- Since the EIB pioneered its Climate Awareness Bond fifteen years ago, green bonds have been moving from niche to mainstream. Complemented by social and sustainability bonds and helped by legislation on sustainable finance, green bonds are becoming increasingly important in directing capital towards sustainable economic activities.

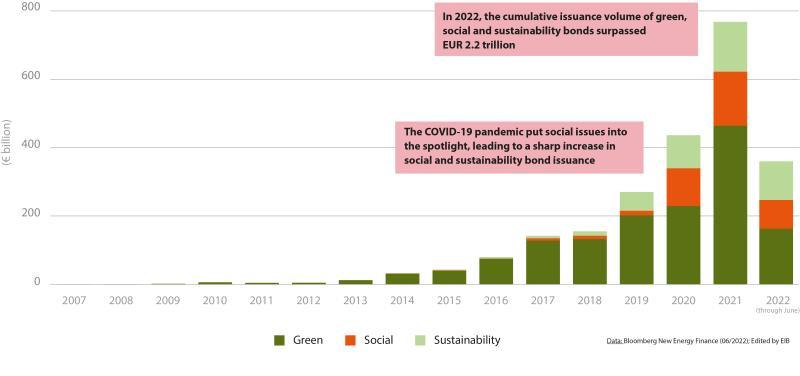

- Total issuance of green, social and sustainability (GSS) bonds stands at around €2.2trn[1], highlighting the market relevance of the EIB’s initiative 15 years ago

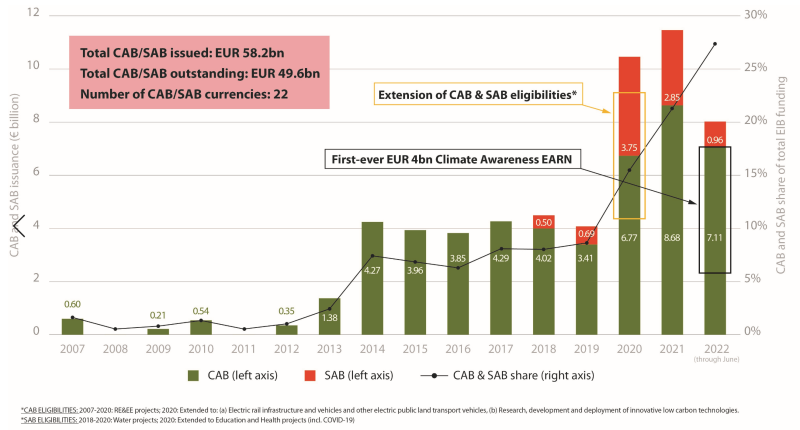

- EIB’s issuance of Climate and Sustainability Awareness bonds (CAB and SAB) is approaching €60 billion, making it the largest GSS issuer in its peer group

- EU legislation on sustainable finance is bound to support the further growth of the GSS market, with EIB spearheading application on the ground

On July 5th 2007 the European Investment Bank (EIB) issued its inaugural Climate Awareness Bond (“CAB”) – the world’s first green bond. The global green bond market has since surpassed the threshold of € 1.5tn in cumulative issuance and is supplemented by around € 720bn of social and sustainability bonds.

[1] Based on data from Bloomberg New Energy Finance

Green, social and sustainability bonds with dedicated use of proceeds – like the EIB’s Climate Awareness Bonds and Sustainability Awareness Bonds – enable investors to track the flow of their funds to the sustainable economy, promoting transparency, accountability, reliability and comparability in sustainable finance.

Proceeds from CABs are allocated to projects that contribute substantially to climate change mitigation, currently in the fields of renewable energy, energy efficiency, low-carbon transport and innovative low-carbon technologies. SAB proceeds are allocated to projects that contribute substantially to environmental and social objectives beyond climate change mitigation (for example, pollution prevention and control and universal access to affordable health services). Currently, funds raised with SABs are eligible to be invested in projects in the areas of water, health (including COVID-19-related projects), education, housing and forestry.

Today, the EIB is the largest multilateral development bank issuer of green bonds with close to €50 billion of CABs and €9 billion of SABs in 22 currencies. In the period 2019-2022, the share of these bonds of EIB’s total issuance has grown from 7% to 27% (see chart below), reflecting the progressive alignment of the EIB’s sustainability lending with the EU Taxonomy Regulation.

In response to growing volumes of eligible disbursements and investor demand for larger, more liquid bonds, the Bank has started issuing CABs in Euro Area Reference Note (EARN) format. EARNs normally have a minimum size of €3bn, which permits to add “benchmark” character to sustainability funding. To highlight the fifteenth anniversary of the first green bond, in May this year the EIB issued a first €4 billion Climate Awareness EARN due June 15th 2032.

“Financial markets play a key role in tackling climate change and achieving the Sustainable Development Goals,” said EIB President Werner Hoyer. “We will not achieve a low-carbon economy without channelling more public and private investors’ money into clearly defined green projects. Nor we will tackle poverty in all its forms if we do not provide long-term financing for sustainable infrastructure. Since 2007, the EIB has been at the forefront of the greening of the financial markets. By turning green bonds from niche to mainstream, we connected the dots between sustainable finance and sustainable projects that turn investors’ money into public good.”

What comes next in the green, social and sustainability bond markets?

In 2016, the G20 Green Finance Synthesis Report highlighted that “the lack of clarity as to what constitutes green finance activities and products (such as green loans and green bonds) can be an obstacle for investors, companies and banks seeking to identify opportunities for green investing”.

The global emergence of taxonomies that define sustainable economic activities has the potential to enhance clarity. GSS bonds are key in this endeavor: by applying the taxonomies and clarifying which economic activities contribute substantially to sustainability, the GSS bonds will also drive the classification of other areas of the economy, helping the transmission of strategic knowledge that will ultimately benefit society at large. Such process can increase international comparability between markets and highlight different approach strategies, further facilitating cross-border capital flows through eliminating uncertainty in the sector.

In the future, all economic activities should be mapped across climate, environmental and social objectives according to consistent sets of criteria.

Harnessing the potential of GSS bonds on a global scale will require an increase of international comparability to reduce uncertainty and facilitate cross-border capital flows. As the G20 report highlighted in 2016, this could be achieved via internationally comparable indicators and does not necessitate a one-size-fits-all approach. In 2017 the EIB, together with the China Green Finance Committee, developed a methodological and practical blue print in a White paper on the need for a common language in green finance. The International Platform on Sustainable Finance is now continuing and extending this initiative in its working group on a “Common Ground Taxonomy”.

With the EU Taxonomy Regulation and the proposed EU Green Bond Standard, the European Union aims to establish a framework in which market forces can efficiently deploy capital at the service of sustainability. The immediate challenge ahead lies in making this ambitious legislative framework work in practice.

In its Climate Bank Roadmap, the Bank commits to progressively aligning its sustainability lending and funding with the framework of the EU Taxonomy Regulation as this develops over time. The CAB and SAB Frameworks[1] published in 2021 provide information of the Bank’s early application of evolving EU sustainable finance legislation.

[1] https://www.eib.org/attachments/fi/eib-cab-framework-2020.pdf

https://www.eib.org/attachments/fi/eib-sab-framework-2020.pdf