- Two-thirds of Germans see the climate and environment as the biggest challenges the country is facing, alongside rising living costs.

- 65% of Germans favour lower speed limits on motorways.

- 81% think that, if we do not drastically reduce our consumption of energy and goods in the coming years, we will be heading for a global catastrophe.

These are some of the results from the latest yearly Climate Survey conducted in August 2022 and published today by the European Investment Bank (EIB). The EIB is the lending arm of the European Union and the world’s largest multilateral lender for climate action projects.

After a challenging year in which Russia’s invasion of Ukraine sparked an ongoing energy crisis and accelerated inflation all over Europe, and a summer marked by record heatwaves and droughts, Germans have become even more acutely aware of the impact of climate change and the need for urgent action.

Climate change awareness and urgency

While COVID-19 was considered the number one challenge for German people last year, concerns over climate and environment now come first. Overall, 65% of Germans express concern regarding environmental problems, a notable 13 percentage points above the European average. This concern is matched by concerns over economic and financial issues such as the rising cost of living (64%; 28 percentage points more than the European average).

Nearly 8 out of 10 Germans (79%) feel that climate change is having an impact on their everyday lives (7 percentage points more than last year). This opinion is shared by all categories of the population.

81% think that, if we do not drastically reduce our consumption of energy and goods in the coming years, we will be heading for a global catastrophe. At the same time, 84% feel that the government is reacting too slowly, and only 27% think that Germany will succeed in substantially reducing its carbon emissions by 2030.

War in Ukraine and the green transition

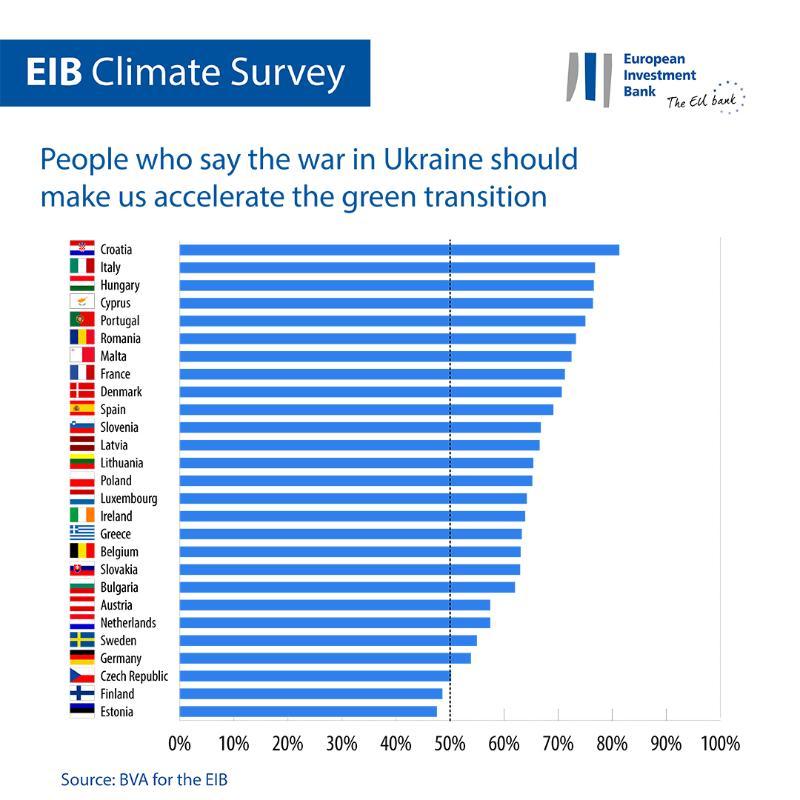

A majority of German people (54%, 12 percentage points below the European average of 66%) believe that the war in Ukraine and its consequences on oil and gas prices should accelerate the green transition. This opinion is more prevalent in younger groups (60% of Germans aged 15–29).

When asked to rank their energy priorities, Germans are more divided on what their country should prioritise, with 39% expecting their government to focus on energy supply diversification to avoid being overly reliant on a single provider, whereas 38% believe that the development of renewable energy should be prioritised instead.

Some energy-saving options do, however, rank high as a priority, with 65% of Germans favouring lower speed limits on motorways (4 percentage points higher than the European average of 61%).

Tackling climate change and addressing high energy prices

To further reduce energy consumption, Germans also prioritise heavily taxing highly polluting energy goods and services such as SUVs and air transport (62%). Yet they are more divided on the indexing of energy prices to the level of consumption per household (57%, 6 percentage points lower than the European average of 63%).

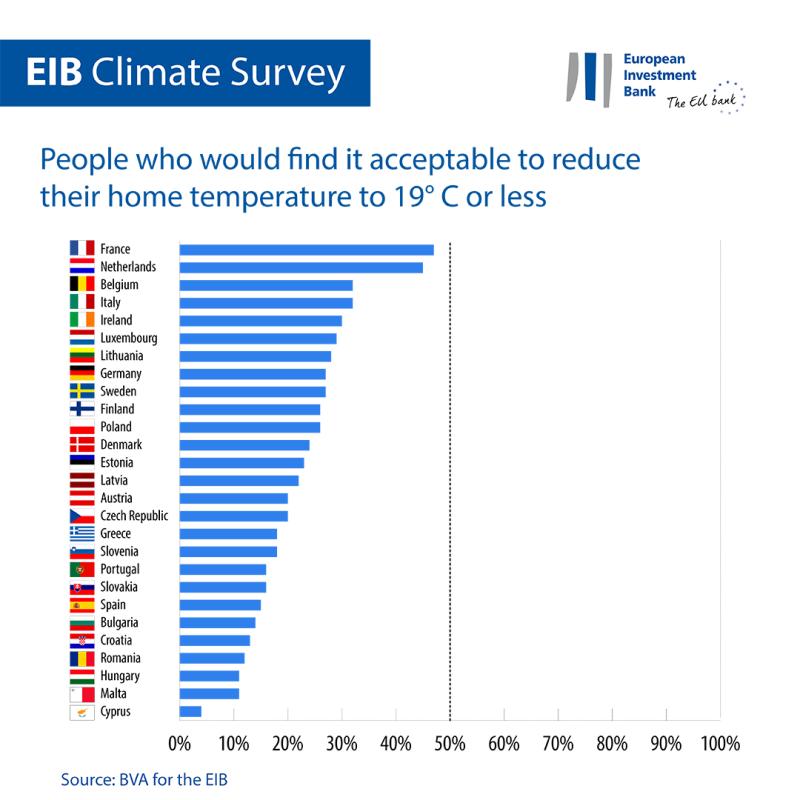

If Germans were to lower the temperature in their homes this winter, only 27% of them would accept capping it at 19° C (20 percentage points fewer than French people (47%). 45% would still heat their homes to 20° Celsius or more. Meanwhile, 23% of Germans say that they already cannot afford to heat their homes properly.

Finally, on addressing high energy prices, 42% of Germans think that in the short term the government should reduce energy-related taxes, whereas 30% of Germans would rather cap or regulate the prices of gas, oil and coal.

EIB Vice-President Ambroise Fayolle said: “Ahead of the COP27 climate conference, the results of the EIB 2022 Climate Survey show that Germans believe that accelerating renewable energy and energy-efficiency measures should be the priority in fighting the global energy and climate crisis. At the EIB we have been supporting clean energy investments for many years, for example by financing energy-efficient, affordable housing, or innovative charging and energy management systems for electric vehicles. We stand ready to use our full range of advisory and financial instruments to support Germany in a just green energy transition that leaves no one behind.”

Download the Excel spreadsheet with the raw data for all 30 countries surveyed here. Please click here to access an EIB web page presenting the key findings of the EIB Climate Survey IV.

Background information

About the EIB Climate Survey

The EIB has launched the fifth edition of the EIB Climate Survey, a thorough assessment of how people feel about climate change. Conducted in partnership with the market research firm BVA, the fifth edition of the EIB Climate Survey aims to inform the broader debate on attitudes and expectations in terms of climate action. More than 28 000 respondents participated in the survey in August 2022, with a representative panel of people aged 15 and above for each of the 30 countries polled.

About the European Investment Bank

The EIB is active in around 160 countries and is the world’s largest multilateral lender for climate action projects. The EIB Group has recently adopted its Climate Bank Roadmap to deliver on its ambitious agenda to support €1 trillion of climate action and environmental sustainability investments in the decade to 2030, and to dedicate more than 50% of EIB funding to climate action and environmental sustainability by 2025. As part of the roadmap, all new EIB Group operations have been aligned with the goals and principles of the Paris Agreement since the start of 2021.

About BVA

BVA is an opinion research and consulting firm recognised as one of the most innovative market research firms in its sector. Specialising in behavioural marketing, BVA combines data science and social science to make data inspiring and bring it to life. BVA is also a member of the Worldwide Independent Network of Market Research (WIN), a global network of some of the world’s leading market research and survey players, with over 40 members.