An economic experiment shows how even a small shift in financing conditions can double the investment a firm chooses to make

How do better financing conditions affect a firm’s investment? Does a firm respond more to lower interest rates or lower collateral requirements? And does it depend on the kind of firm or investment project?

These are key policy questions, in particular for an institution like the European Investment Bank, which aims to stimulate investment with a high social and economic impact through improved access to finance. But there has been no theoretical or empirical research to analyse the preferences firms have for the specific characteristics of their financing.

So we conducted an experiment with 1,126 firms to see what financing conditions would promote the most investment.

The results showed that even small changes in access to finance can double the likelihood that a firm will invest. That’s very important information at a time when interest rates are low and the options for monetary policy seem limited.

Here’s why we conducted our experiment and what we found.

Lack of research on financing conditions

The question of how firms finance their business and investment activity is long-standing in academic literature and policy circles. The availability of sufficient and adapted sources of funding is at the heart of the functioning of market economies.

The leading theories on the optimal financing mix are:

- Modigliani and Miller's (1958) capital-structure irrelevance

- the trade-off theory of Kraus and Litzenberger (1973)

- agency theories, such as Jensen and Meckling (1976)

- and the pecking-order theory of Myers and Majluf (1984)

The overwhelming majority of empirical analyses attempt to explain the proportions of debt and equity instruments in a firm’s total liabilities. To the best of our knowledge, however, almost no theoretical or empirical work analyses:

- the preferences of firms for specific characteristics of debt financing, such as for example collateral requirements, maturity or fixed versus floating interest rate

- the pass-through of these preferences to real investment decisions

- and how these decisions translate into real activity.

The financing conditions knowledge gap

This knowledge gap is surprising. After all, it’s vital that we understand how specific firms at different stages of development value different financing options and how loan characteristics relate to their investment decisions. This is of crucial relevance for:

· economic modelling

· the design of loan offers by private or promotional banks (such as the European Investment Bank)

· central banks, which must evaluate the functioning of the monetary policy transmission channel through interest rates (especially at the zero lower bound).

From the central bank perspective, in the current low interest-rate environment, a policy that extends financing maturities might almost be as effective in stimulating investment as a policy that aims to lower interest-rates even further.

Pick your financing conditions

As part of the EIB Investment Survey in 2016, we analysed responses from 1,126 firms (of which around 80% were SMEs). About one third of these firms were active in manufacturing, another third in the infrastructure sector, and the rest were more or less evenly split into service and construction firms. Here’s what we asked:

- Each firm was asked whether it was currently considering putting into place a specific investment project, and, if so, what type of project this would be. We asked about the size of the project as well as how much external finance they would like to raise for this project and with what ideal maturity.

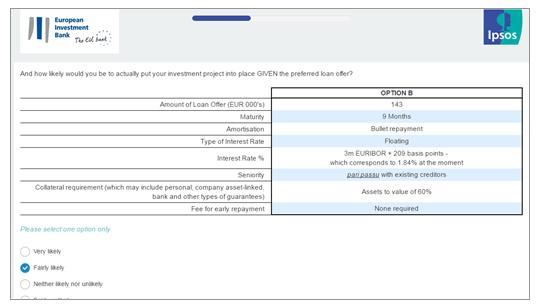

- Next we asked the firms to choose between pairs of randomly drawn hypothetical financing offers. Financing offers differed in terms of their amount and maturity (distributed around firms’ preferred amount and maturity), amortisation, interest rate (distributed around a market mid-rate according to the European Central Bank), interest type, level of seniority and collateral requirements, as well as whether or not there would be a fee for early repayment.

- Finally, firms were required to state how likely they would be to carry out their favourite investment project, given the financing offer that they had chosen in the second step.

All firms were shown eight screens like this one.

Conservative or improved?

The experiment allows us to illustrate how much the probability of investing increases or decreases if its financing terms change.

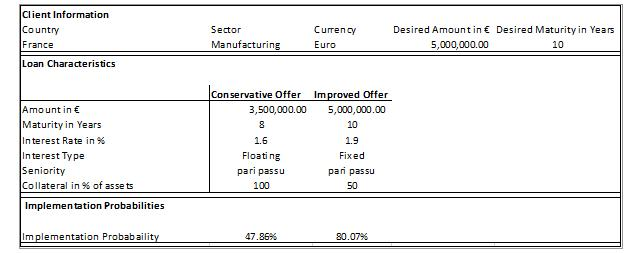

Here’s a simple illustration of this in the table below. It shows how likely a French manufacturing firm would be to implement its investment. The firms seeks a EUR 5 million loan with an ideal maturity of 10 years. It could chose from two scenarios:

- a conservative loan offer

- one that is slightly better than that, because it aligns the loan offer with the firm’s desired amount and maturity, provides a lower interest rate than the market for fixed rates and comes with more favourable collateral requirements.

The difference in implementation probability between the two cases is substantial. Under the conservative offer, only one in two firms said that they would go ahead with the investment project. Under the improved offers, it was four out of five firms.

What financing conditions matter to whom?

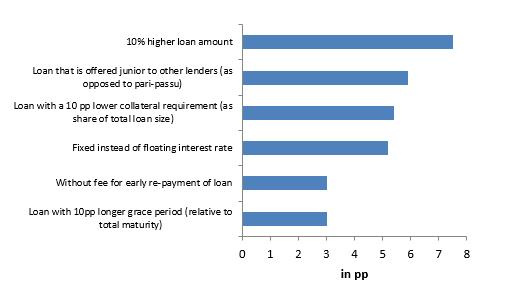

The loan characteristics with the highest effect on firms’ willingness to implement an investment project were:

- the interest rate

- the loan amount

- collateral requirements.

A reduction of collateral requirements from 100% to 50%, for example, was associated with a 15 percentage point increase in the probability that a company would go ahead with a project.

The relationship between the different financing characteristics and a firm’s willingness to invest varied. However, across different types of firm and investment projects, we found that large firms’ implementation probabilities were particularly sensitive to interest rates, while smaller firms (and highly leveraged firms) were more sensitive to the seniority level of the financing offered.

Similarly, service sector firms and firms investing heavily in intangibles care a lot about the loan amount. Manufacturing firms are more concerned about fixing their interest rates.

The effect of changes in each variable on the probability that a company goes ahead with an investment project.

Financing conditions benchmark

Quantifying the effect of different loan characteristics on project implementation provides an important benchmark on how far specific terms of external finance can go in fostering investment activities. It captures in a clean way the elasticity of project implementation with respect to the interest rate—a key variable in the transmission of monetary policy—as well as other loan characteristics, such as collateral and maturity.

The findings shed light on the role of finance in stimulating investment projects. It also provides useful new insights. For example, it’s instructive for an institution that wants to tailor policy measures aimed at access to finance for firms – including products offered by the EIB. With these findings, those measures can be designed to truly maximise their impact on the likelihood of a project being implemented.