A Bavaria venture capital fund backs growth companies like OroraTech, which aims to slow global warming by helping snuff out wildfires

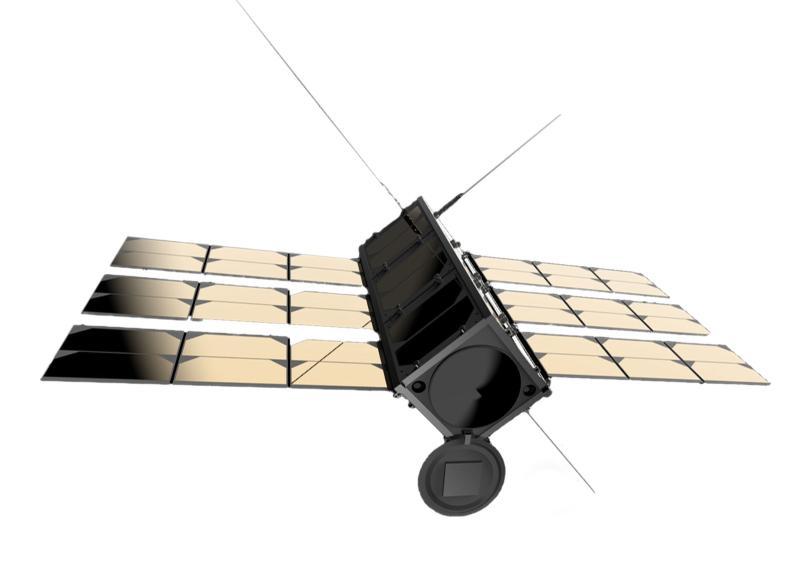

Thomas Grübler was 26 when he and his friends made a cube satellite for their research project at the Technical University of Munich and realised it had a future beyond academia. They envisioned a company that would send these shoe box-sized devices into space to carry out thermal monitoring of the entire globe, protecting against the impact of the wildfires caused by global warming. So they founded OroraTech.

Thomas Gübler

“Many companies and investors think you have lower profits when you do something good to counter climate change,” says Grübler, who is now 30 and chief executive of OroraTech. “This is not true. You can build a company to have more profit when you do something beneficial for the earth, instead of something bad.”

Innovative technologies like OroraTech’s are key to meeting the climate targets set by international bodies and to helping communities adapt to the effects of climate change. But it’s hard for successful start-up tech companies to raise the funds needed to complete their research and to expand their businesses—the so-called “growth” stage of a company’s life cycle. Thankfully for OroraTech and companies like it, the Bavarian state’s venture capital arm, Bayern Kapital, set up a €165 million fund to invest in growth companies.

“We hope to create big Bavarian companies that might even become big German or European companies with lots of jobs and impact on the GDP of Europe,” says Monika Steger, who manages Wachstumsfonds Bayern 2 at Bayern Kapital in Landshut. “There are all these big American technology companies. We hope to build companies like those in Bavaria, with enormous positive impact on the economy.”

Bayern Kapital has invested in more than 300 companies over 25 years in a broad range of industries, including software and life sciences. The current portfolio includes more than 80 companies. Its investment capital comes from the Bavarian state and, in the case of Wachstumsfonds Bayern 2, also from the European Investment Bank. It always finances companies together with private investors. Some of its investments have grown to become major companies, including Commercetools, a cloud commerce company that is now a “unicorn” (a privately held start-up with a value of more than $1 billion)

Bavaria venture capital fund to stem brain drain

Growth companies typically turn to venture capital investment. Venture capital is more freely available in the US and China than Europe, however. That can hinder the growth of European companies or result in their purchase by bigger companies from outside Europe. “Venture capital is growing in Germany,” says Frederic Klohe, a loan officer at the European Investment Bank. “But it’s not enough. So you get a brain drain.”

That’s why the European Investment Bank invested €50 million in Wachstumsfonds Bayern 2 in March 2021. It’s an unusual project for the EU bank, where equity investments are typically done through its small business subsidiary, the European Investment Fund. However, the Bank had done a similar €50 million deal in 2019 with Coparion, a public venture capital fund backed by Germany and its national promotional bank, KfW, and was able to repeat the feat in Bavaria thanks to the backing of the European Fund for Strategic Investments, which increases the risk the EIB can take due to a guarantee from the EU budget.

“This type of investment boosts the entrepreneurial spirit that is essential for a strong economy and which, in Germany, is lagging behind,” says Michael Raschke, who heads the EIB’s investment unit for German banks. “It’s a very good thing for us to support.”

The second Wachstumsfonds Bayern follows a previous fund of the same name that invested €70 million in 23 start-ups over five years, mobilising more than €350 million of private financing.

Shoe-box satellites and Bavaria venture capital fund

The investment comes at a good time for OroraTech. The company rolled out its product just as COVID-19 hit the European economy. Even so, OroraTech was able to recruit new customers online in Australia, South America and Canada. But it can now move to the next stage of its development.

So far, OroraTech has used public data from NASA and European Space Agency satellites in its proprietary software. In January 2022, it will launch the first of its own CubeSats. “Our own satellites are the key to complete our product by providing more data to our customers,” says CEO Grübler. In five to 10 years, OroraTech aims to have a network of 100 to 200 satellites capable of taking a full picture of the surface of the earth at least every half hour.

The satellites will measure the temperature of the surface of the earth at a very high resolution. With so many wildfires caused by global warming, this has important environmental implications. For example, wildfires cause 10% of global carbon dioxide emissions each year. But there are health and economic ramifications, too. Wildfire emissions release pathogens that kill 300 000 people every year. The insured damages from wildfires costs €20 billion annually.

“Our company is very important to us. But we’re working on something that’s very important to everyone,” says Grübler. “To look after the planet.”