Fourth from right Gerhard Hütz, EIB Group Chief Compliance Officer, and fourth from left Jorge Dajani, World Bank Group Chief Ethics Officer

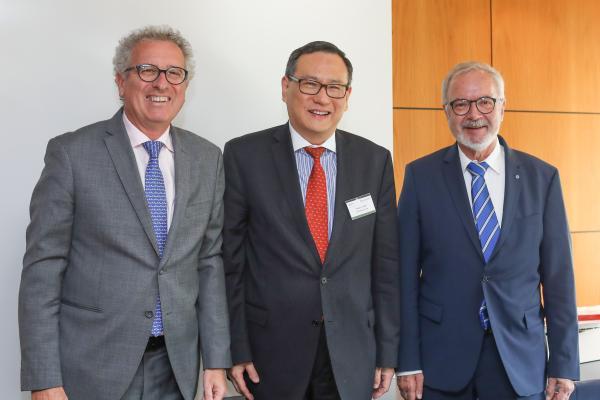

From left to right: Pierre Gramegna, Minister of Finance of Luxembourg / Shaolin Yang World Bank Group, Managing Director and Chief Administrative Officer/ EIB President Werner Hoyer

The European Investment Bank and the World Bank jointly held the “Ethics and Corporate Culture Conference 2019” in the EIB Luxembourg headquarters on 6 June. The conference brought together a full room of 150 experts and participants from Ethics, Compliance, Regulation, Behavioural Science and Artificial Intelligence and it was opened by EIB President Werner Hoyer, Pierre Gramegna, Minister of Finance of Luxembourg, and Shaolin Yang, Managing Director of the World Bank Group.

In his opening remarks, EIB President Werner Hoyer emphasised the importance of ethics for public International Financial Institutions (IFIs) such as the EIB Group and the World Bank Group:

“As International Financial Institutions, we are duty-bound to invest in the public good. We are driven by the desire to improve people’s lives and invest in the future and therefore we must lead by example and be ethical in everything we do.”

On behalf of the World Bank Group, Managing Director and Chief Administrative Officer Shaolin Yang reaffirmed the importance of ethics in development and emphasised International Financial Institutions must exert strong ethical leadership in the world.

“The challenges of development—the challenges of improving the lives of others—are not purely economic or financial. They are ethical,” Yang said. “As collectives of nation-states—the European Investment Bank, the World Bank Group and other IFIs—believe in, and work toward, the ethical necessity of global cooperation to improve lives and societies. And as financial institutions, we take an ethical stance toward the use of the public funds entrusted to us to achieve this mission,” he said.

Pierre Gramegna, Minister of Finance of Luxembourg, added that ethics and corporate cultures would also be influenced by climate action and sustainability debates.

“In everything we do, we have to take climate change into account. Some people seem to get tired to hear about it, but this is just the beginning. It will shape not only ethics but also corporate culture in the years to come.”

The conference broadly covered main elements and challenges of International Financial Institutions’ ethics programmes, corporate culture, regulatory developments, and the impact on compliance, performance, efficiency and staff motivation. Panel sessions on behavioural science, data and information solutions, artificial intelligence and digital ethics gave insights into the latest and future developments.

Why do ethics and compliance culture matter?

Compliance culture and ethics have become increasingly important in the corporate and banking world over the past decade: regulators are intrusively vetting financial institutions, shareholders are articulating their concerns stronger than ever, and more NGOs are challenging organisation’s behaviours, holding them accountable towards the public.

Campaigns which have become viral such as the ‘Me too’ are examples of this changing environment. They raised awareness and encouraged lengthy discussions over inappropriate behaviour and sexual harassment. Increasingly, ethics and integrity are becoming a crucial criterion for managerial evaluation. A decade ago, half of all CEO dismissals were triggered by poor financial performance and less than a tenth by “ethical lapses”. However, in 2018, 39% of departures were due to ethical issues; financial performance only accounted for 35%.

Behavioural science and ethics and compliance

The field of behavioural business ethics and compliance is a relatively new way of thinking about the means to manage the ethics-driven transformation of an institution’s corporate culture. As rules, norms and laws alone are not sufficient in preventing unethical behaviour, the field looks into understanding what drives human behaviour and how to incentivise ‘good’ behaviour.

During the panel on “How can behavioural science support ethics and compliance”, participants debated the question “Why do good people do bad things” and presented the current state of research and concepts on nudging behaviour.

Artificial Intelligence: Ethics of the future

“Are we being reduced to data subjects?”, “Should we use this technology at all?”, “How to cope with bias and Artificial Intelligence (AI)?” “How does AI affect responsibility and accountability?” The conference panel: “Ethics of the future: corporate culture and artificial intelligence”, showed that ethics could contribute to the development and design of AI by asking the right questions. However, the debate also made clear that - although Artificial Intelligence has the potential to change the world as we know it - we are just beginning to grasp its possibilities and dangers.

IFI Ethics Initiative

The Conference, organised by the EIB Group Compliance function OCCO and the World Bank Group Ethics and Business Conduct function, was also the launch point of an IFI Ethics initiative.

Gerhard Hütz, EIB Group Chief Compliance Officer, and Jorge Dajani, World Bank Group Chief Ethics Officer, pointed out the importance of Ethics and the role model of IFIs in this respect.