In Chad only 1 in 20 people have electricity. But the Central African country has lots of sun. A UK company is developing the first solar plant in one of the world’s poorest places.

Robert Pacquement and the Djermaya Solar development team do not shy away from a challenge. His Djermaya Solar development team has worked with Chad’s government for the past three years to support an ambitious solar project. It is vital work. Electricity is scarce, expensive and unreliable in Chad with the current energy system reliant on biomass fuels such as wood and animal dung. The one thing in which Chad is rich is the sun. “This freely available, sustainable resource has a huge potential to transform the country’s energy sector. It can reduce the generation costs and also connect more people to power,” says Pacquement.

The solar photovoltaic plant at Djermaya, 30km north of N’Djamena, the capital, “will be the first utility-scale renewable energy project and will be the first privately owned, financed and managed power plant in Chad. It will generate significant savings for the country,” Pacquement explains. Once the solar plant is operational, the cost of the electricity generated by the solar plant will be less than half the present cost of power in Chad.

The Djermaya solar project draws on risk capital and expertise from InfraCo Africa, Aldwych Africa Developments Limited, JCM Power and Smart Energies. InfraCo Africa, a privately managed company backed by public funds from the UK, Switzerland and the Netherlands that’s part of the Private Infrastructure Development Group, will invest up to US$3 million into Djermaya Solar and, through its developer Aldwych Africa, provide the resource and expertise needed to develop this pioneering project.

The project is backed by a EUR 6.35 million contribution from the EU-Africa Infrastructure Trust Fund (EU-AITF).

Partnerships to boost resources

Public finances are constrained all over the world, but it’s particularly true in Chad. The most effective use of funding from public donors is then to attract additional public or private finance through multilateral development banks. This blending of grants from donors and multilateral development bank financing has helped to leverage investment around the world, including in Sub-Saharan Africa, where the EU-AITF operates.

Created in 2007, the EU-AITF is a EUR 813 million fund founded by the European Commission and several EU Member States. The European Investment Bank manages the fund and hosts its secretariat.

“What is special about the EU-AITF compared to most other trust funds is that each of the 14 donors nominates a project financier. The Private Infrastructure Development Group is one of them. The EIB is another, nominated by the founding donor, the European Commission. Financiers at the EU-AITF can be development finance institutions, banks, Member State agencies or public bodies with international development project expertise. The EU-AITF secretariat provides support to the donors and to the project financiers,” says Katrin Riedel, who works at the Trust Fund’s secretariat in the EIB.

“The EU-AITF is a great example of cooperation,” Riedel says, “because it partners with different donors and with multiple financing institutions. There really is a spirit of mutual exchange between the different stakeholders.”

Collaboration is an opportunity to achieve more than each partner might accomplish on its own. Blending facilities and trust funds are increasingly used by the European Commission and the EIB as tools to channel finance and partner with local governments and donors to deliver aid to the world’s poorest and most vulnerable. Donor contributions can be the key to making a project viable, and to ensure it is sustainable or that its impact is maximised.

Projects that changed lives

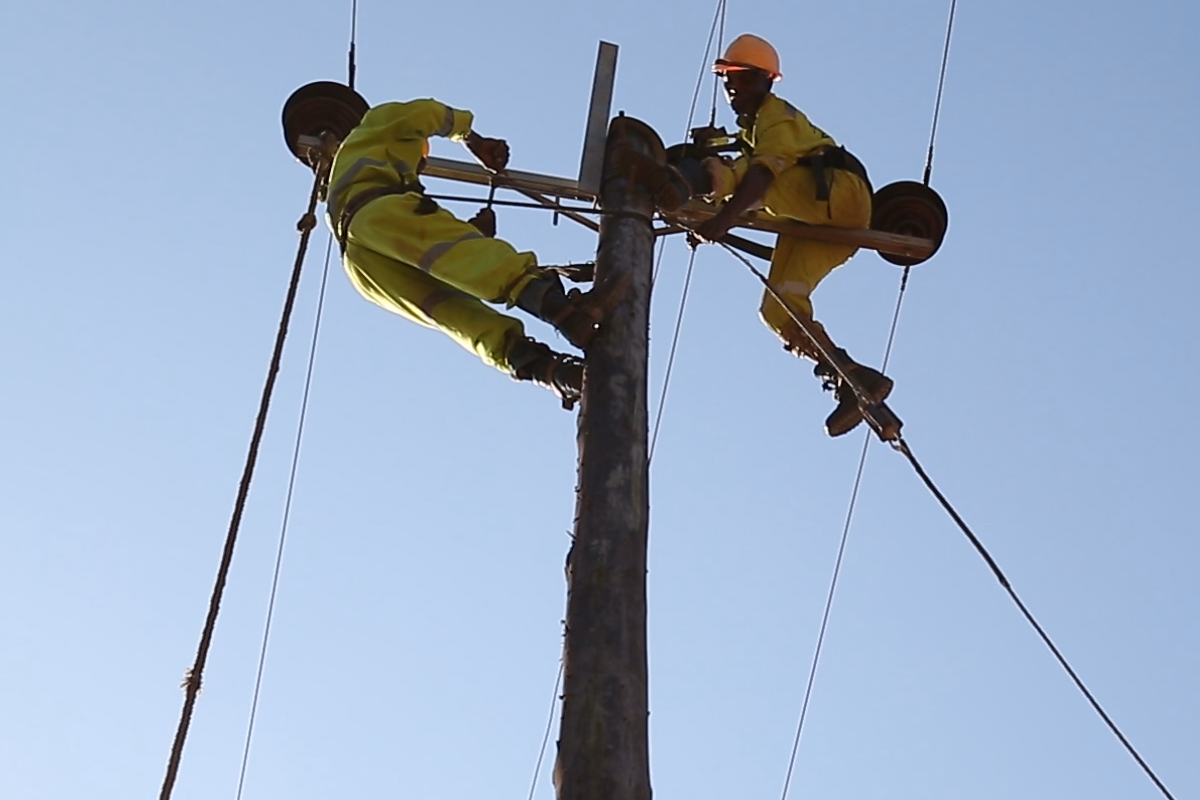

At Djermaya, the contribution of EUR 6.35 million from the EU-AITF, in the form of a 0% interest loan, will finance the building of the transmission line, substation and other electrical work required for system integration and to connect the solar project to the grid.

“Without the EU-AITF support, Djermaya Solar would not have been possible”, says Pacquement.

More than half of the volume of all EU-AITF grants has already leveraged concrete investments in projects worth EUR 7.8 billion. That’s 18.5 times the volume of the grant support.

Some examples are:

- the Seychelles East Africa Submarine Cable project, quadrupling the number of internet subscribers in the Seychelles in only four years

- the Port de Pointe Noire project in Congo-Brazzaville, increasing cargo traffic by 45% and more than doubling container traffic by expanding handling and storage capacity

- the Green Energy Finance for Indian Ocean Region facility, supporting through concessional finance to local companies and entrepreneurs around 40 small-scale private sector projects in renewable energy, energy efficiency and clean production, which are expected to avoid 58,500 tonnes of CO2, 72,000 tonnes of waste, and 57,000 tonnes of chemical fertilizers.

These projects make a real difference to people’s lives. They provide them with access to sustainable energy services, with high-speed internet, or improve the connection to the transport routes that enable them to do business.

More light to come

Djermaya Solar, with its EU-AITF support approved in September 2016, will be developed in two phases:

- the first will construct 30MW of installed capacity, with power first becoming available to Chad’s national grid in 2018-19

- the second will construct another 30MW, taking total installed capacity to 60MW, which may be implemented as soon as 2020.

This pioneering project will help liberalise the energy sector, spurring independent power producers. It will mobilise private investment and promote renewable energy in Chad. It’s also a model that can be replicated in other African countries.

“The EU-AITF has already supported many innovative projects like the Djermaya Solar,” says Riedel. “It’s a great example of successful collaboration.” In its 10 years of operation, the EU-AITF has backed over 100 grant operations with donor funds, in support of more than 80 projects implemented by 7 different project financiers. That’s one sure sign of a successful business model. But the lights coming on in Chad are the brightest signal.