- International banking groups believe in the profitability potential of the region, in particular the Czech Republic, Hungary, Poland and Romania.

- The supply of loans will probably decrease over the next six months and the quality of loans will deteriorate.

The countries of Central, Eastern and South-Eastern Europe (CESEE) are particularly vulnerable to the effects of the war in Ukraine. Financial ties with Russia, the influx of refugees, dependence on foreign direct investment and reliance on energy imports are worsening expectations. Banks are signalling a potential restriction on the supply of loans, and the quality of loans is expected to deteriorate. Despite the uncertainty and growing risk, international banking groups believe in the potential of the region. Two-thirds of banking groups are going to maintain their activity there, and one-third foresee a selective expansion of activity in some countries, even though some of the leading banking groups in the region are also directly present in Russia, Belarus or Ukraine.

These are just some of the main results of the survey on bank loans in Central, Eastern and South-Eastern Europe. The survey was conducted in March 2022 and provides some initial insight into the impact of the war on the bank loan market in the region.

“The new edition of the EIB’s CESEE Bank Lending Survey reveals the first signs of a slowdown in the development of the financial market in the region. Small and medium-sized companies and new enterprises will be the first to feel the escalation of the situation in the coming months,” said EIB Chief Economist, Debora Revoltella. “Stimulating the financial sector and making it more open to financing innovation remains a priority.”

“The uncertainty of the geopolitical situation and the deterioration in economic prospects may have a negative impact on the flow of loans in Central, Eastern and South-Eastern Europe,” said EIB Vice-President, Ricardo Mourinho Félix. “Small and medium-sized companies will suffer the most. Last year, almost half of our financing, about €45 billion, went to small companies. As the supply of credit is expected to decrease, the EIB Group will continue to be involved, directly or through financial intermediaries in the region, in providing access to financing for this sector.”

The war in Ukraine — a new turning point

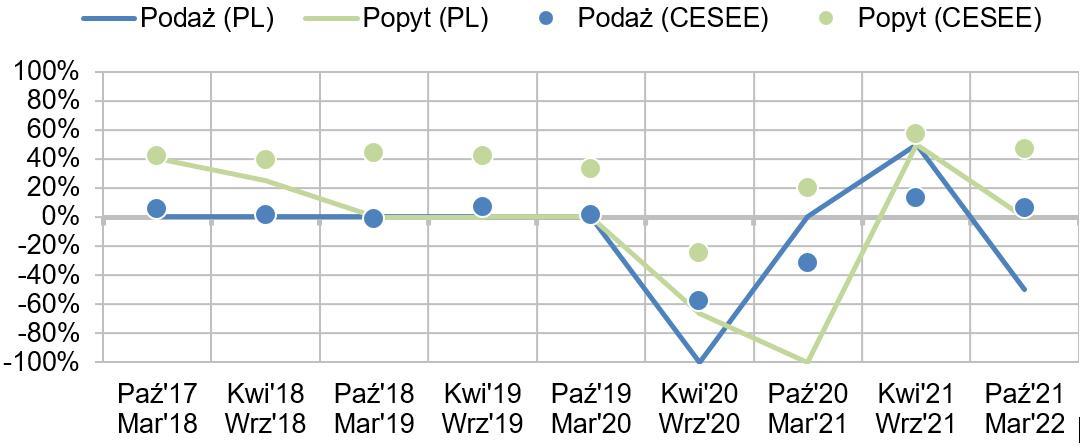

After a significant improvement in loan supply and demand, financing and loan quality, banks from Central, Eastern and South-Eastern Europe are now signalling a turning point where the uncertainty of the geopolitical situation is having a negative impact on their forecasts. The impact of the COVID-19 crisis has been strong, but demand for loans rebounded in 2021 and loan terms, at the end of 2021 and the beginning of 2022, started to become increasingly attractive. Decisive responses to the crisis on the part of EU governments and institutions have prevented sharp deleveraging. However, the war in Ukraine is having a negative impact on the banks’ forecasts. It is expected that demand from bank clients will remain strong, higher for working capital and lower for investment financing. However, some factors are hindering the development of lending: the response of the markets to the crisis is uncertain, inflationary pressures are growing and it is not known what measures will be taken by governments to support the economy.

Survey results on the situation in the Polish banking sector

Parent banks of groups operating in Poland confirm their involvement in the Polish market and plan to maintain their regional activity at current levels, as they believe that their market position is optimal.

In Poland, demand for loans has decreased more in the last six months than in the Central, Eastern and South-Eastern Europe region, and is expected to weaken further.

After a promising rebound in 2021, loan supply conditions in Poland have deteriorated significantly over the past six months, more so than in the rest of the region. In the coming months, loan conditions are expected to deteriorate generally in all segments and categories of activity.

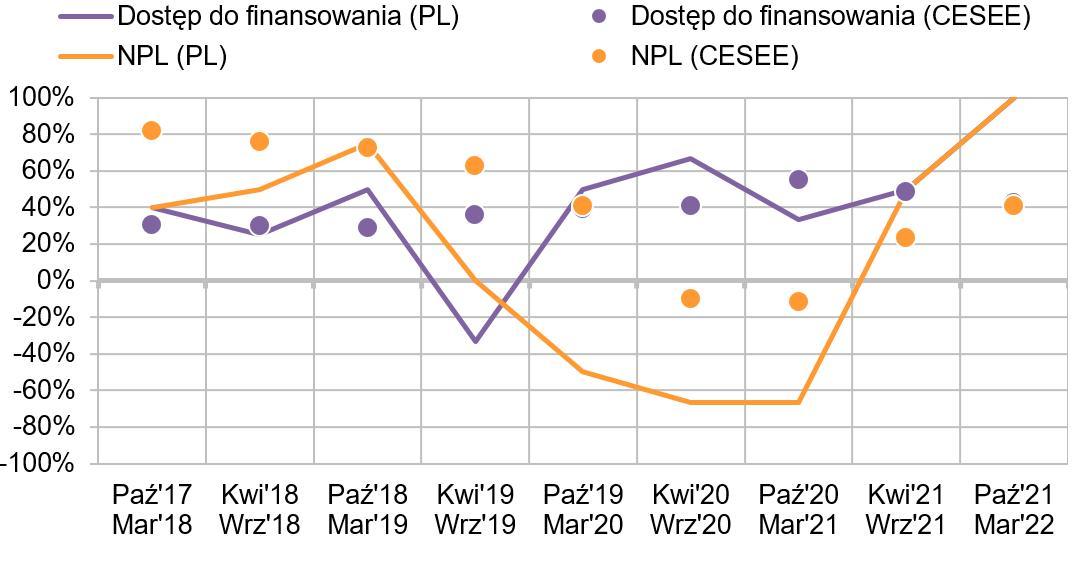

Summing up, over the past six months, Polish banks’ access to financing has continued to improve, mainly through local financing (retail and corporate deposits) rather than group financing.

Banks are also signalling a turning point in terms of the quality of loans. After the positive trend of the last six months, all banks surveyed expect a deterioration in non-performing loan ratios

Source: EIB, CESEE Bank Lending Survey.

Note: All ratios provided as net percentages; Supply/demand: positive values indicate growing demand/supply.

Source: EIB, CESEE Bank Lending Survey.

Note: All ratios provided as net percentages; Access to financing: positive values indicate increased access to financing; NPL: negative values indicate an increase in these loans in the portfolio

Results of the bank lending survey — opinions of parent banks

Parent banks of groups operating in Poland confirm their involvement in the Polish market and plan to maintain their regional activity at current levels, as they all believe that their market position is optimal.

These parent banks confirm the great potential of the Polish market in the Central, Eastern and South-Eastern Europe region. However, opinions on profitability, as measured by the return on capital (RoE) and return on assets (RoA) of Polish operations, are less optimistic than for other parts of the region.

Results of the bank lending survey — opinions of local banks/subsidiaries

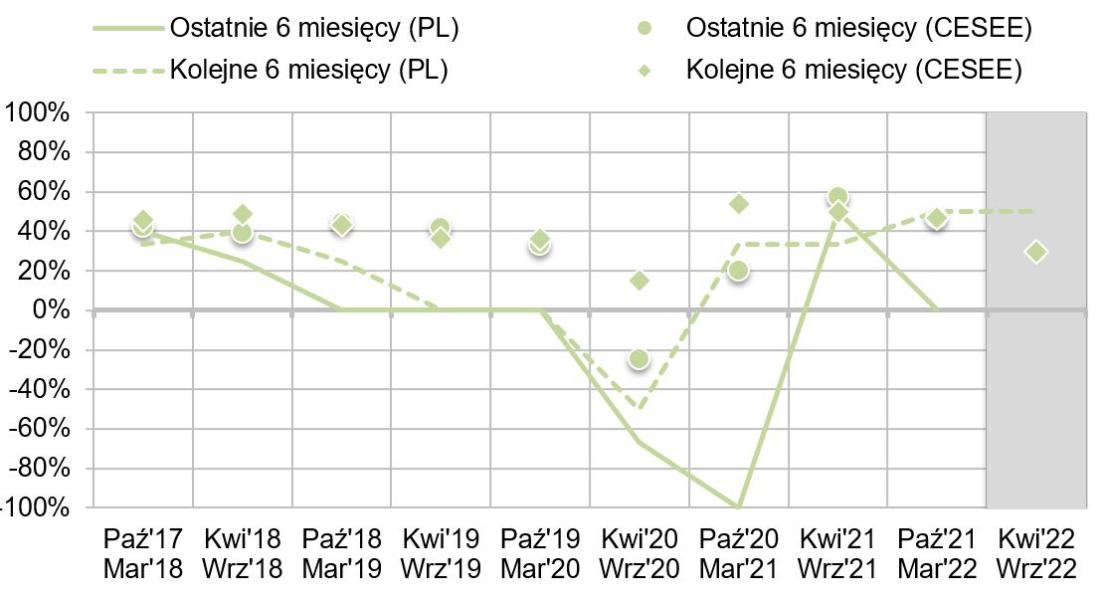

After the rebound in 2021, demand for loans in Poland has lost momentum again and slowed down over the last six months. The main reasons are the tightening of financial conditions due to higher inflation and the outbreak of the war in Ukraine. This slowdown has increased the gap with demand trends in the rest of the region. This slowdown was higher than forecast by banks in autumn 2021 following the second phase of the COVID-19 pandemic.

Polish banks do not expect demand for loans to improve in the coming quarter and expect it to remain behind the other countries in the region.

Source: EIB — CESEE Bank Lending Survey.

Note: The chart shows net percentages, with positive figures indicating growing demand. The series of two forecasts (dashed line and diamonds) is shifted forward so that they could be comparable to present opinions (lines). In other words, the forecasts developed at time t for the next six months are shown in the chart at time t + 1.

Demand for loans

Demand for loans has decreased in the last six months in all loan segments. As opposed to the growth trend shown by the regional average, demand for housing loans has strongly decreased. While demand for loans among small companies has increased over the past six months, demand for loans on the part of large companies has not shown an upward trend. Banks expect a partial recovery in demand over the next six months in all business areas, except mortgages and consumer loans.

Factors affecting demand for loans

In Poland, business loans remained at the same level or decreased, as opposed to the growth trend seen in most countries of Central, Eastern and South-Eastern Europe. In the next six months, demand for fixed investments and debt restructuring is expected to decrease, working capital loans are expected to increase and no changes are expected in the merger and acquisition (M&A) activity. As regards the situation of households and consumer confidence, the prospects of the housing market have decreased sharply over the past six months, thus reducing demand for mortgages (in contrast to the growth trend in most countries in the region). Demand for the remaining loans decreased and stagnation is expected over the next six months.

Quality of loan applications

The quality of loan applications in all segments covered by this survey has remained unchanged, but it is expected to increase over the next six months in the home purchase category; the same is true in other parts of the region.

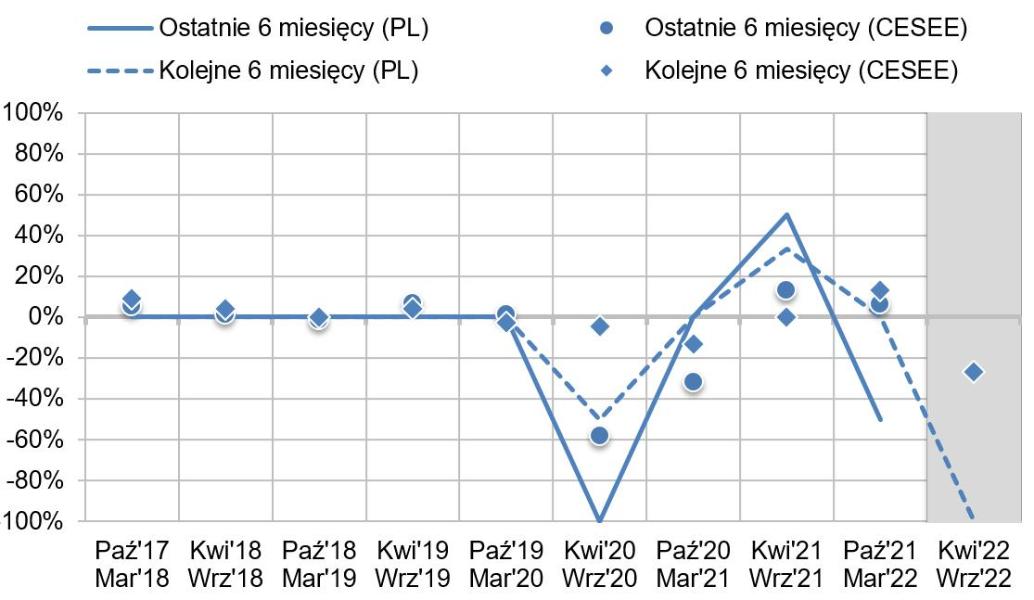

Changes in supply

After a period of recovery in the second half of 2021, loan supply conditions in Poland have significantly deteriorated in the last six months and are below banks’ expectations of autumn 2021 and below supply in the remaining part of the region. Polish banks expect a further decrease in the supply of loans in the coming months.

Source: EIB — CESEE Bank Lending Survey

Note: The chart shows net percentages, with positive figures indicating the decreased supply. The series of two forecasts (dashed line and diamonds) is shifted forward so that they could be comparable to the lines showing present opinions. In other words, the expectations reported at time t for the next six months are presented in the chart at time t + 1.

Supply segments

The supply of loans declined in all segments, while in Central, Eastern and South-Eastern Europe the average remained stable. Banks expect a deterioration in loan supply conditions over the next six months. In all segments, a stronger decrease than in the rest of the region is forecast, particularly in the corporate segments and long-term loans.

Supply of loans: conditions for acceptance of loan applications by banks

Loan acceptance ratios remained stable or decreased in all segments, while other regional markets improved slightly. Banks predict a sharp decrease in loan acceptance over the next six months, while in other countries they are to remain stable (despite the deteriorated loan supply conditions signalled by banks in the region).

Factors influencing supply conditions

According to Polish banks, the tightening of supply conditions was influenced, in particular, by capital restrictions of local banks, the situation in the domestic market and EU regulations. In the next six months, Polish banks expect conditions to tighten due to domestic factors and, above all, the absence of changes in international factors.

Non-performing loan ratios

The quality of loans has improved and non-performing loan ratios have decreased in all banks in Poland in the last six months. This improvement was stronger in the retail segment than in the corporate segment and was above the regional average.

However, it is expected that the quality of loans will not continue over the next six months, which will have an impact on both corporate clients and the retail segment.

Access to financing

Total access of Polish banks to financing has improved in the last six months. Better financing conditions were recorded in the intra-group financing, international financial institutions (MFIs), retail and corporate segments. Over the next six months, it is expected that the financing conditions will remain at the same level, supported by the still positive financing of retail and corporate deposits.

General information

The European Investment Bank finances projects in four priority areas — infrastructure, innovation, climate and environment, and small and medium-sized enterprises (SMEs).

In 2021, the EIB Group allocated €6.5 billion to financing projects in Poland.