- Digitalisation gap between the United States and European Union remains, although eight EU countries now outperform the United States

- During the COVID-19 crisis in 2020, many EU firms were not implementing any digital technology and had no plans to invest in their digital transformation

- In particular, Europe’s smaller companies slowed down their digital adoption

By 2020, 37% of European firms had still not adopted any advanced digital technology, compared with 27% in the United States. The slow adaptation of digital technologies threatens to impede European firms’ competitiveness in the long term, as digital firms tend to perform better than non-digital firms do. They invest more, are more innovative, have better management practices, grow faster and create higher-paying jobs. Digital firms are also more likely to invest in tackling the transition and physical risks of climate change. While EU firms are overall lagging behind US peers in adopting and creating new digital technologies, Europe excels in one area — the intersection of green/digital technologies.

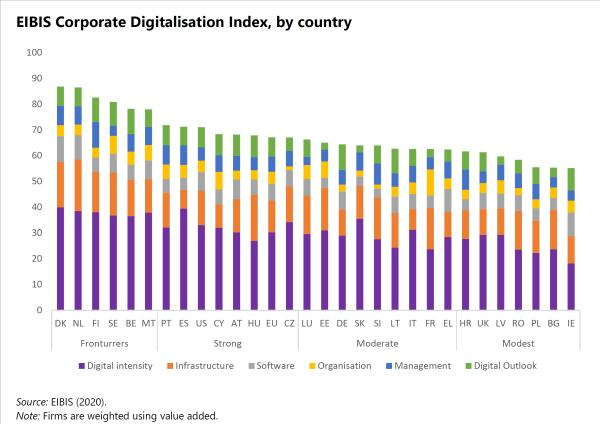

These are the key findings of the new edition of the EIB’s “Digitalisation in Europe 2020-2021: Evidence from the EIB Investment Survey” report. The new report includes the EIB Corporate Digitalisation Index, a cross-country ranking of digital adoption efforts in EU countries and the United States.

Read the summary of the report

Read the full report

“The pandemic has shown us the advantages of being digital. That is why we need to be concerned about the slow speed of digitalisation by EU firms. The gap with the US not only jeopardises our long-term competitiveness. A weak European digital sector also means that we will lack ownership of our data,” said EIB Vice-President Ricardo Mourinho Félix. “Increasing digitalisation should therefore be a cornerstone of the recovery. With the EIB, EU policymakers have an efficient instrument at hand to support digitalisation on all levels: from investment in high-speed digital infrastructure to support for startups and financing for small and medium-sized companies or corporates. We stand ready to do more.”

“To accelerate the pace of digitalisation, we should focus on three elements: an enabling ecosystem, including the availability of digital skills, the right kind of financial support for investment and a European vision to counter the digital imbalances that exist across the European Union. Europe needs to make it a priority,” said EIB Chief Economist Debora Revoltella. “In addition to more diversified financial instruments, we need to continue working on a well-functioning, competitive and integrated EU market environment that pushes firms to invest more in the most advanced digital technologies. We also need to review regulations that prevent firms from growing and reaching the size needed for the successful adoption of digital technologies within their businesses.”

The EIB Corporate Digitalisation index: Digital adoption in the European Union and the United States

The EIB Corporate Digitalisation Index makes it possible to group countries according to firms’ assessment of digitalisation. The index shows that, on average, the European Union fell short of the United States during the first COVID-19 lockdowns in 2020. However, there were several EU countries that outperformed the United States: Spain, Portugal, Belgium, Sweden, Finland, the Netherlands and Denmark.

Overall, the share of digital firms in the European Union and the United States has increased compared to the results of last year’s index. In 2020, only 63% of EU firms had implemented at least one digital technology, compared to 73% in the United States. However, the European Union is not closing its digital gap with the United States. European firms implement internet of things technologies less often and are lagging behind in the construction sector in particular. What is more, EU firms tend to perceive digital infrastructure as a major obstacle to investment more often.

Small businesses, the backbone of Europe’s economy, are holding back digital adoption overall

The European Union’s digital gap with the United States is particularly severe for smaller firms with fewer than 50 employees. In the European Union, 60% of micro firms (five to nine employees) have not implemented any digital technologies, while 75% of large firms (with more than 250 employees) are already digital. The relationship between firm size and digital adoption rates can be observed in all sectors.

A key factor contributing to the slow adoption of digitalisation by small firms is a lack of the right set of skills to embrace these new technologies. Although a lack of access to finance is not a major impediment to investment in the European Union, it can be a barrier to the adoption of digital technologies for small firms.

Microenterprises and small and medium-sized companies are the backbone of the European economy and represent 99% of all businesses and more than two-thirds of employment in the European Union, compared with slightly more than 40% of employment in the United States. As such, the difference in the number of small firms contributes to the digitalisation gap between the two economies.

Digitalisation does not have to be a threat

The EIB report shows that digital firms tend to be more productive and are more likely to export their products and services. Large digital firms in particular are more productive than non-digital firms. They also tend to export more of their goods and services.

Moreover, the study finds that digital firms grow faster. They are more likely to have hired new employees over the past three years; while a large share of non-digital firms (especially small firms) are stagnating, both in the European Union and the United States.

The report also finds that digital firms can support the adaptation of new skills. In particular, firms that adopt new digital technologies tend to be more profitable and are in a better position to invest in human capital. Similarly, investment in digital skills — and an environment that is conducive to learning about them — is more likely to come from digital companies than those not investing in digital transformation.

Digital technologies foster the green transition

While the United States clearly has a higher share of digital firms than the European Union, Europe is a leader for firms that are investing to address transition and physical risks of climate change or embracing the combination of investment in climate and digital.

The European Union excels compared to the United States for the share of firms that are investing in both climate and digital (32%, compared to 28%). The share of firms that are only investing in climate (but not digital) in the European Union is also nearly three times higher than in the United States (14% compared to 5%).

Overcoming the barriers to digital transformation

Investments in digital infrastructure will be key to reducing the digital divide. Digital infrastructure played a critical role during the COVID-19 pandemic. 16% of EU firms consider the available digital infrastructure as a major impediment to digitalisation (compared to only 5% in the United States) but this assessment varies significantly across EU Member States.

A further recommendation of the study is to support an enabling environment to create new leaders in digital sectors while ensuring Europe’s digital environmental innovators keep their lead. This will help push the technological frontier, in particular for the application of digital technologies that support investments to tackle the impact of weather events, reduce carbon emissions and foster the green transition. Supporting young firms requires improvements to competition, environmental and data regulations, and the rapid implementation of the digital single market in the European Union.

Read all recommendations and the full report here

Background information

About the Economics Department of the EIB

The EIB Economics Department provides economic research and studies, as well as unique analysis of investment activities in the EU and beyond, and supports the Bank in its operations and in the definition of its positioning, strategy and policy. Chief Economist Debora Revoltella heads the Department, a team of 40 economists.

About the EIB Investment Survey (EIBIS)

The EIB Group Survey on Investment and Investment Finance is a unique, annual survey of some 13 500 firms. It comprises firms in all EU Member States, as well as a sample of US firms which serves as a benchmark. It collects data on firm characteristics and performance, past investment activities and future plans, sources of finance, financing issues and other challenges that businesses face. Using a stratified sampling methodology, EIBIS is representative across all Member States of the European Union and for the United States, as well as for firm size classes (micro to large) and four main sectors. It is designed to build a panel of observations to support time series analysis, observations that can also be linked to firm balance sheet and profit and loss data. EIBIS has been developed and is managed by the Economics Department of the EIB, with support for development and implementation by Ipsos MORI.

For more information see: http://www.eib.org/eibis.