While the COVID-19 emergency has overshadowed other policy goals in the short term, climate change will continue to remain at the top of the EU political agenda for many years to come. Energy efficiency (EE) is a key pillar of the EU’s long-term strategic vision for a prosperous, modern, competitive and climate-neutral economy.

In this context, a better understanding of firms’ investment decisions in energy-efficiency measures and their key determinants is important, to properly design policy actions and keep momentum for climate action.

Going Green – Who invests in energy efficiency, and why it matters, a new report by the EIB, provides a brief overview of firms’ investments in energy efficiency measures and the role of various factors in their decisions, based on the EIB Investment Survey (EIBIS).

This report analyses and discusses the answers given by firms concerning their spending on energy-efficiency measures, the quality of their building stock, and the role of various factors in their energy efficiency investment decisions. These answers are compared across countries, sectors and firms size to identify areas for potential improvement and target setting.

Who is investing in energy efficiency?

EU firms give a low priority for energy efficiency investments

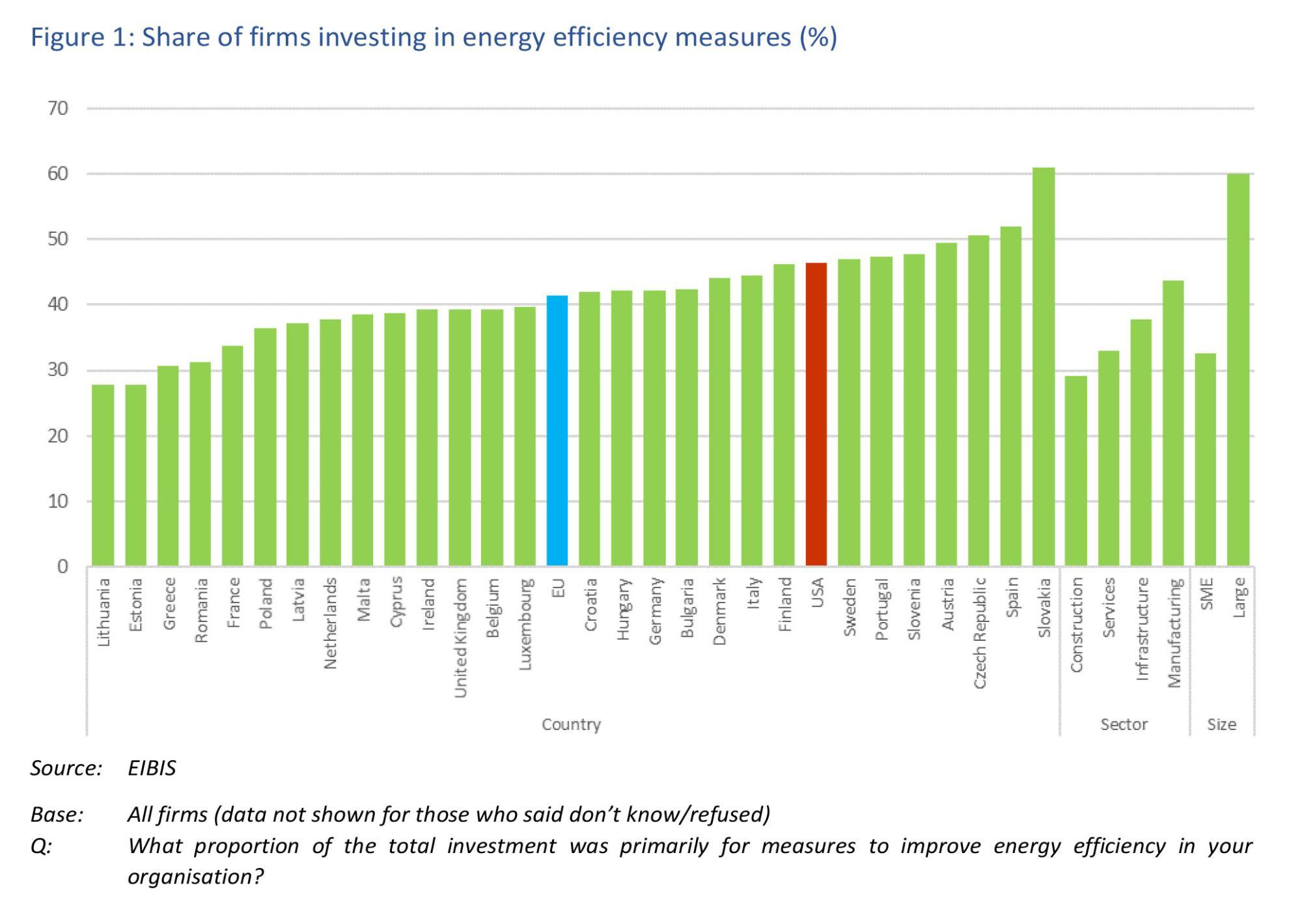

In 2019, more than 40% of EU firms carried out measures to improve energy efficiency, showing an increase over 2018 results. Slovakia displayed the highest percentage of firms investing in energy efficiency, with 61% of firms investing in those activities. Spain, the Czech Republic, Austria, Slovenia, Portugal and Sweden followed. These seven EU countries showed a greater share of firms investing in energy efficiency than in the United States, where 47% of firms invested in energy efficiency. By contrast, Lithuania, Estonia, Greece, Romania and France were at the other end of the spectrum, a ranking almost unchanged from the previous year.

The share of firms investing in energy efficiency appears to be positively associated with the energy intensity and size of firms. In particular, manufacturing, the most energy-intensive sector, presented the highest share of firms investing in energy efficiency (43% in 2019), followed by infrastructure (37%) and services (30%). The construction sector displayed the lowest share of firms investing in energy efficiency with 25%. Finally, large firms were twice as likely to invest in energy efficiency than SMEs.

The share of energy-efficiency improvements in total investments by firms is approximately the same on both sides of the Atlantic

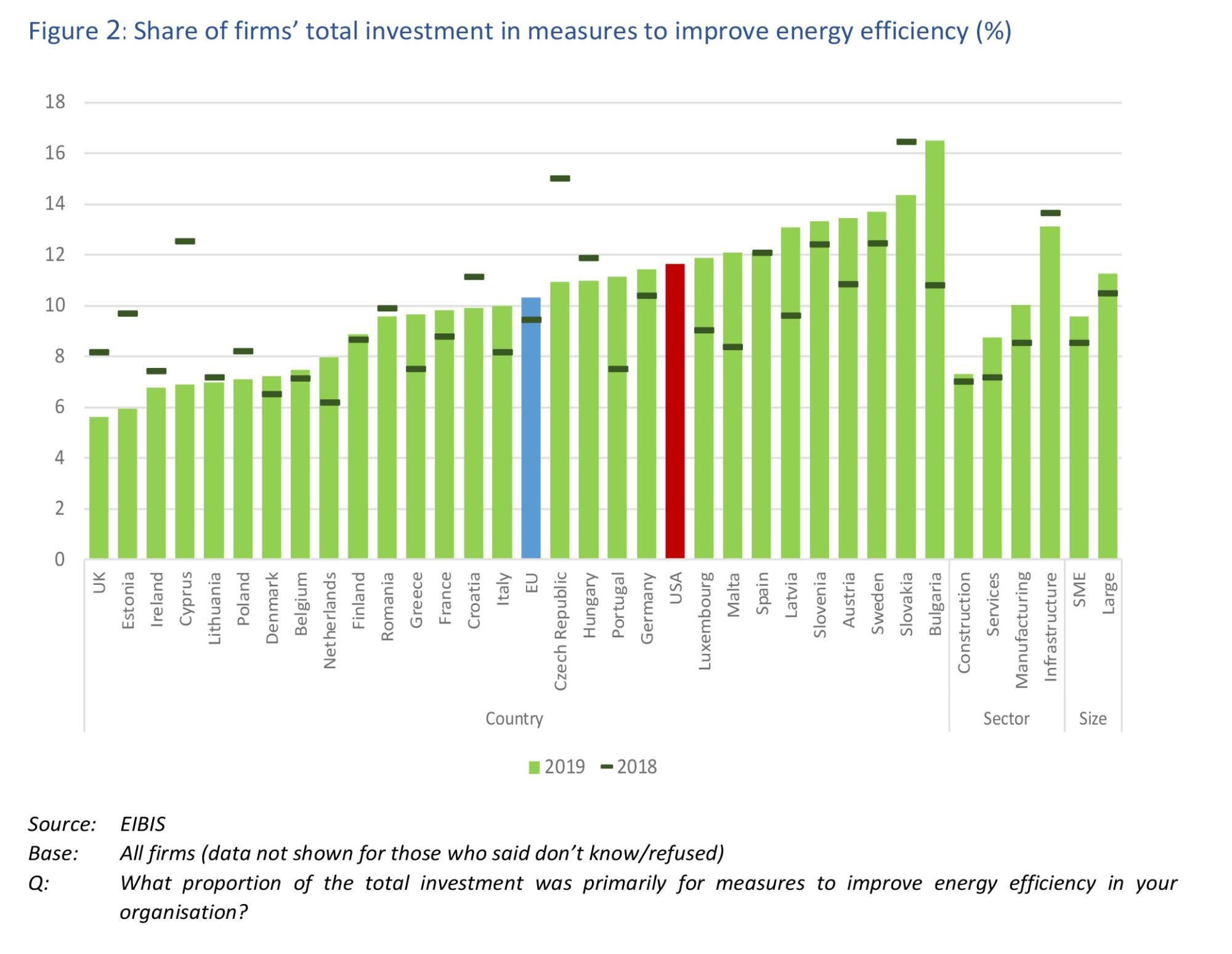

In 2019, European firms spent 10% of their total investment on energy efficiency improvements, whereas this proportion for the US firms was 12% (Figure 2). The good news is that both the share of EU firms that also invested in energy-efficiency measures, as well as their spending in such measures, increased between 2018 and 2019.

Spending on energy-efficiency improvements is higher in energy-intensive sectors and larger firms, in which energy is a significant cost determinant. In 2019, firms in the infrastructure and manufacturing sectors (which are relatively energy-intensive) spent 13% and 10%, respectively, of their total investment budget on measures to improve their energy savings. By contrast firms in the services sector and the construction sector spent less, 9% and 7.5% respectively, of their total investment budget. Similarly, the share of energy efficiency-related investment expenditure is higher for larger firms compared to smaller firms.

The share of firms’ total investment budget that goes to energy efficiency improvements varies widely across EU members. In 2019, firms in Bulgaria spent more on energy efficiency projects (16%) than firms in any other EU country and especially those in the United Kingdom, which invested only 5% of their investment budget. Firms’ spending in each country varied significantly between 2018 and 2019, possibly affected by the fact that energy efficiency investments are non-recurring investments. Generally, firms in some Southern and Eastern European countries spend relatively more on energy efficiency improvements than in other European regions, particularly the Baltics.

Why energy efficiency investment matters

Energy cost concerns are becoming an important determinant of EU firms’ investment decisions

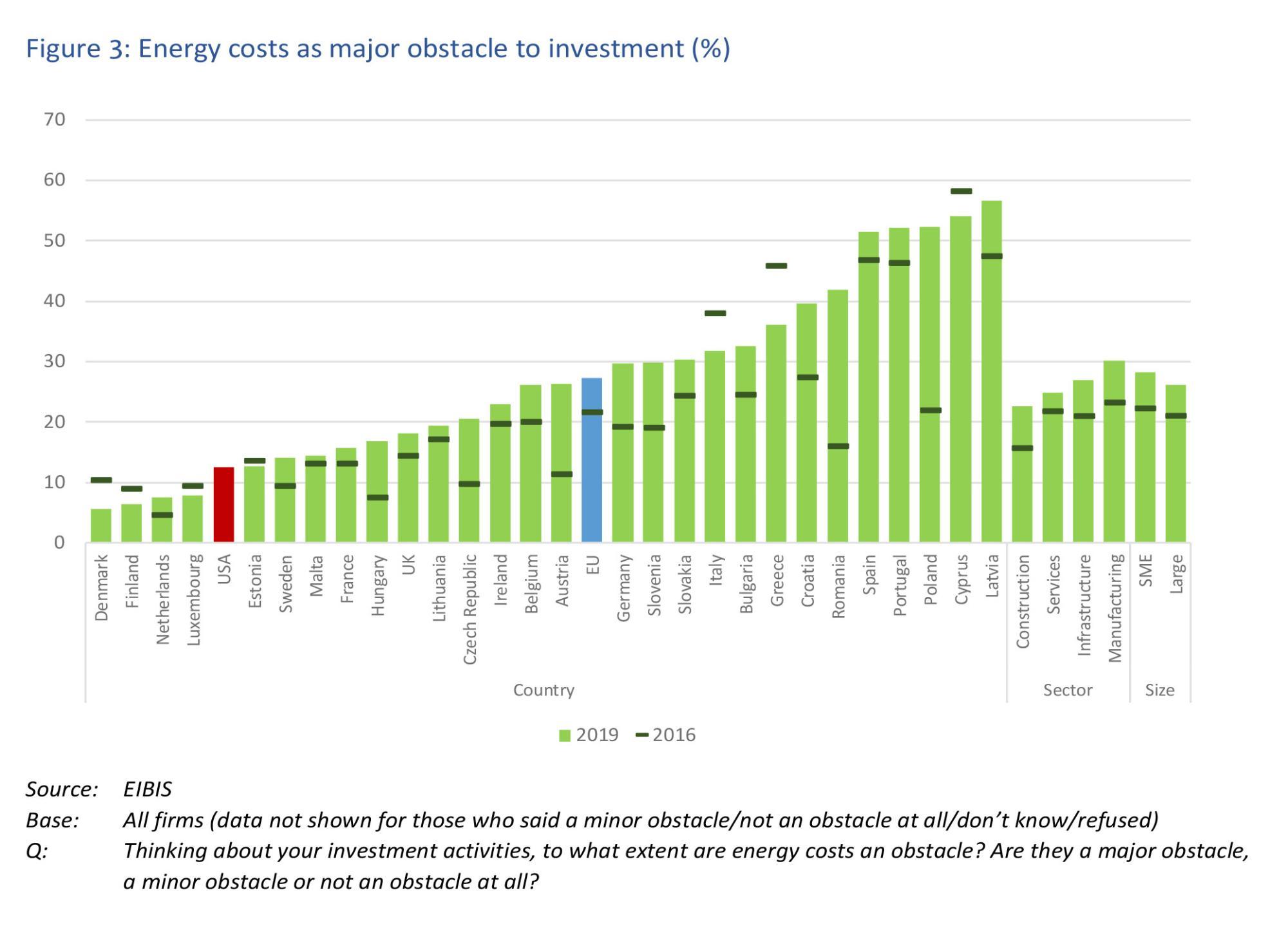

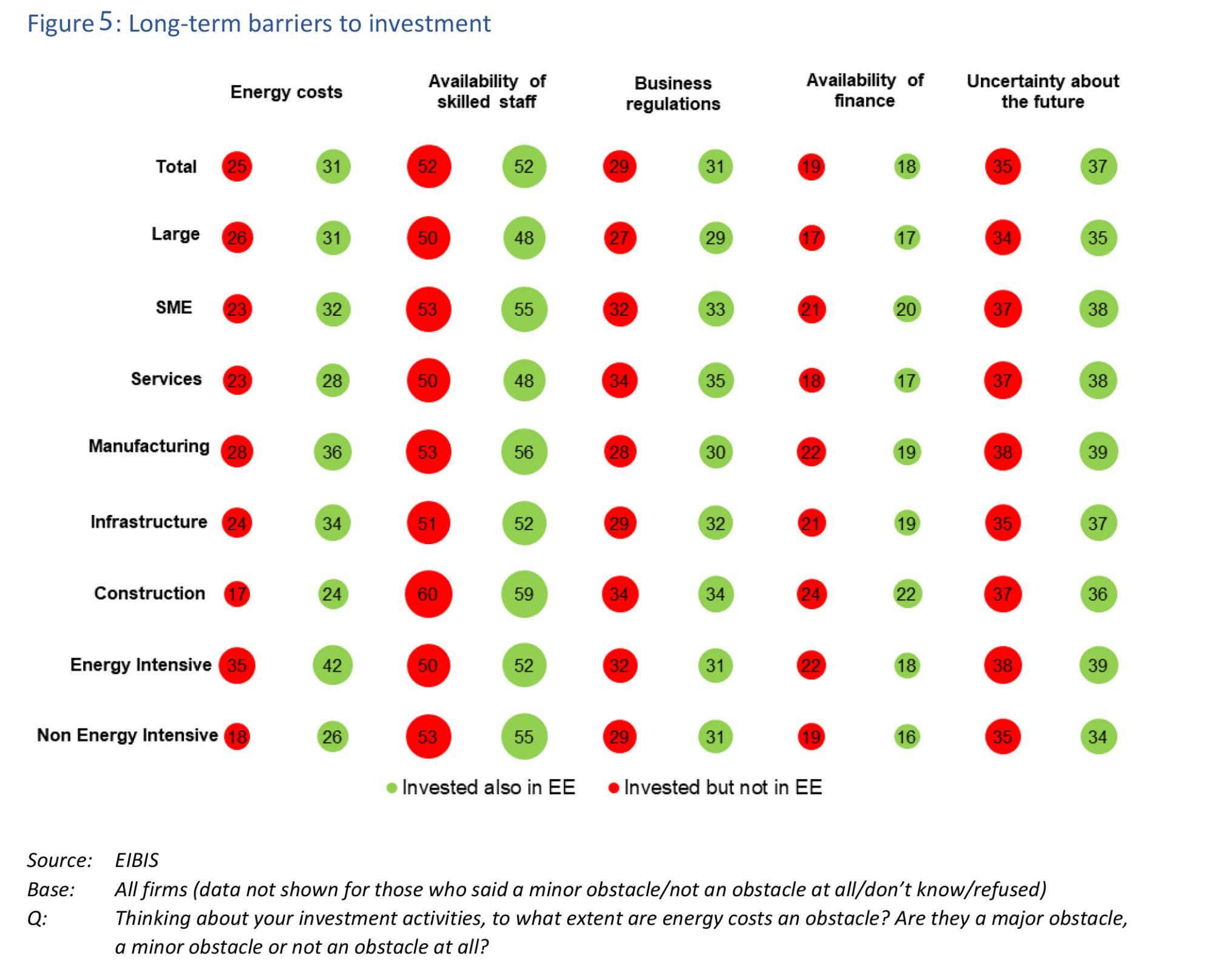

In 2019, almost a third of the European firms report energy costs as a major obstacle to investment compared to roughly a tenth in the United States. While this figure may not sound so high compared to other cited obstacles (Figure 5), such as availability of skilled staff, access to finance and critical infrastructure, it does reflect a significant change in firms’ perspectives, given that it grew steadily from roughly a fifth in 2016. In the United States, energy cost concerns seem to be less of an obstacle for investment activities, probably because shale gas causes downward pressure on domestic energy prices (Figure 3).

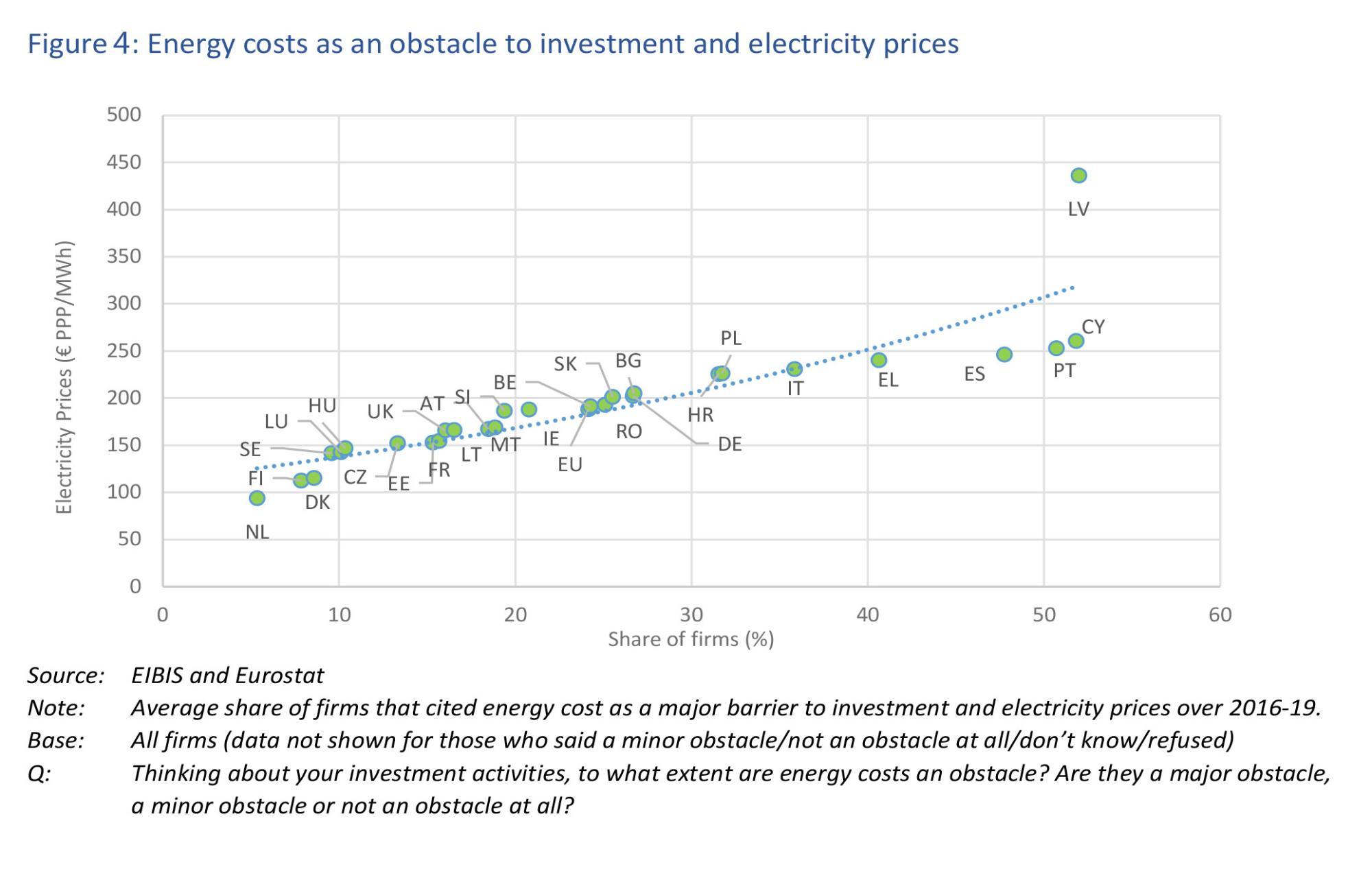

The role of energy cost in firms’ investment decisions differs considerably across EU members and sectors. In 2019, the share of firms that reported energy cost as a major obstacle to investment ranged from 6% in Denmark to 56% in Latvia. Geographically, this share is higher in southern countries (Italy, Greece, Spain, Portugal, Cyprus) compared to Scandinavian countries (Denmark, Finland, Sweden) and is positively correlated with the presence of higher electricity prices (Figure 4). Firms located in the south of Europe have experienced higher energy costs, despite the falling oil prices, due to higher taxes and levies aimed at supporting the deployment of renewables. Differences are also present across sectors, with firms in energy-intensive sectors, such as manufacturing, being more concerned about energy costs compared to less energy-intensive ones, such as services (Figure 3).

At the same time, higher energy cost concerns act as an economic incentive for investments into energy efficiency. Regardless of firm size and sector, investments in energy-saving technologies are higher where energy is considered an important cost factor (Figure 5). These firms tend to be more aware of the potential cost savings from investments in energy efficiency and are more inclined to invest in cost-saving technologies. On the contrary, there seems to be no significant difference between investment decisions in energy efficiency and other investment areas of other long term barriers, such as access to finance, availability of skilled staff, business regulation and uncertainty about the future.

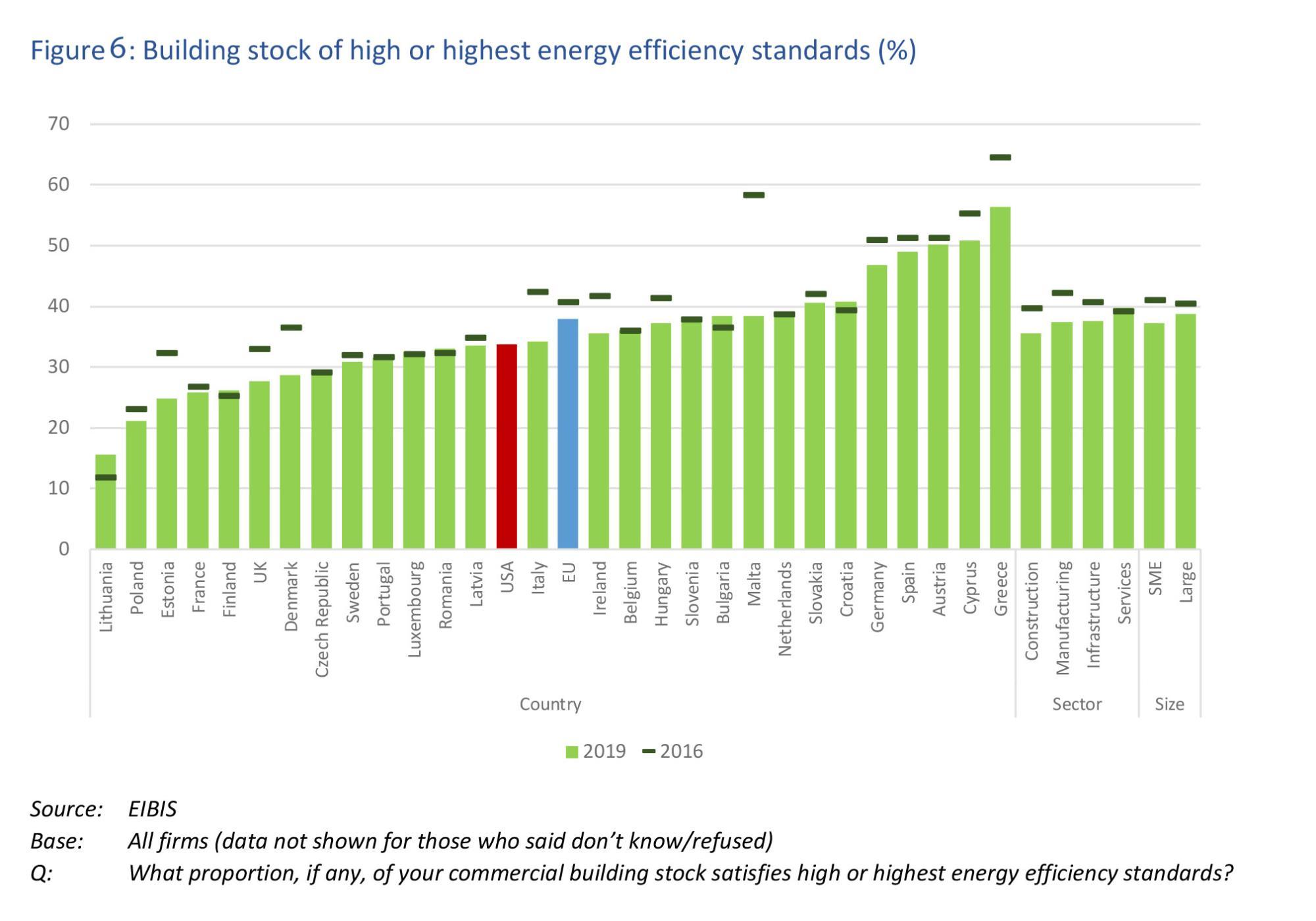

The untapped potential of energy savings is high, as EU firms consider their building stock of relatively low quality

In 2019, EU firms reported a third of their commercial building stock to be of high or highest energy efficiency standards, higher than in the United States (Figure 6). Still, since 2016, the firms’ perceptions of the quality of their building stock has deteriorated. This seems to suggest that most of Europe’s existing building stock may not yet meet recently-adopted energy performance requirements in the Energy Performance Directive and the Energy Efficiency Directive and that we are still to witness the improvement of the stock as it is brought up to the new standards.

The opinion of firms on the quality of their building stock varies considerably across countries and regions. Firms located in the south of Europe – notably in Greece, Cyprus and Spain – believe that more than 50% of their building stock satisfies high or highest energy efficiency standards, almost four times more than firms in Lithuania, which say that only 16% of their building stock is energy-efficient. Firms in the Baltics have the most pessimistic views about the quality of their building stock than any other EU region. Part of the cross-country differences could be explained by differences in culture, expectations, technical information and environmental objectives. These factors affect firms’ beliefs on building stock performance when assessing various aspects, such as thermal comfort, air quality, activity noise, light quality and environmental control.

Conclusions

The European Union’s “energy efficiency first” principle and ambitious greenhouse gas emission reduction targets leave no room for complacency

EIBIS shows that energy costs are emerging as a significant concern for investment activities of European firms, especially for those located in South Europe. This is less of an issue for US firms, thanks to domestic shale gas that exerts downward pressure on energy prices. To offset the effect of higher taxes and levies, and retain their competitiveness, EU firms must become more energy-efficient, meaning that they must use less energy per unit of production. Nevertheless, EIBIS data show that only half of EU firms invest in energy efficiency measures and that this accounts for only a small share of their total investment budget. Given that they believe that only a third of their building stock satisfies the highest energy efficiency standards, on average, there is clearly great potential for further energy efficiency savings.

The good news for Europe is that between 2018 and 2019 average spending on energy efficiency measures, as a share of total investment of EU firms, slightly increased. In 2019, firms in South and North-West Europe, and those in energy-intensive sectors across Europe, appear to have invested more, displaying significant variation from the previous year, as such investments are non-recurring. Most of these investments were probably driven by the age of the building stock, the importance of energy costs in the production of goods and services and the availability of information on technology options and their related energy cost savings. Energy audits play a crucial role in this, as they highlight opportunity from energy efficiency and from advanced management practices such as strategic business monitoring systems and pay-for-performance practices. However, EIBIS reveals that less than a third of SMEs have conducted an energy audit in the past three years, particularly in the Baltics – the region where firms have the most negative perceptions about their building stock’s quality.

However, the unprecedented impacts of the COVID-19 pandemic threaten positive developments for energy efficiency investments in the European Union. The COVID-19 pandemic and climate investments are closely interlinked: as the pandemic seriously affects economies and dampens global energy commodity and carbon prices, it weakens the incentives to invest, among others, in cost-saving technologies. The European Union is struggling to mitigate the extent of the planned recession and the rising unemployment rates. Governments are responding with monetary and fiscal measures. At a time when a large portion of the economy is looking to the public sector for support, this is an excellent opportunity to ensure that the relief for current, acute strains on the economy comes with guarantees about building a secure and sustainable energy future.

There is no room for complacency if Europe is serious about moving towards a carbonneutral economy, given that delayed actions will result in higher costs and emissions and overall lower or negative economic growth. To incentivise firms to play their part in energy conservation and equip them to adapt to a changing economy, efforts to provide clear energy policy signals should continue, along with a supportive regulatory framework and improved access to climate finance and information. Clear policies and exchange of best practices would enable firms to roll out strategies and investment plans in line with the commitment of the Paris Agreement. Regulations that push for higher energy building performance standards and phase out environmentally harmful subsidies to fossil fuels could indirectly influence investments and individual behaviour, as well as steer production and consumption towards a sustainable path. Last but not least, improved access to finance and favourable financing conditions for climate investments would help firms to achieve a just energy transformation, without affecting their competitiveness.