What does the energy crisis mean for urgent cuts to greenhouse gases and the transition to net zero? A boost for clean energy, but also possible delays in investment, volatility and inflation—and a still more important role for public banks

Higher fossil fuel prices over the medium term will accelerate the transition to clean energy. With higher gas prices, the prospects for solar PV, large-scale battery storage and the electrification of heat for buildings and industry transform. But it also makes the transition messier. The distributional impact of higher prices (rather than higher carbon taxes) needs to be urgently addressed, globally and nationally. Against a backdrop of inflationary pressure, rising interest rates and greater volatility, the cost of capital is likely to rise – and there remains a risk that the private sector delays decisions to invest. Public banks, including the European Investment Bank, have an important role to play.

A human tragedy gives way to a global energy crisis

Russian aggression in Ukraine is first and foremost a human tragedy. It has also triggered an unprecedented increase in fossil fuel prices, and thus paved the way for a global energy crisis. As COP27 begins, it is useful to assess what this might mean for reducing greenhouse gas emissions by half by 2030 on our way to net zero.

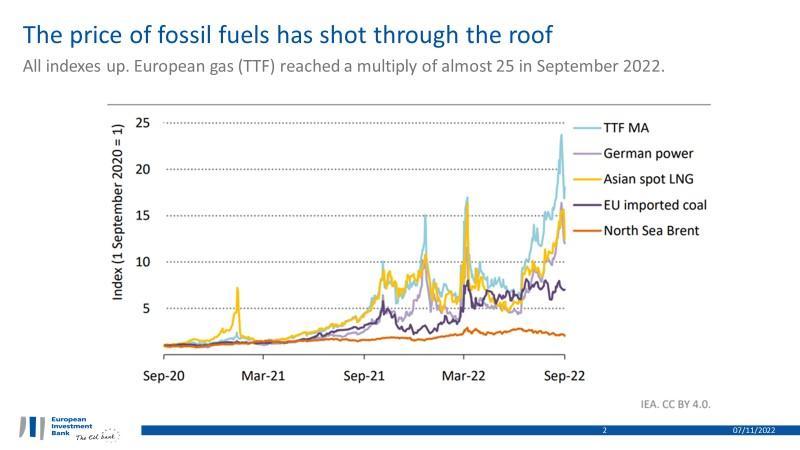

As consumers of energy, we are all experiencing first-hand the impact on our bills. Nevertheless, the sheer scale of the change in relative prices is important to stress. Figure 1, reproduced from the recent IEA World Energy Outlook 2022, does just that. In September this year, natural gas prices in Europe peaked at a multiple of almost 25 compared to two years ago. At the time of writing, the price of gas on the spot market is falling fast, but the price to deliver gas next year remains at almost €150 per MWh – still a multiple of around seven. High and volatile gas prices are likely to remain for the years ahead. This feeds most directly into power markets, as seen in Figure 1 for the German power market, but elevated and more volatile prices are likely to characterise the markets for imported coal and oil too.

What does a period of high and volatile fossil fuel prices mean for the long-term prospects of reaching net zero by 2050? This piece emphasizes the likely acceleration of clean investment, but also recognizes the challenges arising from a transition driven by a period of high and volatile fossil fuel prices, with rents flowing to exporting countries, as opposed to a steady, rising carbon tax in which rents would have flown back to domestic governments. It highlights the potential role of public banks along a messier transition pathway, including some of the more recent EIB initiatives.

High fossil fuel prices will accelerate the transition

Higher fossil fuel prices help drive the case for low-carbon alternatives. This is perhaps most obvious in the power generation market itself. As has been much discussed in recent years, large-scale competitive auctions for renewables in good locations can drive costs down to the €30-€50 per MWh level. In a world with cheap gas, however, this could be insufficient: the German spot price for power has been below €40 per MWh for most of the last decade. This is transformed in the current context, with average spot prices over €200 this year.

Challenges remain. Power prices are likely to fall over the medium term, not least reflecting energy savings and the build out of renewables. Supply side constraints – the complexity of the planning process; supply chain constraints – are likely to delay and push up final costs. However, the current price signal is clear – and favourable in a context in which the European Union is looking to treble today’s total installed renewable capacity by 2030. The prospects for solar – as the quickest technology to deliver – are particularly strong.

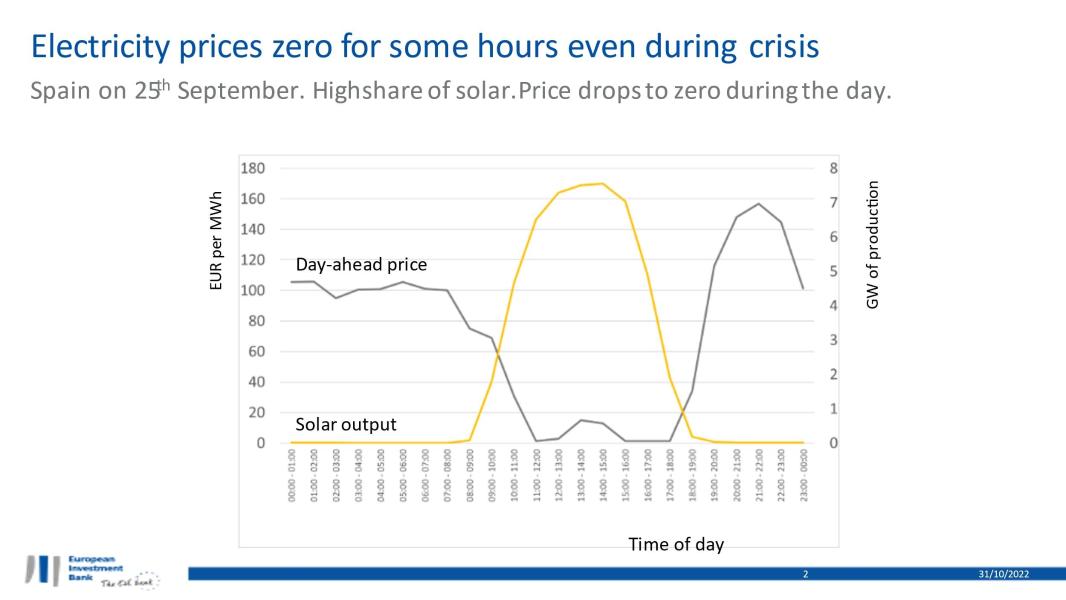

Let’s turn to batteries. High gas prices translate into high electricity prices for those hours in which gas-fired power plant is “on the margin”, i.e. the most expensive plant being operated to meet system demand. In a power system with a large and growing share of renewables, there are still plenty of hours in which the gas is not on the margin, hence prices remain relatively low. Figure 2 shows an example from Spain during late September. Prices during the day fell to almost zero, reflecting the large surge in output from the solar fleet.

These type of price dynamics are crucial for the economics of batteries in which balancing revenues – i.e. arbitrage between hours with low and high prices –are an important source of revenue1. In the case of Spain, this would involve charging the battery in the late afternoon for almost zero cost, and discharging in the evening for €160 per MWh. Prior to the energy crisis, the evening price in Spain is likely to have been around €50 per MWh or less. In other words, the energy crisis has approximately trebled the unit revenues from large-scale batteries or pumped storage. This shift should help stimulate new projects. The EIB is actively working on a number of battery or hydropower pumped storage projects, including a 105MW lithium-ion battery in Bordeaux, France or Hydropower pumped storage in Portugal.

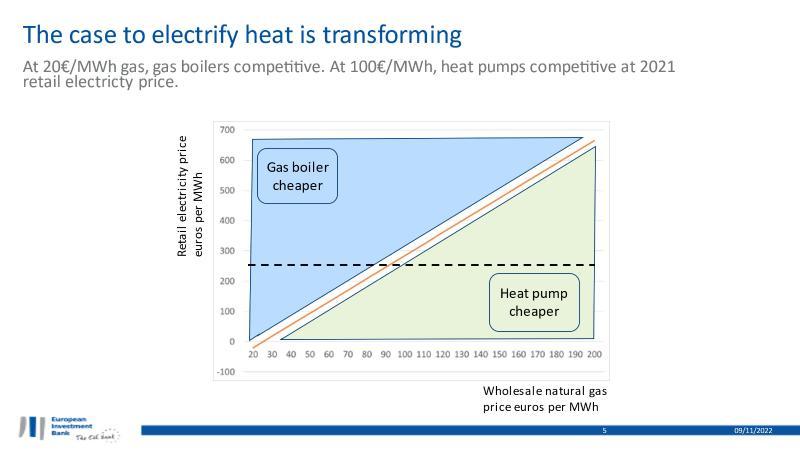

Let’s turn to the electrification of heat and the case for heat pumps. Nearly 60% of home heating in the European Union is supplied by fossil fuels, over two-thirds of which is from natural gas. The most obvious alternative is to switch to electricity in the form of a heat pump. The capital cost of a heat pump is around four times higher than a gas boiler. However, it has lower operating costs, driven by the fact that the pump produces three to four units of heat per unit of electricity consumed. The investment case for heat pumps therefore relies on demonstrating that the savings in fuels costs – based on electricity rather than gas – outweigh the increase in capital costs.

Author’s calculations. Based on load factor of 15%, the levelized capital cost of a heat pump is assumed to be €80 per MWh versus €20 for a condensing gas boiler. The operating cost savings of the heat pump needs therefore to be at least €60 per MWh. In estimating the operating cost, it is assumed (i) gas boiler efficiency of 92% (ii) an additional €30 per MWh to convert gas wholesale prices into retail prices (iii) a seasonal coefficient of performance of 3.5. The average EU retail electricity price – shown as a black dotted line - was €240 (eurostat) in second half 2021. Note the graphic retains wholesale gas prices (rather than retail) on the horizontal axis to allow for comparison with current wholesale gas prices (also in Figure 4)

Figure 3 shows how the energy crisis has transformed the economics of domestic heat pumps. The horizontal axis shows different values for the wholesale price of natural gas – ranging from €20 per MWh, reflecting values for much of the 2010s, up to €200 per MWh. The vertical axis shows the retail price for electricity. The green triangle depicts combinations of natural gas and electricity prices in which purchasing a heat pump makes financial sense; conversely, the blue triangle shows combinations in which it is cheaper to buy a gas boiler. The orange line shows the ‘’switching value’’ for electricity and gas prices, i.e. the value at which one switches from one technology to the other.

Back in 2020, driven by low natural gas prices, the financial case to invest in a heat pump – at least in the absence of a subsidy – was not there. Even with free electricity, the savings in fuel costs are not sufficient to outweigh the additional capital cost. This is the tip of the blue triangle in the bottom left hand corner of Figure 3. Now consider a gas price of €150 per MWh – the current value in the European market for delivery in 2023. Investing in a heat pump makes financial sense, i.e. you are in the green triangle, if the retail electricity price is below €475 per MWh. To put this in context, as shown in a dotted black line, in late 2021 the average retail price in the European Union was €240 per MWh. In reality, for many householders with rooftop solar and batteries, the cost of power may be considerably lower than the retail value. In short, the investment case for heat pumps is strong.

In reality, of course, the investment decision is more complex. Installing heat pumps in an existing property often requires additional investment in energy efficiency measures and may require switching to underground heating. It remains difficult to find heat pump installers and there are long lead times to deliver. All that said, the energy crisis has transformed the economics of heat pumps. And if you add in that the market is developing fast, in particular with new models producing higher water temperatures (60-80°C) allowing for a straight swap with a gas boiler, the prospects for the electrification of heat are strong. These are projects that the EIB is able and willing to support2.

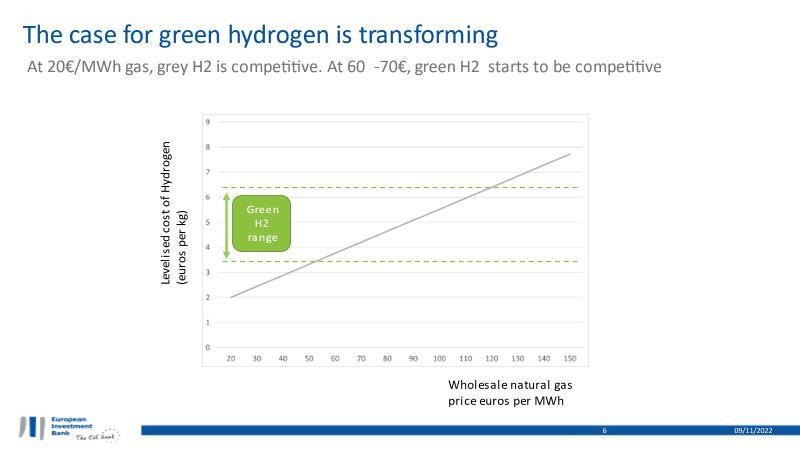

Finally, let us turn to green hydrogen. At the moment, 94 million tonnes of hydrogen is manufactured globally on the basis of fossil fuels, mostly natural gas – i.e. grey hydrogen – and thus a significant source of greenhouse gas emissions. This is used to manufacture fertilizers and as an input to a wide range of industrial processes. The low-carbon alternative is to manufacture hydrogen on the basis of electrolysis of water in the presence of low-carbon power, i.e. green hydrogen.

Author’s calculations. For grey hydrogen, assumes gas consumption of 44 MWh/tH2; GHG emissions of 56.1 gCO2/MJ of natural gas; an ETS price of €50 per tCO2 rising in real terms. For green, the range of levelized costs is derived by assuming a load factor range of 20-40% and RES input cost of €30-€50 per MWh, with assumptions on electric efficiency and electrolyser costs from the literature.

As shown in Figure 4, the energy crisis transforms the financial case for green hydrogen. The cost of producing green hydrogen is driven by the degree to which a manufacturer can spread the fixed cost of the electrolyser over a large number of hours of operation (i.e. the load factor) as well as the cost of the main input - green power. In Europe, let’s assume a cost for large-scale renewable power at €30-€50 per MWh, combined with a load factor for the electrolyser of 20-40%. This gives a cost range of €3.50-€6.50 per kg of hydrogen.

Figure 4 shows how the cost of green hydrogen stacks up against grey hydrogen, depending on the price of natural gas on the wholesale market. At gas prices seen over the last decade, i.e. €20-€30 per MWh, grey hydrogen is more competitive. Once gas prices reach the €60-€70 per MWh range, green hydrogen starts to become competitive for projects with exceptionally high load factors. With gas prices at €150 per MWh, as it is the current future market expectation for gas in Europe in 2023, even marginal green hydrogen projects become competitive. The EIB is actively working on a number of green hydrogen projects currently, including a 20MW electrolyser in Spain designed to produce green hydrogen for the fertilizer industry.

To conclude, a period of high fossil fuels prices transforms the economics of several low-carbon technologies, helping to strengthen the investment case. This section illustrates how different combinations of gas and electricity prices impacts the investment case for battery storage, heat pumps and green hydrogen. Although the examples are based on EU data, in the context of a global phenomenon of cheap renewable power and rising gas prices, the basic message of stronger project economics for many low-carbon technologies holds globally. Acceleration of investment is made all the more likely through the favourable policy context within which projects are being developed, including the Fit for 55 package in the European Union, augmented by REPowerEU; the Inflation Reduction Act in the US; as well as ambitious clean energy investment programmes in China and India.

Risk of a disorderly transition

A period of high fossil fuel prices helps accelerate investment in low-carbon alternatives. This is good news. Economists3 have long argued for a global carbon tax to send a strong credible price signal to households and businesses about the choice between high- and low-carbon alternatives, and to drive long-term investment. The current spike in the price of fossil fuels sends a similar signal, arguably more forcefully4 than that recommended by the carbon pricing literature.

We should not, however, get carried away.

Yes, price signals work. European consumers have demonstrated this by duly cutting gas demand thus far in 2022 by 7% compared to the average over the last three years – and by 23% in August (bruegel.org). But sudden, dramatic changes in energy prices come at a cost. First, there are strong distributional impacts – locally, nationally and globally –putting at risk the political consensus built up around the idea of a just transition. Second, increasing price volatility, particularly against a setting of regulatory uncertainty, is likely to increase the cost of capital and may lead investors to delay investment. In short, a disorderly transition.

We look at each argument in turn.

First, consider the distributional impact. Were the transition driven by price signals sent through high carbon taxes, governments would now be collecting substantial revenues. These could in turn be used to lower labour taxes, redistribute towards those most impacted by the transition, fund innovation or support international climate finance goals. Instead, today’s price signals are driven by the high cost to import fossil fuels. This price increase redistributes wealth from importing countries (i.e. consumers) to exporting countries (i.e. producers), via the balance sheets of an array of energy companies – primarily oil and gas companies, but also energy utilities –and dividend returns to their shareholders.

At the global level, the impact is most starkly felt by least-developed countries importing fossil fuels. The IEA estimates that 75 million people that have recently gained access to electricity may now lose the ability to pay for it, and around 100 million people with access to clean cooking may return to unhealthy cooking.

More generally, energy bills have become unaffordable for many citizens. To their credit, European governments have reacted. Bruegel estimates that €674 billion have been allocated to shield consumers and firms from the rising energy costs – with €264 billion earmarked in Germany alone. Note these aggregate results include general measures – such as reducing energy VAT or retail price regulation – as well as measures specifically targeted to vulnerable groups.

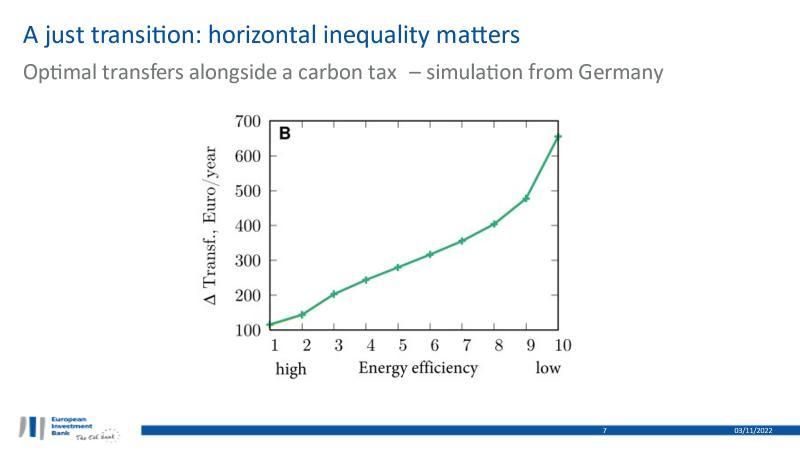

Support measures for the most vulnerable often tend to focus on income. Recent work by academic economists in the context of a just transition, however, stresses the need to consider ‘’horizontal’’ inequality, i.e. that even within groups with a broadly similar income level, the impacts of a rise in the price of fossil fuels may differ strongly. Consider workers needing to commute long distances by car, households owning or renting housing with poor energy-efficient standards, or indeed communities dependent on high-emitting industries.

Optimal carbon taxation and horizontal equity: A welfare-theoretic approach with application to German household data, Journal of Environmental Economics and Management 116, https://doi.org/10.1016/j.jeem.2022.102730 The figure shows a first-best solution for a given degree of inequality aversion.

An interesting recent paper by Martin Hänsel and co-authors from the Potsdam Institute for Climate Impact Research examines some of the policy measures to address horizontal inequality arising from meeting emissions targets. Figure 5 shows some results based on the modelling of the German economy. The results highlight that optimal transfers accompanying a carbon tax are five to six times higher (€650 per year) for energy-intensive households compared to energy-efficient households (€115 per year). The paper goes on to explore the implications for climate policy in practice, i.e. designing fiscal policy, but with low levels of information and realistic administrative challenges. The paper argues that, in such a setting, clean energy subsidies (and by extension publicly-supported investment programmes, including those supported by public banks) can make sense alongside carbon taxes as a means to target support energy-intensive households.

What does this mean for the current energy crisis? Higher fossil fuel costs – just like the carbon tax in the paper by Hänsel – exacerbates the challenge to address distributional concerns from the transition. Second, it can be challenging in practice to fine tune the fiscal system to provide targeted support, especially when distributional impacts depends on a variety of factors (income, housing stock, employment, etc.). As a result, subsidies to clean energy programmes, including energy efficiency for buildings, may be an effective way to supplement wider fiscal measures to address inequality, though in practice this requires a sound understanding of the distributional impacts of particular programmes.

This is perhaps a timely reminder to public banks. The broad message – that investment can help support wider fiscal measures to tackle distributional impacts – is certainly consistent with the high-level principles published last year by the multilateral development banks. Within the European Union, the EIB and the European Commission have just signed a €11.5 billion public sector loan facility to support public sector entities in investing in regions most affected by moving away from fossil fuels. The EIB will shortly announce its approach to support a just transition outside the European Union. In short, from a public bank perspective, the energy crisis makes work to support a just transition even more relevant – locally, nationally and globally.

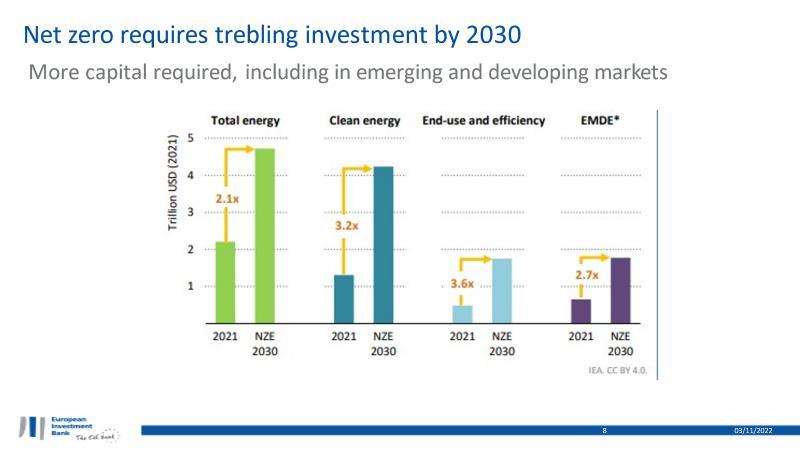

Let me turn to a second concern about a transition driven by high and volatile fossil fuel prices. Despite sound economic fundamentals for clean energy projects stressed in Section 2, the cost of capital is likely to rise. This in part reflects monetary policy responding to inflationary pressure – somewhat triggered by high energy prices. In the energy space, this risks being further reinforced by increased volatility in key markets (e.g. wholesale power). This is a concern, given the overall challenge to treble investment in the energy sector, as shown in Figure 6 drawn from the IEA World Energy Outlook.

Note EMDE refers to emerging and developing markets but excludes China.

The transition was never going to be plain sailing. But with the onset of the energy crisis, the transition pathway has become messier and more disorderly. And that risks delaying investment. Ben Bernanke, recently honoured as a Nobel Laureate, pointed out in a classic paper5 in 1983 why uncertainty can delay irreversible investment. If the return on investment is unclear, it can be better to wait to find out more. The decision to wait is driven by the downside uncertainty – and not the expected returns set out in Section 2 above. This is a concern. As Figure 6 reminds us, we don’t have time to wait.

What does the energy crisis mean for a public bank?

The energy crisis changes the relative price of fossil-fuel based technologies. Low-carbon alternatives, in particular direct electrification, become more competitive. Factor in a steady increase in market share (electric vehicles, battery storage, domestic and industrial heat pumps), and a conducive policy environment across much of the largest markets in the world, and the prospects for a marked acceleration in the transition are good.

However, there are head winds. Higher fossil fuels prices – unlike a carbon tax – make us all poorer, with potentially dramatic impacts for some of the most vulnerable in society. This is true at the level of a region, a nation or the globe. In particular, it risks setting back access to energy in some of the poorest countries in the world. Additional distributional measures are required, both including targeted fiscal measures and investment programmes. In difficult times, such measures need to be well-designed and well-communicated to maintain broad support for the transition. Moreover, higher price volatility, the risk of recession, and supply chain constraints all suggest a more disorderly transition than expected – with a higher cost of capital as a result. Some investors may simply decide to wait for greater certainty – time which we don’t have.

What does this imply about the role of public banks?

Three messages are key. First, faced with rising cost of capital, public banks can play a traditional countercyclical role to help boost investment in clean energy solutions through long tenors, large loan sizes and, in many cases, access to grant facilities. In the energy space, and particularly in the context of evolving regulatory frameworks, public banks can play an important role in sharing risks, notably those stemming from newer business models, or helping provide credibility to the market in banking new regulatory changes. The multilateral development banks start from a strong base, having provided $82 billion in climate finance in 2021. The EIB Group has responded to the crisis by announcing an additional €30 billion in loans and equity for clean energy projects, in support of the REPowerEU Plan by 2027.

Second, accelerating investment often goes beyond the supply of finance. Through technical assistance facilities, public banks have the capacity to work upstream with clients to help improve project fundamentals and thus access to finance. In some cases, it is a matter of replication and scalability – such as scaling up the renovation of public buildings or designing competitive auctions for utility-scale solar programmes. In other cases, upstream option analysis can help public authorities or state-owned entities to design transition programmes, such as helping prepare strategic environmental assessments to help accelerate roll out of renewable programmes in a particular region, or working with a district heating company to examine options to decarbonise heat supply. Access to technical assistance becomes more important in the context of the current crisis.

Third, as stressed above, the energy crisis has exacerbated concerns about a just transition. Through targeted support to clean energy investment programmes, such as energy efficiency measures in social housing, public banks can help wider fiscal efforts to address distributional concerns –at local, national and global level. This requires a good understanding of the likely distributional impacts of clean energy investment programmes. Public banks are well placed to be able to support their shareholders in promoting a more equitable transition.

In short, public banks can help across all three points. This is partly a question of increasing scale; partly a question of increasing speed of delivery. The energy crisis in general, as well the role of public banks within it, is likely to dominate much of the discussion at COP27. It should not be seen as a reason to delay implementation of ambitious net zero targets – quite the reverse. The crisis does, however, exacerbate distributional concerns at the global level. It will likely reinforce the case for international climate finance as a means to ensure a more just transition. Faced with the prospect of large short-term investment needs on the one hand and a rising cost of capital on the other, the role of public banks within the architecture of international climate finance is more relevant than ever.

- Large scale battery projects usually derive revenues from several different system services: providing capacity, providing frequency control reserves, as well as balancing revenues (i.e. arbitrage described above).

- EIB support for heat pumps – both for domestic and industrial use - is largely channelled through wider green loans to SMEs and midcaps. The share of signatures committed to climate action and environmental sustainability (‘’Green Windows’’) has risen sharply in recent years: from 6% in 2017 to 15% in 2021, and estimated to reach 24% in 2022.

- See The world urgently needs to expand its use of carbon prices | The Economist

- A back-of-the-envelope calculation illustrates this point. Consider the short run marginal cost of a combined cycle gas turbine plant. Prior to the energy crisis, assume natural gas cost €30 per MWh, which with a 50% efficiency, implies power can be sold with power prices of €60 per MWh or more. Post crisis, assume the same plant sells power for €300 per hour, i.e. twice the current forward price for gas at the time of writing. The wholesale price for power has risen by €240 per MWh. Combined with an GHG emissions factor of 0.35 tCO2 per MWh, this equates to an effective carbon tax of 240/0.35 = 680 EUR/tCO2. To put this in perspective, this is equivalent to the EIB shadow cost of carbon for an emission in the year 2045 (Annex 5 of EIB Group CBR).

- B.Bernanke, 1983, Irreversibility, Uncertainty and Cyclical Investment, The Quarterly Journal of Economics, 98(1), 85-106, https://doi.org/10.2307/1885568 .