- Women-led companies rely on a substantially different financing mix to firms led by men.

- Female-led startups are still rare globally, and face obstacles in accessing finance.

- Women-led firms achieve higher environmental, social and governance scores while supporting the upskilling of their employees more by investing in training.

Marking the 2022 Financial Alliance for Women Summit, which brings together a wide range of business leaders focusing on what institutions can do to champion the female economy, the European Investment Bank (EIB) today launched its new research study: Support for female entrepreneurs in Europe: Survey evidence for why it makes sense.

The report is based on various proprietary EIB surveys, highlighting the importance of investing in women’s business leadership.

EIB Vice-President Thomas Östros said: “Gender lens investing is both a duty and an opportunity for all societies and businesses — and a no-brainer for us at the EIB. We need to support a women-friendly ecosystem where women business leaders can thrive. We will continue to support women entrepreneurs through relevant initiatives such as SheInvest and 2X Challenge, and work relentlessly to achieve gender equality in the European Union and beyond.”

EIB Chief Economist Debora Revoltella added: “Investing in women’s business leadership is not only the right thing to do. It is also a matter of delivering better business and development impact results. Firms striving for gender balance are just better firms: more innovative, more digitalised and more likely to care about climate change and act accordingly. When compared to the rest of the world, Europe’s women entrepreneurship rates lag behind. This is a concern because female-led firms strive for gender equality and offer more job opportunities for women. We believe that a whole set of measures is needed to change the status quo. Finance plays a significant role beyond the support provided at the very early phases of enterprise growth. Failing to fully leverage women’s potential comes at an economic and social cost for all.”

Financial Alliance For Women CEO Inez Murray said: “Europe is behind the United States on rates of female-led startups. It is time to invest in making our entrepreneurial ecosystems more female-friendly. This means getting the right data, like this research, to understand the nature of the problem and give it visibility. Then we need to galvanise the public and private sectors into working together to solve it. The business case for supporting women is clear. Women are excellent borrowers and are loyal banking customers. While fewer of them start a business, once up and running, women’s businesses perform just as well as men’s. We need to bring accountability to the system. We want each EU country to set up an Investing In Women Code, so that financial services providers report on the volume of financing to women businesses. This has been done in the United Kingdom and has galvanised the ecosystem.”

Read our summary here.

Why are women important for the economy?

Female entrepreneurs are role models for women’s empowerment and make significant contributions to the economy. Supporting female entrepreneurs helps create new jobs while generating societal benefits.

Evidence shows that female-led firms are more likely to have sound management practices in place — setting more performance indicators — and are more willing to introduce new products and innovative solutions, not only in the European Union but also across the world. Gender diversity in the workplace can bring more creativity, efficient solutions and better decision making. Still, more needs to be done to achieve parity and enable women to leverage their potential in a transforming economy.

Women also tend to support the green transition more, and attentively monitor CO2 emissions as well as setting energy efficiency targets. Women-led companies have higher environmental, social and governance scores, which improve firms’ evaluations and how they are perceived by investors and clients.

Women-led firms generate further positive spillovers, with their greater use of training courses (40% of women-led firms compared to 34% of male-led firms) contributing to the human capital of the company and empowering employees beyond the firm. Women also attract (and retain) more women, positively affecting female employment and reducing gender disparities while promoting more inclusive growth. Notably, 47% of female-owned firms have more than 50% female workers, while 74% of men-owned firms have less than 50% female employees.

What is holding women back?

The female workforce is underrepresented in the labour market, politics and top positions in firms, and women tend to work more in part-time jobs, which typically offer fewer opportunities for career progression, limiting their full potential.

Female startups and scale-ups are still rare, with a share of female founders of 23% in the United States, 20% in the United Kingdom and 11% in the European Union.

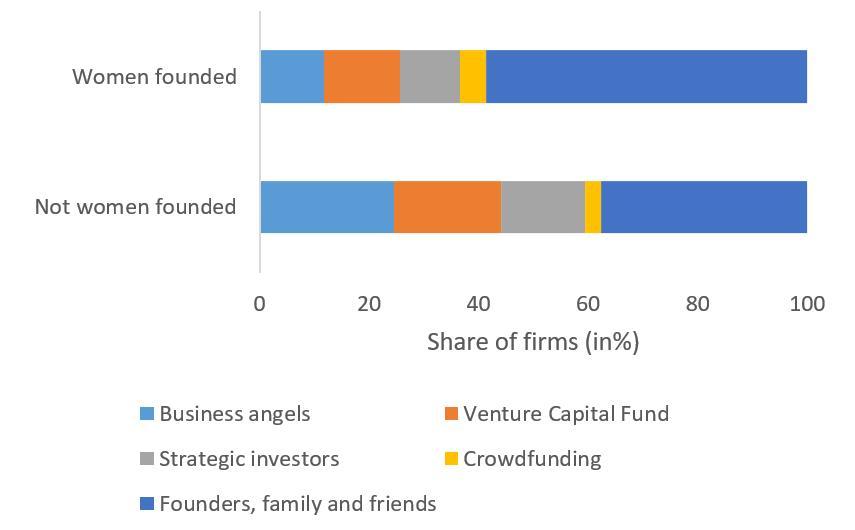

Female-funded firms in the European Union and neighbouring countries find a lack of access to finance to be one of their greatest obstacles. Furthermore, the financing mix of female entrepreneurs is less diversified than that of their male counterparts, with equity more likely to come from themselves, family or friends.

Female-funded companies get public support, but this is mostly in the form of grants to get up and running. They have much more limited access to the wider range of growth finance.

Financial opportunities to back women-led businesses are less prominent, with a lack of balance even in the startup sector. Business angels play a smaller role in the equity mix of female-founded startups (10% vs. more than 20% for male-led startups), as do venture capital funds.

Moreover, men are 3.1 times more likely than women to work in the ICT sector, and the current digital-led economy places more obstacles in the path of female labour. This gap is also evident in the application of cutting-edge technologies by companies, with women-led firms being less likely to apply them.

Skills gaps are one of the biggest obstacles for women in business, as they are for male-led companies based in the European Union. Neighbouring countries have the same disadvantage, with political instability playing an important role in discouraging women.

Building female-friendly entrepreneurial ecosystems in Europe

Evidence suggests that women-led firms are more vulnerable to the effects of shocks and recessions, and COVID-19 has not been an exception to this. At the same time, many female-led firms have been resilient and have successfully adapted their business by shifting their firms online and towards new forms of product delivery, in a comparable way to male-led firms. Stepping up efforts to achieve gender parity is needed to live up to global and EU commitments, and to roll back recent gender equality setbacks. This includes putting in place proper social infrastructure, regulations and taxation incentives so that women are not prevented from working or setting up a business in the first place.

A crucial enabler for parents remains the availability of childcare services at an affordable cost. To tackle gender entrepreneurship gaps, improving access to finance and networks is key. Financial markets and environmental, social and governance-conscious investors can further catalyse opportunities for women.

Background information

The European Investment Bank Group is the long-term lending institution of the European Union owned by its Member States. It makes long-term finance available for sound investment in order to contribute towards EU policy goals. To improve the impact of its activities on women and girls, the EIB has adopted a Strategy on Gender Equality and Women’s Economic Empowerment and a Gender Action Plan with the aim of embedding gender equality and, in particular, women’s economic empowerment in the EIB’s business model covering its lending, blending and advisory work within and outside the European Union.

To improve female representation in the venture capital, private equity and private debt market, the European Investment Fund (EIF) is pursuing gender objectives through its investment activity under the InvestEU programme. The InvestEU gender smart criteria embedded into the EIF’s selection process have been designed with a view to supporting more female-led funds or gender diverse teams with a focus on the role of women in decision making and leadership positions.

More information on EIB gender equality initiatives

About the Economics Department of the EIB

The EIB Economics Department provides economic research and studies, as well as unique analyses of investment activities in the European Union and beyond. It supports the Bank in its operations and in the definition of its positioning, strategy and policy. Chief Economist Debora Revoltella heads the Department, a team of 45 economists.