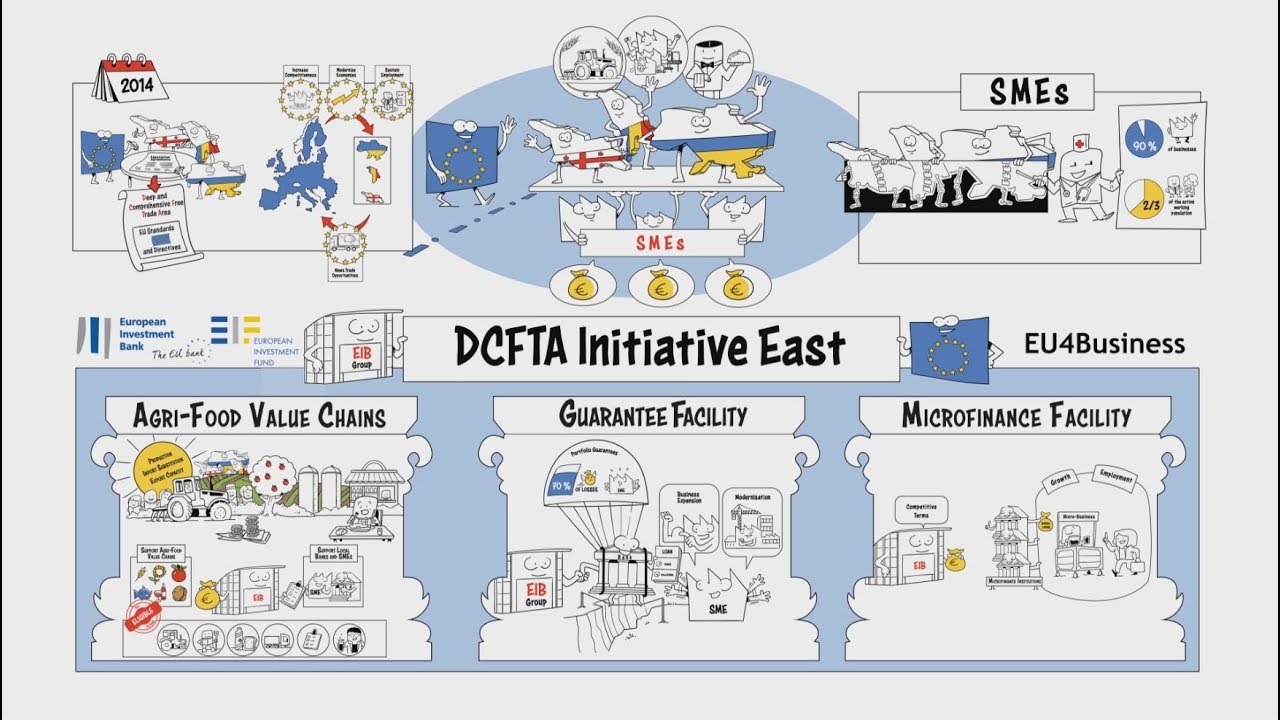

The Deep and Comprehensive Free Trade Area (DCFTA) Initiative East provides targeted financial and technical support to small and medium-sized enterprises (SMEs). The initiative aims to:

- increase competitiveness,

- modernise local economies, and

- sustain employment.

DCFTA Initiative East is available for the countries that have signed an association agreement with the European Union, specifically:

How it works

DCFTA Initiative East supports economic growth and job growth in the selected countries. The initiative enhances access to finance in the form of improved lending terms and conditions. It specifically provides first loss SME portfolio guarantees, enabling local intermediary banks to take on more risk and reach out to underserved segments of the economy.

DCFTA Initiative East consists of:

- SME loan guarantees to local banks and other financial intermediaries through the European Investment Fund.

List of financial intermediaries currently supported under DCFTA Initiative East Guarantee Facility - Technical assistance to counterpart financial intermediaries (including microfinance institutions), in the form of capacity building and advisory services to rural SMEs. The technical assistance targets particularly the development of agri-food value chain.

- Financing to local microfinance institutions to support local micro-enterprises.

EU4Business

The Deep and Comprehensive Free Trade Area (DCFTA) Initiative East is part of the European Commission’s wider EU4Business initiative, which brings together EU-funded programmes supporting SME development and improving the business environment in the Eastern Partnership region.

How to get support

Contact the EIB Information Desk for enquiries regarding the financing facilities, activity, organisation and objectives of the EIB.

EIB Global

For more than 50 years, the EIB has been the European Union’s international development bank. Our key investments across the world help create stability, promote sustainable growth and fight climate change everywhere.