15 years ago, the European Investment Bank issued the world’s first green bond. Today, the green, social and sustainability bond market is worth over €2.2 trillion but the bonds are worth more than that because they are the key to true sustainable finance.

When Aldo Romani and his team started integrating sustainability into the funding programme of the European Investment Bank in 2007, they spotted an opportunity. On the one hand, investors were looking for new ways to know that they were buying something truly green. On the other hand, the Bank wanted to create a meaningful financing tool to direct investments into projects that made a substantial green contribution.

Romani came up with a new type of bond combining the two — the green bond. “The idea behind it was simple,” Romani explains. “You allocate the amount you collect to projects that have a positive impact on the fight against climate change, and at the same time, you allow investors to monitor what you do.”

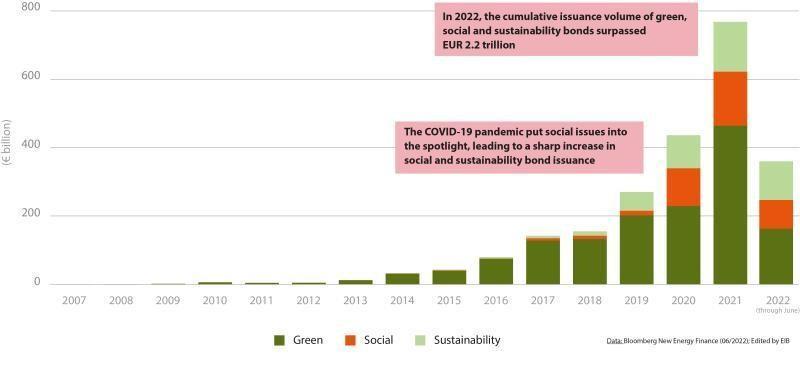

Since their debut in 2007, these bonds — meanwhile complemented by social and sustainability bonds — have become increasingly popular worldwide, with a market worth more than €2.2 trillion today. The European Investment Bank is the largest multilateral development bank issuer of green, social and sustainability (GSS) bonds, with over €50 billion in Climate Awareness Bonds (CAB) and around €9 billion in Sustainability Awareness Bonds (SAB).

As the EU climate bank, the European investment Bank issued a €4 billion 10-year Climate Awareness benchmark note in May, to highlight the bonds’ 15th anniversary.

The quest for true sustainable finance

If we are to boost support for projects that truly fight climate change, protect the environment and safeguard social sustainability, we need to develop a common language for sustainable finance. This is one of the biggest obstacles to reaching a generalised approach, and it is why the development of green bonds was such a significant step.

The success of the green, social and sustainability bond market has meanwhile shown that it is possible to systematically measure the impact of the economy on sustainability in a way that the capital market can understand and use.

With its inaugural Climate Awareness Bond in 2007, the European Investment Bank promised to allocate the funds exclusively to eligible renewable energy and energy efficiency projects, with higher transparency on investment flows — not only approved loans — and ongoing monitoring of the funds’ expected impact over time. This is important, since many factors, including market conditions, may constrain the actual flow of funds and as projects are implemented, the initial impact assumptions may change.

Climate Awareness Bonds showed that it was possible to report on actual investments by sustainability objectives, rather than merely by sector, as had been the prevailing practice. In 2018, the European Investment Bank created Sustainability Awareness Bonds to extend the same approach to other areas of environmental and social sustainability, such as water, health (including COVID-19-related projects), education, housing and forestry.

Green bond potential

Driven by investor demand for sustainable investment and clarity, the GSS bond market has grown to more than €2.2 trillion in the past 15 years, over two thirds of which developed in the past five years. Between 2018 and 2022, for example, the European Investment Bank’s use of these bonds rose from 7% of its total funding to 30%.

Green, social and sustainability bonds are about more than just funding, their power lies in their ability to shed light on sustainability projects and their actual implementation on the ground. An evaluation report has shown that these bonds kick-start a process of reliable verification that improves the quality of the entire funding and financing process from A to Z. They can also help increase international comparability between markets and highlight different approaches, further facilitating cross-border capital flows by reducing uncertainty for market participants.

“We are currently witnessing a Copernican Revolution in the policy of sustainable finance, where legislators are developing a common language across different financial products and national jurisdictions that permits capital markets to act more efficiently and thereby improve the effectiveness of sustainable investment,” Romani says. “GSS bonds are not intended anymore as just a financial product, but as an expression of a structural development that gives finance the opportunity to work for the public good.”

The way forward

We are still some way off from a clear and universally accepted definition of what counts as sustainable, but the European Union is leading the way with its own common language for sustainable finance, creating a key reference for the global market.

By adopting the EU Sustainability Taxonomy Regulation in 2020, the European Union established the principle that it was possible to measure how economic activities contributed to sustainability objectives more reliably and comparably. Most importantly, it also formalised the logic for a shared definition of core aspects of sustainability, so that a consistent set of standards can be developed for the use of proceeds across different sustainable financial instruments (for example, green loans and green bonds).

Green, social and sustainability bonds like Climate Awareness Bonds and Sustainability Awareness Bonds enable sustainable investors to track the flow of their funds across the investment chain, binding finance with the real economy. With the help of the taxonomies under development, they are the most advanced effort to facilitate sustainable investment. By clarifying what contributes substantially to sustainability, they also help to drive the classification of economic areas that do not produce a substantial contribution. This additional classification — recently advocated in a report of the EU Platform on Sustainable Finance — is required to determine which of these areas do no significant harm to the environment or can, with appropriate investments, reduce such harm to acceptable levels.

As set out in its 2021 Climate Bank Roadmap, the European Investment Bank will contribute to this process by tracking its green finance in line with the framework established by the EU Taxonomy Regulation. This will bring greater clarity and transparency to its stakeholders, spearheading the application of EU legislation on sustainable finance.

With its 15 years of experience in the green, social and sustainability bond market and its direct participation in the International Platform on Sustainable Finance, the European Investment Bank is making the EU Taxonomy Regulation operational for both funding and lending, developing sustainable finance beyond labels and making it a meaningful instrument at the service of society.