figure is higher than in the US (46%).

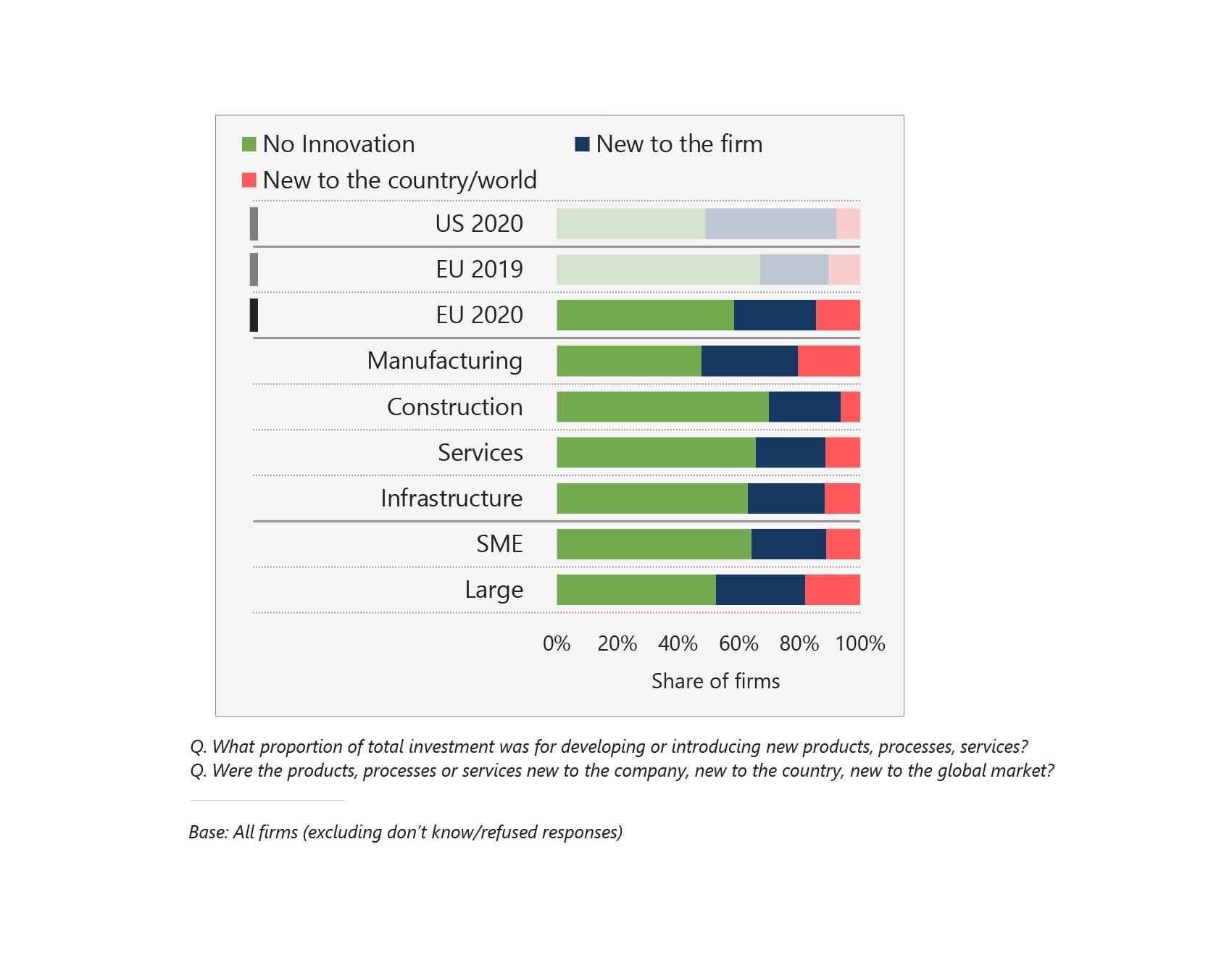

Innovation activities

Before COVID-19, around four in ten firms (42%) developed or introduced new products, processes or services as part of their investment activities, which is higher than in the 2019 EIBIS edition (33%). 20% of EU firms can be classified as active innovators, although this is lower than in the US (25%). In total, 63% of firms have either fully or partially implemented a digital technology. While this is higher than in EIBIS 2019 (58%), this remains lower than in the US as well, specifically due to a lower use of Internet of Things (IoT) applications and drones. 40% of firms also see a long-term need to adapt their product/services portfolio because of COVID-19.

Country overviews

Firms in Austria, Croatia, Malta and the Czech Republic are the most likely to say that they expect to invest less due to COVID-19, while firms in Romania, Luxembourg and Ireland are the most likely to say they will invest more.

Explore detailed results and analysis of the EIB Investment Survey results by EU country.

Investment report

The Investment report, issued annually by the European Investment Bank, provides a comprehensive overview and analysis of investment and the financing of investment in the EU. It combines the exploration of investment trends with in-depth analysis, focusing especially on the drivers and barriers to investment activity. The report leverages a unique set of databases and survey data, including EIBIS. The report provides critical inputs to policy debates on the need for public action on investment, and on the types of intervention that can have the greatest impact.