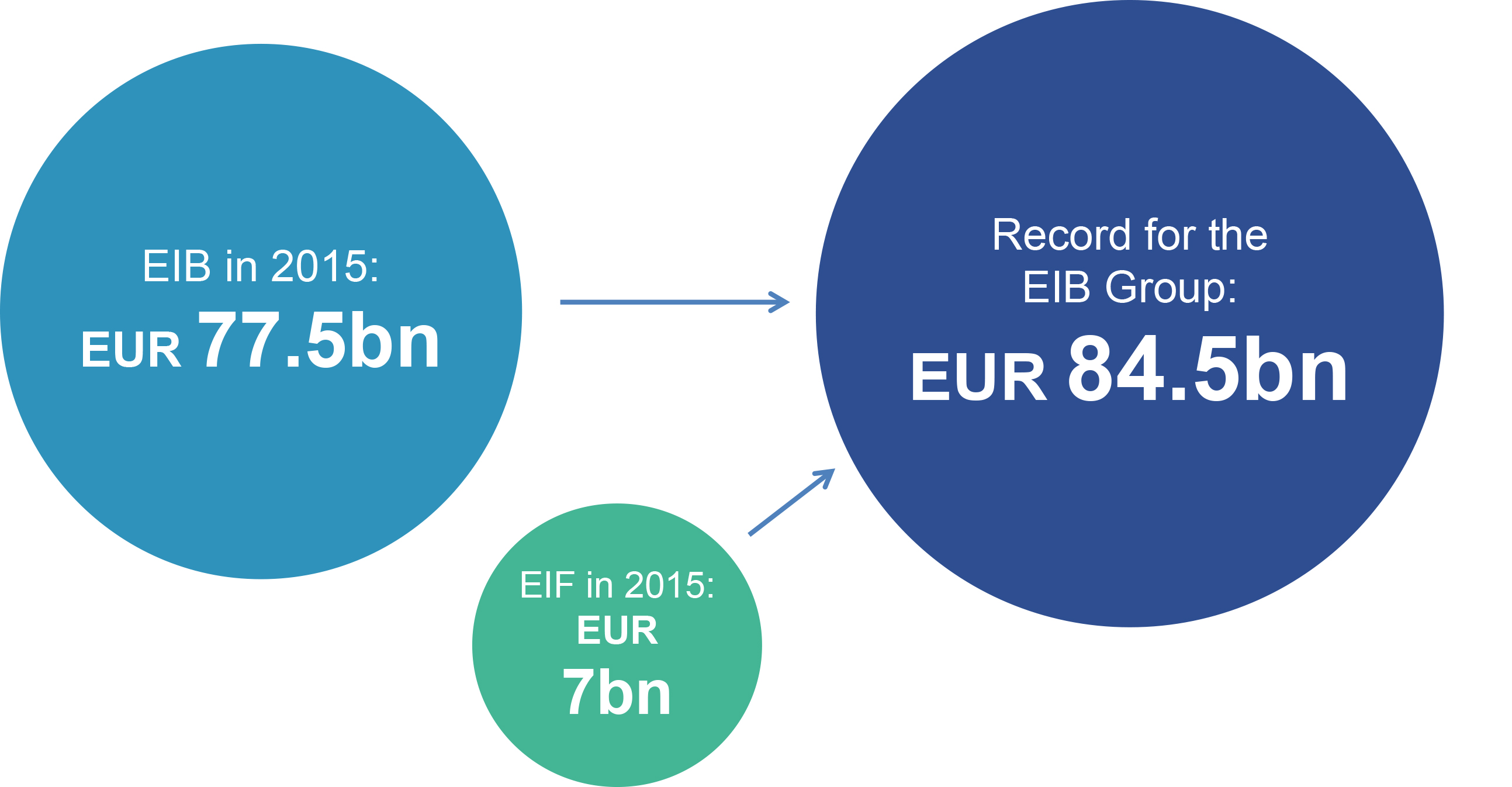

The European Investment Bank Group, the world’s largest multilateral financial institution, today announced record lending in 2015, totalling EUR 84.5 billion, that will support investment in crucial infrastructure and improve access to finance across Europe and around the world. This included record support for investment by SMEs and unprecedented lending for innovation and climate related projects by the EIB Group.

Figure 1: Summary of EIB Group lending in 2015

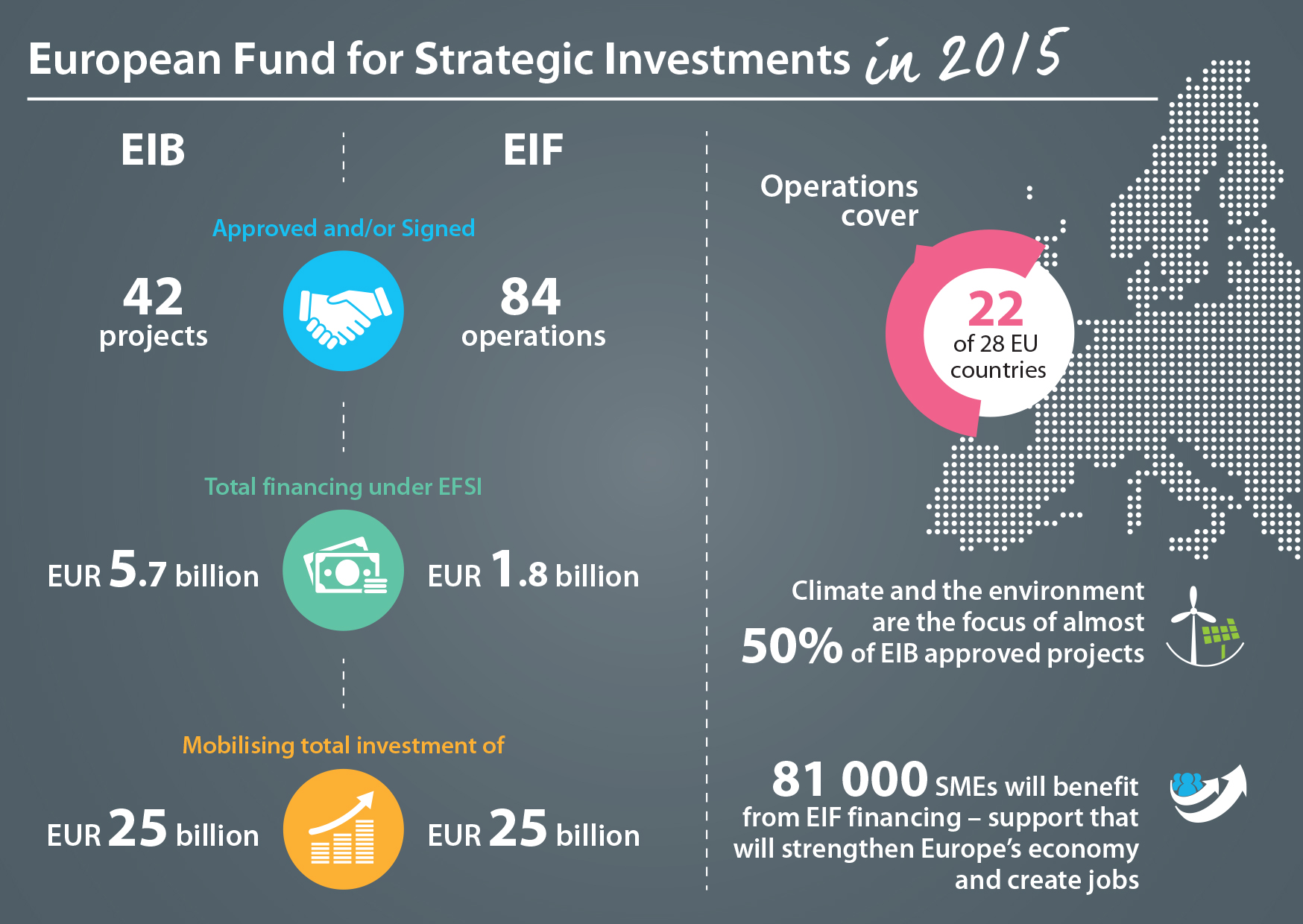

During 2015 the EIB Group – the European Investment Bank and the European Investment Fund – provided EUR 7.5 billion of new financing backed by the Investment Plan for Europe guarantee from the EU budget. This financing supported total investment worth more than EUR 50 billion, or approximately 16% of the final target of EUR 315 billion to be triggered by the Investment Plan for Europe over three years.

In September the EIB launched the European Investment Advisory Hub, another pillar of the Investment Plan for Europe. The Hub helps projects attract funding from all available sources. In 2015 the Hub managed requests for advice from across the EU.

Figure 2: European Fund for Strategic Investments in 2015

“Europe needs to invest in innovation, innovation and more innovation, and that has been the EIB Group’s focus. In addition to achieving its goals and targets ahead of time, the EIB Group also launched investments under the Investment Plan for Europe, even before the European Fund for Strategic Investments was set up. We moved quickly and have mobilised over 50 billion euros in new investments since April. We have also launched the European Investment Advisory Hub, the second pillar of the Plan. Now Europe also needs to make its regulation more investment-friendly, including by removing regulatory barriers and completing the internal market. This is the third element of the Investment Plan for Europe, and the Plan cannot succeed without it”, said Werner Hoyer, EIB Group President.

In 2015 the EIB Group agreed a record level of support for innovation investment, totalling EUR 18.7 billion of new lending for innovation.

Support by the EIB Group to improve access to finance by small and medium sized companies during 2015 included both EUR 29.2 billion of lending through local partner banks and the largest ever annual engagement by the European Investment Fund, the EIB Group's specialist provider of risk finance for SMEs across Europe.

The EIB provided almost EUR 19 billion for strategic infrastructure that backed construction of new and upgrading of existing hospitals, schools, universities, social housing, ports, roads and railways, as well as essential investment in water, energy and communications infrastructure. This included the first investment programmes to provide assistance to EU member states dealing with emergencies linked to the unprecedented arrival of refugees. The EIB is uniquely positioned to support investment improving conditions in the refugees’ countries of origin, of entry in the EU, of transit, and of destination.

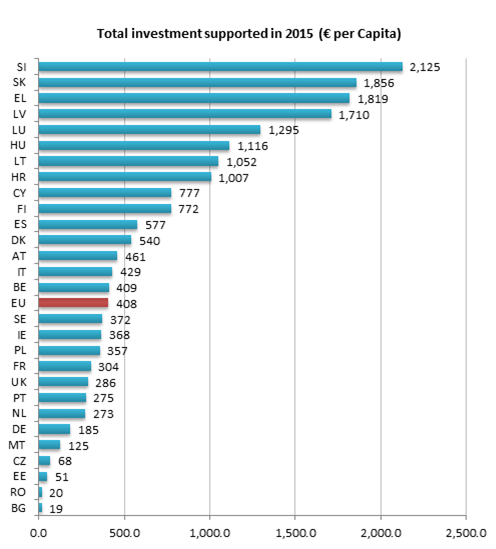

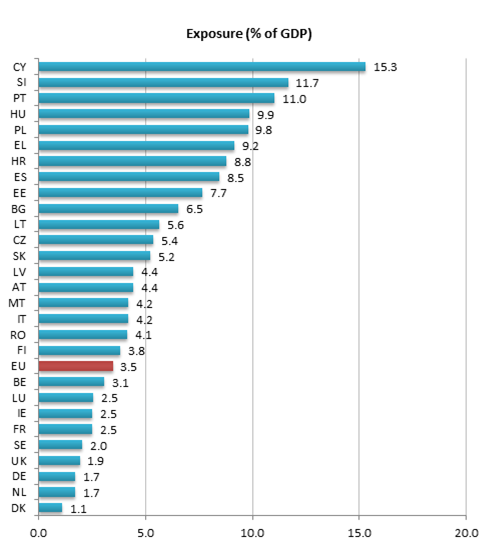

The EIB Group does not operate under any geographical quotas, but lending focuses on countries where targeted investment is most needed. Accordingly, the bank’s exposure in some of the most vulnerable EU countries such as Cyprus, Slovenia, Portugal, Hungary, Poland and Greece is over 9% of GDP, and in 2015 EIB lending represented more than EUR 1,700 per capita in Slovenia, Slovakia, Greece and Latvia.

Figure 3: Total investment supported by the EIB in 2015 per capita

Figure 4: Overview of EIB overall exposure as percentage of GDP

The EIB Group is the largest multilateral provider of climate finance in the world. Last year EIB climate related lending accounted for 26.5% of the Bank’s total financing, in excess of the EIB’s commitment to ensure at least 25% of its financing should go to climate action projects.

Climate-related lending came up to EUR 20.6 billion, including EUR 10.1 billion for climate-friendlier transport, EUR 3.4 billion for renewable energy, EUR 1.6 billion for climate related innovation, research and development, and nearly EUR 1 billion for adaptation to a changing climate.

2015 was also a record year for energy efficiency lending. The EIB provided EUR 3.6 billion for schemes to reduce heating bills and energy use in schools, hospitals, companies and social housing, in Europe and beyond. EIB lending for energy efficiency has more than tripled in the last four years.

“Climate change is the main global challenge of our time. Over the next five years we will provide almost EUR 100 billion for climate action across the world. Crucially we will work with other multilateral development banks to mobilise private capital for investments that make a difference to climate change and to the way we adapt. All our countries have committed to ambitious sustainable development goals, but public investment on its own will not suffice. We must all do more of what the EIB Group does best: leveraging and catalysing private investment for the good of our planet”, said Werner Hoyer, EIB Group President.

The EIB Group operates globally. In 2015 it provided EUR 7.8 billion of lending outside Europe. The EU Enlargement and EFTA countries represented the largest beneficiary region outside the EU, with loans totalling EUR 2.7 billion. The Eastern Neighbourhood received EUR 1.5 billion of EIB finance in 2015, the Mediterranean Countries EUR 1.4 billion, EUR 1.1 billion for Asia, Central Asia and Latin America and a further EUR 1.1 billion for the Africa, Caribbean and Pacific regions alongside the Republic of South Africa.

In March last year the EIB also completed EUR 180 billion of additional lending activity requested by Europe’s head of state and government for the 2013-2015 period and supported by a EUR 10 billion capital increase. The target was achieved nine-months ahead of schedule.

Video of the press conference:

Photographer: Isopix ©EIB

Download original

Photographer: Isopix ©EIB

Download original

Photographer: Isopix ©EIB

Download original

Photographer: Isopix ©EIB

Download original

Photographer: Isopix ©EIB

Download original

Photographer: Isopix ©EIB

Download original

Photographer: Isopix ©EIB

Download original

Photographer: Isopix ©EIB

Download original

Photographer: Isopix ©EIB

Download original

Photographer: Isopix ©EIB

Download original