- A backlog of investment in advanced technologies, innovation and climate change challenges European global role

- Companies willing to invest but pessimistic about the political and regulatory outlook

- Additional EUR 140bn per year needed to achieve the EU target for R&D of 3% of GDP by 2020

A backlog of investment continues to weigh on Europe‘s economy: climate change mitigation investments remain depressed, while EU firms are still not putting enough resources into research and development, other intangibles, and even machinery and equipment, to stay globally competitive. The share of investment and other growth-enhancing expenditure in total government expenditures remains low, in particular in the periphery. However, overall investment, especially in the corporate sector and in buildings, is picking up and reaching historical averages in most EU countries. This encouraging trend needs to be amplified and extended to more innovative and cutting-edge sectors if Europe wants to turn the page of a decade of underinvestment and catch up with the United States and China.

These are the main findings of the EIB Investment Report 2018/2019, presented by the European Investment Bank (EIB) at its Annual Economic Conference in Luxembourg on November 28. The report incorporates the results of the annual EIB Investment Survey (EIBIS) of 12,500 businesses in the EU.

“Overall investment in Europe is doing partially well,” said EIB Vice-President Andrew McDowell. “However, there are investment gaps in sectors that are essential to address the challenges of today and the future. To remain globally competitive in the face of rapid innovation and digitalisation, achieve sustainability, and create an inclusive and cohesive society, we need to invest. Moreover, we need to invest smartly and boldly to learn new skills, to innovate and adopt new technologies, renew our infrastructure and cut dependence on fossil fuels. The EIB stands ready to help tackle these challenges.”

General Investment trends

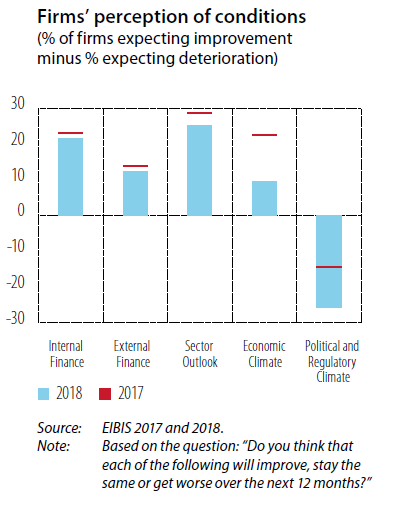

According to EIBIS data, firms are expecting to increase investment, on average, in nearly all EU countries. They remain optimistic about short-run financing and sectoral conditions, but are increasingly pessimistic about the political and regulatory climate. On balance, looking a year ahead, firms are significantly less optimistic than in 2017 about the overall economic climate, and marginally less optimistic overall.

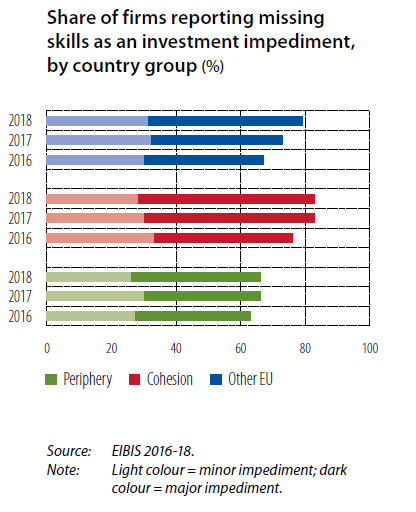

77% of EU firms consider lack of staff with the right skills to be a barrier to their investment activities. This share has increased by ten percentage points in the past three years. The problem of the shortage of a workforce with relevant skills may further worsen with the rise of the intangible economy that will be associated with more innovation and digitalisation. These trends will likely increase social polarisation as the demand for workers with high and low skills increases at the expense of those in the middle, threatening social cohesion. This calls for more coordinated policy action in terms of skills enhancement at the European level, with a clear win-win in economic and social cohesion terms.

EU risks losing ground on innovation

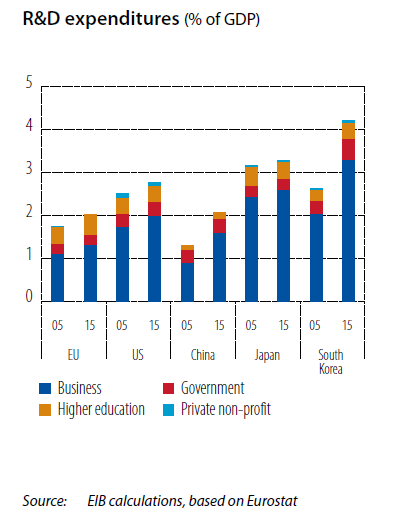

EU R&D investment remains stable at 2% of GDP, a level recently matched by China and below spending in the US at 2.8%. If the EU wants to achieve its target of R&D investment of 3% of GDP by 2020 it would need to invest an additional EUR 140bn per year.

Business R&D largely accounts for the difference, being 1.3% of GDP in the EU and 2% in the US. Meanwhile, EIB data shows that US firms devoted 48% of total investment to intangibles as a whole, compared to 36% in the EU. Only 8% of EU firms can be categorised as “leading innovators”, compared to 16% in the US.

According to EIBIS data, 42% of EU firms assess their investment in digital technologies as insufficient. Delays in digitalisation adoption have a cost. We estimate a 17% gap in productivity for non-digital firms versus digital ones. The overwhelming predominance of small firms in the EU aggravates the problem, as smaller firms are much less likely to invest in digital technologies: only 55% of firms with fewer than 50 employees invest in such technologies, compared to 72% among larger firms. The digital gap is most evident in the EU services sector, where 74% of firms have adopted some digital technology, whereas in the US the share is 83%.

The consequences of this gap may be stark. “Our analysis shows that there is path dependency in exploiting the benefits of digitalisation. This means that the most efficient and advanced digital companies are expected to not only preserve their market position, but to further consolidate it thanks to digital technologies”, said Debora Revoltella, EIB Director of Economics. This is also confirmed by the fact that digital giants in the service sector have benefited substantially from their first-mover advantage to become market leaders in their respective segments. “There is a cost of inaction, which we do not want Europe to pay”.

Investment in climate change mitigation stagnates

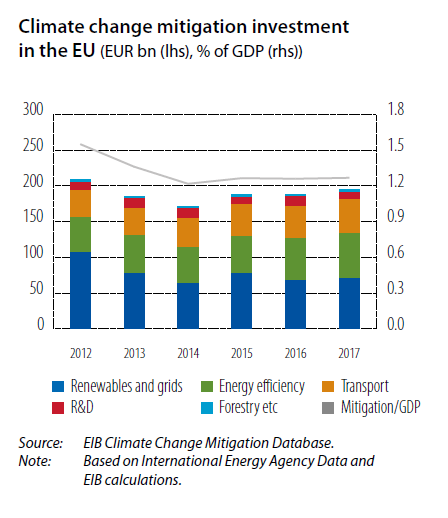

EU investment in climate-change mitigation (CCM) continues to stagnate at just under 1.3% of GDP, remaining stubbornly below the 1.5% of GDP achieved in 2012. While CCM investment in transport and in energy efficiency shows a gradual rising trend, it is investment in renewable energy and related grid infrastructure that has fallen. Investment in energy efficiency would need to increase fourfold to meet EU climate targets for 2030 and beyond.

Background information:

About the EIB Investment Report

The EIB Investment Report provides a comprehensive overview and analysis of investment and the financing of investment in the European Union. The 2018/2019 edition on “retooling Europe’s economy” examines many of the structural issues that will determine the continent’s future prosperity and sustainability: skills, innovation, digital technologies, critical infrastructure and climate change mitigation.

The Investment Report is produced by the EIB Economics Department, a team of 40 economists headed by Debora Revoltella, Director of Economics. The department’s mission is to provide economic analyses and studies to support the Bank in its operations and in the definition of its positioning, strategy and policy.

About the EIB

The European Investment Bank plays an important catalytic role in promoting sound investment projects in support of EU policy goals in Europe and beyond. In 2017, the EIB provided EUR 70bn in long-term finance to support private and public productive investment, with the EIF providing EUR 9.3bn. Together, as a first estimate, this helped realise investment projects worth roughly EUR 250bn.

The EIB is both a bank and a public institution. Owned by the 28 Member States of the EU, the EIB raises money from international capital markets and lends these funds for investment projects that address systemic market failures, targeting four priority areas in support of smart sustainable and growth and job creation: innovation and skills, SMEs, climate action and strategic infrastructure.

The EIB delivers sound operations at the highest standards. Projects must not only be bankable, but also comply with strict economic, technical, environmental and social standards in order to yield tangible results, improving lives. Alongside lending, the Bank’s blending activities can help leverage available resources, e.g. helping to transform EU funds into financial products such as loans, guarantees and equity. Advisory activities and technical assistance can help projects to get off the ground and maximise value-for-money.

The investments supported by the EIB Group have lasting impact on the EU economy. Working closely with the European Commission Joint Research Centre, the Bank’s economists have used the well-established RHOMOLO model to estimate the future macroeconomic impact of EIB-supported operations in the EU. By 2036, investments supported by the EIB Group in 2017 are expected to raise EU GDP by 0.7% over the baseline scenario, adding 650 000 jobs, through structural impacts on productivity and competitiveness.

http://www.eib.org/infocentre/publications/all/investment-report-2018.htm

http://www.eib.org/infocentre/publications/all/investment-report-2018-key-findings.htm