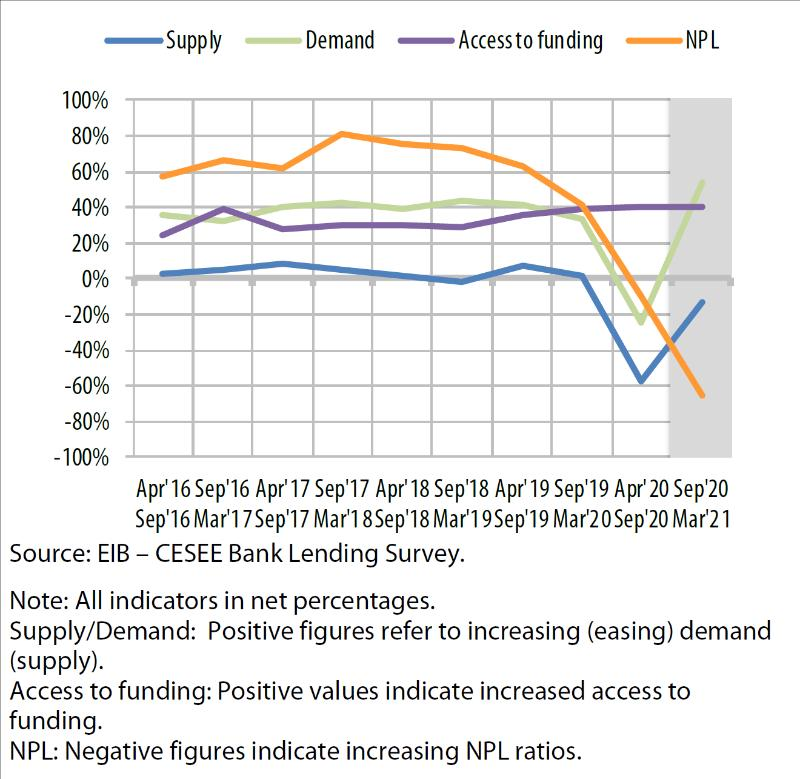

- Following the COVID-19 economic shock, demand for loans decreased and credit standards tightened in the region between March and September 2020.

- Non-performing loans have started increasing for the first time since 2015, but less than anticipated in spring 2020.

- However, international banking groups are showing substantial commitment to the region with strategies tilted towards expansion or stability.

Today the EIB published the autumn edition of the EIB CESEE Bank Lending Survey. It provides insights into banking group activities and business expectations in Central, Eastern and South-eastern Europe (CESEE). The report analyses portfolios, demand and supply for financing and the development of non-performing loans.

Read the full report here.

Development of supply, demand, access to funding and non-performing loans in the CESEE region

The survey results show that international banking group strategies and commitment to the CESEE region are tilted towards expansion or stability. Nonetheless, COVID-19 has brought about a deceleration in activities to increase capital. CESEE subsidiaries and local banks further report a decrease in demand for credit and have tightened credit standards over the past six months.

The surveyed banks indicate that demand for financing contracted for the first time in the past five years. Investment in particular is decreasing while working capital needs continue to contribute to the demand for financing.

Non-performing loan ratios deteriorated, although less than anticipated in the spring 2020 edition of the survey. This trend is expected to continue over the next six months and is affecting credit standards. Banking groups and national banks report tightened credit standards across the board, including for lending to small and medium-sized companies. Collateral requirements in particular tightened significantly.

“COVID-19 has led to an unprecedented shock for our economies. Regulatory and policy measures have played a significant role in keeping the economy afloat. In particular, public guarantee schemes have been very effective in maintaining lending activity by banks in the CESEE region” said EIB Vice-President Ricardo Mourinho Félix, responsible for economic studies. “The EIB Group will continue to support the region through the pan-European Guarantee Fund and our regular investment and advisory activities, not only to alleviate the hardship endured but also to reignite the investment needed to make the region’s economies greener, more digital, more competitive and more inclusive”, he added.

“Despite the relentless pandemic, the financial systems in the CESEE region are still coping. International banks are showing their commitment to the region. The decline in demand for investment financing is worrying in light of the twin green and digital challenge that economies in the region are facing. To reignite investment and in order to tackle the green and digital transformation to remain competitive in the long term, public support and coordination will be key,” added EIB Chief Economist Debora Revoltella.

The CESEE Bank Lending Survey is part of regular reporting from the EIB, International Monetary Fund (IMF), European Bank for Reconstruction and Development (EBRD) and World Bank for the European Bank Coordination “Vienna Initiative”, a framework for safeguarding the financial stability of emerging Europe. The survey for the new edition of the report was conducted as the COVID-19 pandemic unfolded. Previous editions are accessible here.

Background information

About the EIB Economics Departmnt

The EIB Economics Department provides economic research aend studies, as well as unique analysis of investment activities in the European Union and beyond, and supports the Bank in its operations and in the definition of its positioning, strategy and policy. Chief Economist Debora Revoltella heads the Department, a team of 40 economists.

About the EIB CESEE Bank Lending Survey

The EIB CESEE Bank Lending Survey is a unique, bi-annual survey of some 90 local banks, banking groups and financial institutions in Central, Eastern and South-eastern Europe. The latest edition of the survey was conducted in September 2020 and collects information about the period from March to September 2020 as well as expectations for the period from October 2020 to March 2021. The survey collects information on credit standards, credit terms and conditions, approval rates and the various factors that may be responsible for changes, including domestic and international elements. Demand for loans is also investigated in terms of loan applications as well as their quality. The survey also includes specific questions on credit quality and the funding conditions for banks. It is designed to build a panel of observations to support time series analysis, observations that can provide an almost real-time assessment of the health of the banking sector in the CESEE region. The CESEE Bank Lending Survey was developed and is managed by the EIB Economics Department, and is part of a series of reports by the EBRD, IMF and World Bank for the Vienna Initiative.