EFSI and its legacy

Key figures

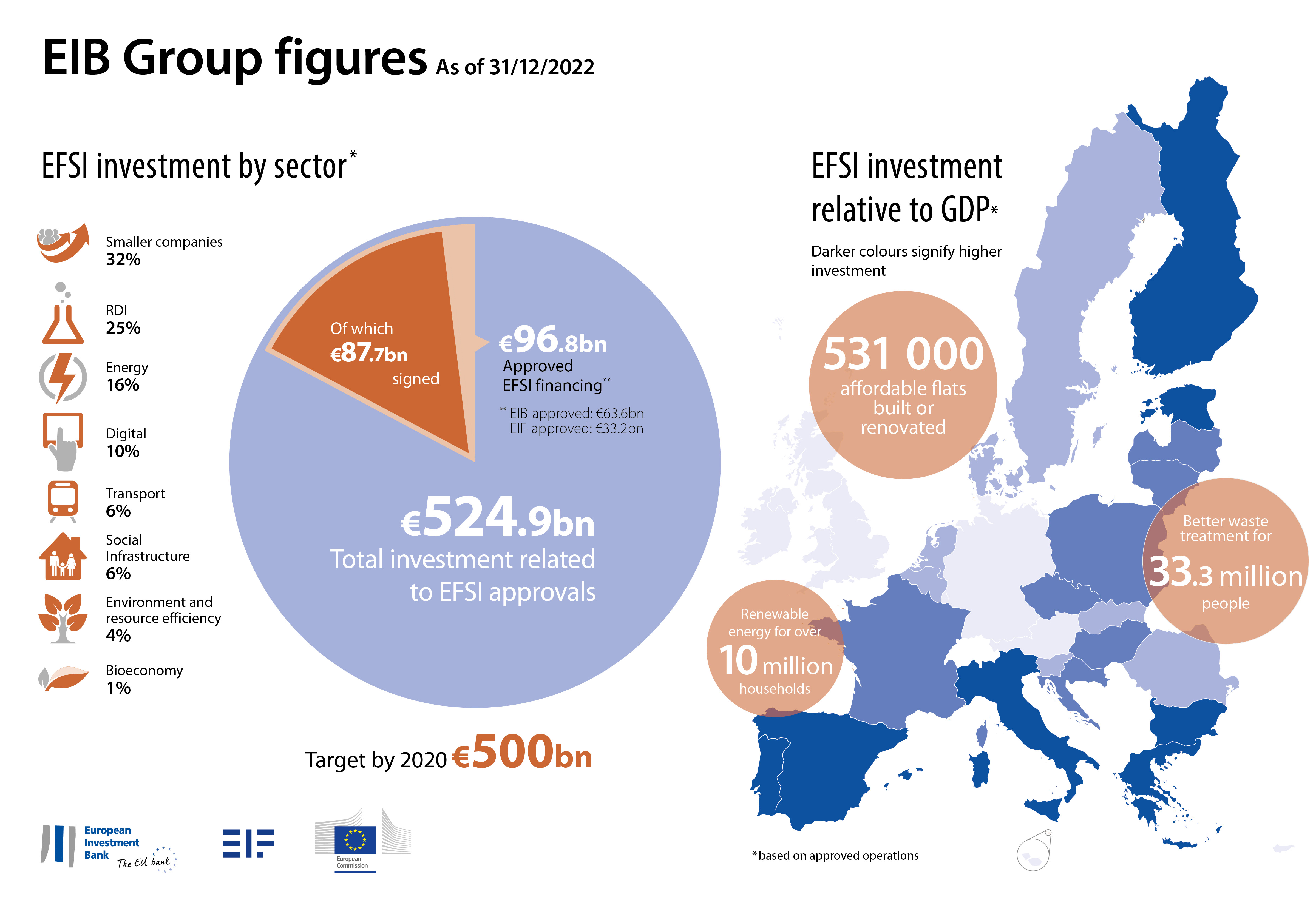

€540.3 billion

total investment related to EFSI approvals

€102.1 billion

of financing approved

Some 1,500,000

small and medium businesses expected to benefit

Helping where it is most needed

Furthering jobs and sustainable growth

Best practice

Since its launch, hundreds of projects have benefitted from EFSI and all of them contribute to making our continent more social, green, innovative or competitive. The examples below give a glimpse of the many things that EFSI helps flourish.

The EFSI Steering Board governed the implementation of EFSI to ensure the appropriate use of the Guarantee from 2015 until 2020. It determined the strategic orientation of EFSI, including its risk profile, the operating policies and procedures necessary for its functioning and operations with investment platforms, national promotional banks or institutions. The Steering Board comprised five members, three appointed by the EC, one appointed by the EIB and one expert appointed as a non-voting member by the European Parliament

Steering Board meetings – Minutes

In accordance with Article 7 of the EFSI Regulation, the minutes of the Steering Board meetings were published as soon as they were approved by the Steering Board.

2020

2019

2018

- Minutes of the Meeting held on 14 December 2018

- Minutes of the Meeting held on 18 October 2018

- Minutes of the Meeting held on 19 July 2018

- Minutes of the Meeting held on 18 May 2018

- Minutes of the Meeting held on 18 April 2018

- Minutes of the Meeting held on 9 February 2018

- Minutes of the Meeting held on 17 January 2018

2017

2016

- Minutes of the Meeting held the 23 November 2016

- Minutes of the Meeting held the 7 September 2016

- Minutes of the Meeting held the 4 July 2016

- Minutes of the Meeting held the 6 June 2016

- Minutes of the Meeting held the 10 May 2016

- Minutes of the Meeting held the 04 April 2016

- Minutes of the Meeting held the 14 March 2016

- Minutes of the Meeting held the 18 February 2016

- Minutes of the Meeting held the 28 January 2016

- Minutes of the Meeting held the 08 January 2016

2015

- Minutes of the Meeting held the 15 December 2015

- Minutes of the Meeting held the 4 December 2015

- Minutes of the Meeting held the 20 November 2015

- Minutes of the Meeting held the 26 October 2015, reconvened on 30 October 2015

- Minutes of the Meeting held the 18 September 2015, reconvened on 2 October 2015

- Minutes of the Meeting held the 2 September 2015

- Minutes of the Meeting held the 22 July 2015

Meetings with stakeholders

- Summary of discussions with the stakeholders held on 18 July 2019

- EFSI Stakeholders' consultation summary report - December 2018

- Summary of discussions with the stakeholders held on 18 October 2018

- Summary report of EFSI Stakeholders' consultation held on 8 December 2017

- Summary of discussions with CEEP, EASD and Housing Europe held on 10th July 2017

- Summary of discussions with National Promotional Banks and Institutions held on 9th February 2017

- EFSI Stakeholders' consultation summary report - September 2016

- Summary of discussions with Greenpeace and NPBs held on 4th July 2016

- Summary of discussions with Counter Balance, Bankwatch and WWF held on 6th June 2016

- Summary of discussions with BusinessEurope, EBF, ESBG and EACB held on 10th May 2016

The EFSI Investment Committee was responsible for approving the use of the EU guarantee for EIB operations supporting strategic investments under the Infrastructure and Innovation Window, in line with EFSI investment policies and the requirements of EU Regulation 2017/2396 between 2016 and 2020.

The Investment Committee was comprised of the Managing Director, his deputy and eight independent experts, appointed by the Steering Board.

Decisions and Rationales of the Investment Committee

Investment Committee decisions approving the use of the EU guarantee for EIB operations, including the rationales of the Investment Committee for these decisions, are publicly available. Projects for which the EIB and the client agreed on confidentiality until contract signature are listed in reports published once the projects were signed.

2023

2022

2021

2020

- Decisions taken by the EFSI Investment Committee in December 2020

- Decisions taken by the EFSI Investment Committee in October / November 2020

- Decisions taken by the EFSI Investment Committee in September 2020

- Decisions taken by the EFSI Investment Committee in July 2020

- Decisions taken by the EFSI Investment Committee in June 2020

- Catch-up report: decisions taken by the EFSI investment Committee in 2020 for projects previously subject to a confidentiality agreement, as of 18 May 2020

- Decisions taken by the EFSI Investment Committee in May 2020

- Decisions taken by the EFSI Investment Committee in April 2020

- Decisions taken by the EFSI Investment Committee in March 2020

- Decisions taken by the EFSI Investment Committee in February 2020

2019

- Catch-up report: decisions taken by the EFSI investment Committee in 2019 for projects previously subject to a confidentiality agreement, as of 16 December 2019

- Decisions taken by the EFSI Investment Committee in December 2019

- Decisions taken by the EFSI Investment Committee in November 2019

- Decisions taken by the EFSI Investment Committee in October 2019

- Decisions taken by the EFSI Investment Committee in September 2019

- Decisions taken by the EFSI Investment Committee in July 2019

- Decisions taken by the EFSI Investment Committee in June 2019

- Catch-up report: decisions taken by the EFSI investment Committee in 2018-2019 for projects previously subject to a confidentiality agreement, as of 17 May 2019

- Decisions taken by the EFSI Investment Committee in May 2019

- Decisions taken by the EFSI Investment Committee in April 2019

- Decisions taken by the EFSI Investment Committee in March 2019

- Decisions taken by the EFSI Investment Committee in February 2019

2018

- Catch-up report: decisions taken by the EFSI investment Committee in 2018 for projects previously subject to a confidentiality agreement, as of 21 December 2018

- Decisions taken by the EFSI Investment Committee in December 2018

- Decisions taken by the EFSI Investment Committee in November 2018

- Decisions taken by the EFSI Investment Committee in October 2018

- Catch-up report: decisions taken by the EFSI investment Committee in 2018 for projects previously subject to a confidentiality agreement, as of 21 September 2018

- Decisions taken by the EFSI Investment Committee in September 2018

- Decisions taken by the EFSI Investment Committee in July 2018

- Decisions taken by the EFSI Investment Committee in June 2018

- Decisions taken by the EFSI Investment Committee in May 2018

- Decisions taken by the EFSI Investment Committee in April 2018

- Decisions taken by the EFSI Investment Committee in March 2018

2017

- Catch-up report: decisions taken by the EFSI investment Committee in 2017 for projects previously subject to a confidentiality agreement, as of 25 January 2018

- Decisions taken by the EFSI Investment Committee in December 2017

- Decisions of the Meeting held on 11 December 2017

- Decisions of the Meeting held on 13 November 2017

- Decisions of the Meeting held on 17 October 2017

- Decisions of the Meeting held on 18 September 2017

- Decisions of the Meeting held on 17 July 2017

- Decisions of the Meeting held on 13 June 2017

- Decisions of the Meeting held on 15 May 2017

- Decisions of the Meeting held on 03 April 2017

- Decisions of the Meeting held on 07 March 2017

- Decisions of the Meeting held on 30 January 2017

2016

- Catch-up report: decisions taken by the EFSI investment Committee in 2016 for projects previously subject to a confidentiality agreement, as of 21 September 2018

- Decisions of the Meeting held on 07 and 08 December 2016

- Decisions of the Meeting held on 10 November 2016

- Decisions of the Meeting held on 10 October 2016

- Decisions of the Meeting held on 20 September 2016

- Decisions of the Meeting held on 14 July 2016

- Decisions of the Meeting held on 13 June 2016

- Decisions of the Meeting held on 17 May 2016

- Decisions of the Meeting held on 04 April 2016

- Decisions of the Meeting held on 07 March 2016

- Decisions of the Meeting held on 27 January 2016

Documents related to EFSI

In accordance with Article 7 of the EFSI Regulation, documents related to the European Fund for Strategic Investments (EFSI) are made publicly available.

Steering board documents

- Ex-Ante Derogations from EFSI Limits Post 2020

- EFSI Steering Board Activity Report

- Covid-19 Envelopes of financing for multiple underlying operations under IIW

- Study in response to ECA Recommendation 5: Improving the geographical spread of EFSI supported investment

- Response to ECA Audit Recommendation 5: Improving the geographical spread of EFSI supported investment

- Geographical eligibility of cross-border operations involving non-EU entities under EFSI

- EFSI Multiplier Methodology Calculation

- EIF - EFSI Multiplier Methodology Calculation

- Operating Policies and Procedures necessary for the functionning of EFSI

- Key Performance Indicators - Key Monitoring Indicators Methodology

- EFSI Strategic Orientation

- Transparency and Public Disclosure of Steering Board documents

- Investments in Funds in line with EFSI regulation

- Rules applicable to operations with investment platforms and national promotional banks or institutions

- Stakeholders Consultation on the Orientation and Implementation of the EFSI Investment Policy

EFSI implementation under SMEW

- Transfer of part of EFSI EU guarantee from IIW to SMEW

- EIF - SME WINDOW PRODUCTS

- EIF - SME WINDOW PRODUCTS

- EIF SME Window Facilities

- SME Window: CDP-EIF Equity Co-operation Platform: Social Impact Italia EFSI Thematic Investment Platform for Social Impact Finance in Italy

- EIF - SME Window Guarantee Facilites

- SMEW Equity Product

- SMEW EUR 500m Increase

- SME Window EaSI Guarantee Enhancement

- EIF SME Window Frontloading Products

- SME Window Investment Platform with CDP

- EFSI Thematic Investment Platform for Technology Transfer in Italy

- EFSI multi-country Investment Platform for SMEs through securitisation

EFSI implementation reports

- 2022 Report to the European Parliament and the Council on 2022 EIB Group Financing and Investment Operations under EFSI

- 2021 Report to the European Parliament and the Council on 2021 EIB Group Financing and Investment Operations under EFSI

- 2020 Report to the European Parliament and the Council on 2020 EIB Group Financing and Investment Operations under EFSI

- 2019 Report to the European Parliament and the Council on 2019 EIB Group Financing and Investment Operations under EFSI

- 2018 Report to the European Parliament and the Council on 2018 EIB Group Financing and Investment Operations under EFSI

- 2017 Report to the European Parliament and the Council on 2017 EIB Group Financing and Investment Operations under EFSI

- 2016 Report to the European Parliament and the Council on 2016 EIB Group Financing and Investment Operations under EFSI

- 2015 Report to the European Parliament and the Council on 2015 EIB Group Financing and Investment Operations under EFSI

Legal documents

- Regulation (EU) 2017/2396 of the European Parliament and of the Council of 13 December 2017 amending Regulations (EU) No 1316/2013 and (EU) 2015/1017 as regards the extension of the duration of the European Fund for Strategic Investments

- Regulation (EU) 2015/1017 of the European Parliament and of the Council of 25 June 2015 on the European Fund for Strategic Investments, the European Investment Advisory Hub and the European Investment Project Portal

- Sixth amendment and Restatement Agreement on the Management of the European Fund for Strategic Investments and on the granting of the EU guarantee (April 2020)

- Framework partnership agreement on the European Investment Advisory Hub