The Multilateral Development Banks (MDBs), together with the International Monetary Fund (IMF), reaffirmed their commitment to promoting an economic environment conducive to long-term investment financing for infrastructure. They agreed to continue to work together in accordance with their mandates, expertise and resources and help their G20 members prioritize their investment needs in infrastructure, ensure an enabling environment for infrastructure investments, and mobilize finance from a range of sources, in particular from the private sector.

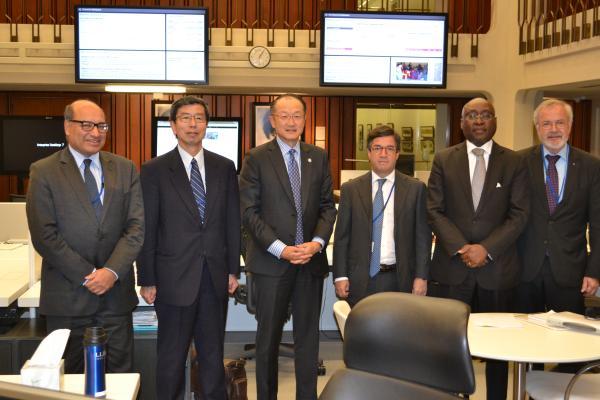

The MDBs and the IMF responded to calls by the G20 to foster infrastructure investment in G20 countries. “The Multilateral Banks offer considerable financing and can have a strong capacity and impact in supporting the priorities set by the G20. Given their role and experience, MDBs and the IMF can also contribute to set standards and provide leadership, working in close cooperation with G20 Member States”, said European Investment Bank President Werner Hoyer, who currently chairs the MDB coordination meetings in the margin of the IMF/World Bank annual meetings in Washington.

The Australian G20 Presidency had made fostering investments, particularly in infrastructure and small and medium-sized enterprises, a priority to support economic growth, create jobs and improve productivity across the G20 countries.

President Hoyer emphasised that there is no shortage of global funds, but there are challenges in channelling them towards productive investments. As governments cannot finance large global infrastructure needs on their own, G20 nations will have to look into ways of mobilising private sector investors to deliver high-quality, inclusive and sustainable infrastructure.

The President also emphasised that stimulating investment in infrastructure will need to address further hurdles including weak strategic guidance and project selection, poor budget planning and project appraisal, and delays in completing projects.

“We have the knowledge and vision to move beyond traditional long-term lending and reinforce our catalytic role for commercial financing on a larger scale, providing a necessary bridge between governments, projects sponsors and capital markets”, President Hoyer said.